Formats

Chief Executive’s Overview#

Over the past year, staff from the Department of the Prime Minister and Cabinet have continued to be actively engaged in support of the Prime Minister, his Cabinet colleagues, and His Excellency the Governor-General across a wide range of activities and priorities.

On the policy front, the focus has remained squarely on assisting the Government to deal with the impact of the global financial crisis – both to mitigate the worst aspects of the recession on New Zealanders and their interests, and also to enhance the ability of business and communities to recover quickly and in a more competitive state. Numerous policy initiatives have been pursued by ministers within the framework of the Government’s economic growth agenda and its six economic policy drivers: a better regulatory environment for business; higher skills; high-quality infrastructure; support for science, innovation and trade; improved public sector performance; and a fair and efficient tax system. DPMC staff have contributed to policy development processes in all these areas, in particular working closely with central agency colleagues to lift performance of the public sector.

A new Performance Improvement Framework (PIF) was developed for government agencies, drawing on similar work done by the United Kingdom’s Cabinet Office in its Capability Reviews. The PIF methodology was tested and piloted in 2009, before being rolled out to the first four government agencies early in 2010. Results of the PIF assessments will be made public progressively, as the reviews are completed. The purpose of the framework is to provide an independent view of departmental capabilities and generate a plan of action for improving performance. As one of the three central agencies, DPMC is closely involved in this process and in supporting chief executives in their leadership of improvement initiatives.

In July the Prime Minister’s newly appointed Chief Science Advisor, Professor Sir Peter Gluckman KNZM, delivered his first public address at Massey University. The position of Chief Science Advisor is independent and its operation is supported by DPMC; it was inaugurated by the Prime Minister last year to pursue the government’s goal of increasing support for science and innovation. Sir Peter’s brief is to promote the role of, and contribution from, science in New Zealand and to enhance the use of science at the heart of national decision-making. Sir Peter has made a strong start in his first year in office.

DPMC also led a cross-agency project to draw up the Government Action Plan on Methamphetamine (“P”) which was announced by the Prime Minister on 8 October. The New Zealand Customs, New Zealand Police, Ministry of Health, and Ministry of Justice were core members of the group. Initiatives included more active enforcement; interception and compliance; better treatment pathways; and restricting access to precursor drugs.

In addition to the ongoing provision of policy advice on matters of the day or urgent priorities, DPMC also facilitated a three-way agreement between Māori Television, TVNZ and TV3 over free-to-air broadcasts for the Rugby World Cup 2011 and led coordination of policy development on the Government’s Whānau Ora initiative. The Officials’ Committee for Domestic and External Security Coordination (ODESC), which is chaired by DPMC, played a policy coordination role in the development of the Government’s Defence Review.

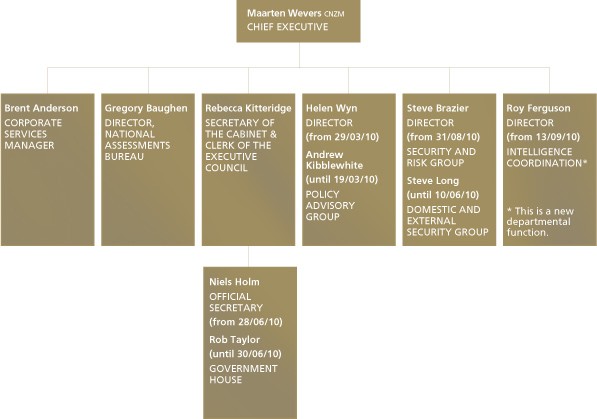

Following a review of the intelligence agencies conducted by Mr Simon Murdoch on behalf of the State Services Commissioner, the Government introduced some changes to strengthen governance and oversight of the intelligence community. Under DPMC’s leadership a new position of Director Intelligence Coordination has been established within DPMC, a revised brief has been determined for the re-named National Assessments Bureau, and a whole-of-intelligence-community governance mechanism has been introduced. These changes are intended to ensure greater focus and better performance from these agencies in ensuring New Zealand’s security. One consequence of the review is that DPMC’s intelligence and security staff will relocate to the new building in Pipitea Street being built for the Government Communications Security Bureau (GCSB).

This past year has also seen good progress on the Government House Conservation Project. The project is on time and within budget. It is expected to be completed in 2011, allowing Their Excellencies the Rt Hon Sir Anand Satyanand and Lady Satyanand to resume occupancy of their Official Residence before their term concludes in August. During the interval provided by the project, the Official Secretary took the opportunity to review staffing and support arrangements for Their Excellencies. A new staffing structure was subsequently implemented at Government House, with a number of new staff appointments made.

Their Excellencies have had another busy year, welcoming a number of significant visitors and undertaking official travel overseas to represent New Zealand: the visits by Their Excellencies to Papua New Guinea, the Solomon Islands, Singapore and Timor-Leste were highlights of the year’s programme. A further significant event in the year was the August 2009 ceremony held at Old St Paul’s in Wellington when, following the Government’s decision to reinstate titular honours, more than 60 New Zealanders were re-designated as knights or dames of the New Zealand Order of Merit.

The Cabinet Office worked closely with the Visits and Ceremonial Office over a period of months to ensure a successful visit by HRH Prince William in January to open the Supreme Court building on behalf of Her Majesty the Queen. This was Prince William’s inaugural official overseas visit.

In April I had the privilege of hosting – together with Iain Rennie, the State Services Commissioner – colleagues from similar Westminster-based jurisdictions in the United Kingdom, Australia and Canada for our regular biennial gathering. The discussions allowed us to explore some of the common issues and challenges we face in supporting the elected governments of the day and particularly our respective prime ministers as leaders of those governments. The meeting reaffirmed not only the strength of our system of accountable, responsible and responsive parliamentary democracy but also the critical role of professional and impartial support from the public service in maintaining effective executive and democratic government. We all recognised we have much to learn from each other, and much to contribute, as we seek ever more professional and high-quality support.

I am gratified to report that the DPMC Climate Survey for 2010 – which was extended this year to measure staff engagement – was again able to attract a high level of staff response. Although there was some slight variation in the results across the survey questions compared with the previous report two years ago, in general staff remain very positive about working in the department and levels of satisfaction about their place of work are at the higher end of those achieved in the New Zealand public service. The Senior Management Group will continue to give the highest priority to ensuring our staff remain motivated, productive and well supported in their busy roles.

This year saw the retirement of Steve Long, Director of the Domestic and External Security Group (DESG). Steve came to DPMC following a very distinguished career at New Zealand Police. His contribution to DPMC over more than four years was a strong one, bringing DESG to a new level of performance in security-risk identification and the management of cross-government issues. I would also like to record my thanks to Andrew Kibblewhite, former Director of the Policy Advisory Group, for his five years of excellent service. Andrew has left us to take up the role of Deputy Chief Executive at the Treasury. In addition Rob Taylor, after delivering first-rate support to Their Excellencies as Official Secretary, Government House, has returned to the Ministry of Foreign Affairs and Trade. We have been pleased to welcome Helen Wyn and Niels Holm, as Andrew’s and Rob’s successors.

Once more I wish to place on record my deep appreciation for the hard work and professionalism of all the staff of the department over the past year. I could not do my job without their support and willingness to serve as they do. The privilege of working at the heart of New Zealand’s vibrant democracy is one that all staff freely acknowledge. The roles they perform are responsible and require ongoing diligence, judgement and commitment. My particular thanks go to my senior management colleagues for their continuing support for me personally. They share a big load, willingly.

[Signed by]

Maarten Wevers CNZM

Chief Executive

The Department’s Role#

The Department of the Prime Minister and Cabinet occupies a unique position at the centre of New Zealand’s system of democratic government. It exists to support the effective conduct of executive government by the Prime Minister, the Governor-General and members of the Cabinet. The department’s principal role is provision of advice, on a daily basis, to the Prime Minister and Cabinet on the wide range of complex issues that confront the Government – particularly its policy priorities. Issues that governments are required to deal with are often complex or pressing, and require well-founded advice and judgement. DPMC also provides impartial advice, through the Clerk of the Executive Council and Government House, to the Governor-General. It plays a role in coordinating and leading the work of government departments and agencies, and other entities as appropriate, to ensure that decision-making takes account of all relevant viewpoints and that advice is as coherent and complete as possible. In addition, it supports the Cabinet decision-making process.

Supporting The Prime Minister And Cabinet

The Prime Minister is the political leader of the government and the country – and its main public “face”. The Prime Minister is also the chair of the Cabinet, and is responsible for the effective operation of executive government. These roles combine political and executive responsibilities. DPMC provides assistance to the Prime Minister in three broad categories.

Issues that are the direct responsibility of the Prime Minister

The Cabinet Office provides free and frank advice and support on constitutional issues relating to the conduct of executive government – including during elections and transitions between administrations – and issues associated with the operation of the Cabinet system.

Issues that arise across the full range of government business

DPMC provides a continuous flow of advice to the Prime Minister on major and daily issues, along with oversight of wider government activity and access to information and assessments. DPMC works with central agencies to draw together departments in support of the Government’s priorities, to focus agencies on providing options for action, to ensure implementation of agreed programmes and policies, to drive for enhanced agency performance, and to deal effectively with issues which affect the nation. The Cabinet Office, which is within DPMC, provides the secretariat support for decision-making by the Cabinet and its committees.

Administrative support to the Prime Minister

This includes preparation of replies to Parliamentary questions, and dealing with Official Information Act requests and other correspondence. A totally separate body, the Office of the Prime Minister, also advises the Prime Minister: it is the primary point of responsibility for managing political issues and relationships with other political parties and for providing administrative and media support.

Supporting The Governor-General

The office of the Governor-General is an important part of New Zealand’s constitutional arrangements. New Zealand is a constitutional monarchy and the Governor-General serves as the representative of our head of state, The Queen of New Zealand. His constitutional, ceremonial and community roles together seek to maintain national unity and foster national identity. The Clerk of the Executive Council and Government House staff support the Governor-General in carrying out his functions.

Bringing The System Together

DPMC strives to support a high standard of executive decision-making by providing quality advice that is timely, responds to the directions set by the Government, is forward-looking, is cognisant of changing circumstances and emerging issues, and gives assurance that policies are being delivered in an effective and coordinated manner. In addition we play a role in coordinating and leading the work of government departments and agencies, and other entities as appropriate, to ensure that decision-making takes account of all relevant viewpoints and that advice is as coherent and complete as possible.

Outcomes#

The Government's Priorities

- Improve the quality of public services

- Better equip New Zealanders to meet the economic challenges they face

- Grow the economy and create sustainable new jobs

DPMC's Outcome

- Good government with effective public service support

DPMC's Objectives

- Decision-making by the Prime Minister and Cabinet is well informed and supported.

- Executive government is well conducted and continues in accordance with accepted conventions and practices.

- The Governor-General is appropriately advised and supported in undertaking his constitutional, ceremonial and community-leadership roles.

- The intelligence system and national security priorities are well led, coordinated and managed.

- State sector performance is improved.

DPMC Output Classes#

- Policy advice and secretariat and coordination services

- Support services to the Governor-General and maintenance of the residences

- Intelligence assessments to support national security priorities

DPMC has two additional fixed-term responsibilities:

- Science Advisory Committee and Government House Conservation Project.

Strategic Environment

- DPMC works closely with the Office of the Prime Minister, other ministers and their offices; with business, iwi, and other external interests; and with the Treasury, State Services Commission and other public service and state sector agencies as necessary.

Our Capacity and Capability

- DPMC values its people for their capacity to shape thinking, achieve results through others, communicate with influence, serve, exemplify professionalism and probity, and exercise leadership. DPMC provides personal and professional development and opportunities in a challenging work environment.

Statement Of Accountability#

The Chief Executive of the Department of the Prime Minister and Cabinet is accountable to the Prime Minister for the financial and human resources management of the Crown’s investment in the department and for the production of the classes of outputs detailed in its Statement of Service Performance, with the following exceptions:

- The Secretary of the Cabinet is responsible directly to the Prime Minister for the impartial recording of Cabinet decisions and the development and administration of Cabinet processes. The Secretary is also responsible to Cabinet as a whole for ensuring the confidentiality of Cabinet proceedings and the impartial and effective operation of the Cabinet system.

- The Secretary of the Cabinet, as Clerk of the Executive Council, is responsible directly to the Governor-General and the Prime Minister for servicing the Executive Council and providing advice as may be required on constitutional matters.

- The Director of the National Assessments Bureau is accountable to the Prime Minister for the provision of impartial information and assessments under Output Class 3: Intelligence assessments to support national security priorities.

[Signed by]

Maarten Wevers CNZM

Chief Executive

Date: 24 September 2010

[Signed by]

Brent Anderson

Corporate Services Manager

Date: 24 September 2010

Output Class 1: Policy Advice and Secretariat and Coordination Services#

Description

This class of outputs involves:

- providing immediate, medium and long-term impartial policy advice that is delivered freely and frankly to the Prime Minister and, at the Prime Minister’s request, to other ministers

- promoting and facilitating the coordination of interdepartmental policy development and promoting a more collective approach across the state sector to the formulation and implementation of the government’s key priorities

- coordinating central government activities to enhance New Zealand’s domestic and external security, including intelligence, counter-terrorism preparedness, emergency/crisis management, and defence operations

- providing advice to the Governor-General, the Prime Minister and ministers on constitutional issues relating to the conduct of executive government to support the conduct and continuity of government within accepted conventions and practices (this includes support for the change of Governor-General)

- providing impartial secretariat services to Cabinet, Cabinet committees and the Executive Council; and promulgating their decisions

- providing advice on the policies, processes and procedures relating to the Executive Council, Cabinet and Cabinet committees; and adapting these as required

- coordinating the policy and administrative aspects of the legislative programme as directed by the Cabinet Legislation Committee

- advising on central government decision-making processes

- providing policy advice and administrative support for the New Zealand royal honours system.

The department assists the Prime Minister in overseeing and leading the government as a whole. In addition, it supports the Cabinet decision-making process. As a central agency, the department has a clear role to play in promoting effective policy coordination across the public service. Ministers need to have complete trust in the quality of the advice and support the department offers on the proper conduct of government business within accepted conventions and practices.

| 30.06.09 | 30.06.10 | 30.06.10 | ||

|---|---|---|---|---|

| Actual $000 |

Actual $000 |

Main Estimates $000 |

Supplementary Estimates $000 |

|

| 8,404 | Revenue - Crown | 8,369 | 8,454 | 8,369 |

| 3 | Revenue – other | – | 5 | – |

| 8,250 | Expenditure | 8,337 | 8,459 | 8,369 |

| 157 | Surplus | 32 | – | – |

| 2009/10 | ||

|---|---|---|

| Performance Measures | Actual Standard | Budget Standard |

| Advice provided meets the department’s quality, quantity and timeliness standards. | Stakeholder feedback indicates high satisfaction. | Key stakeholders are satisfied. |

| Services provided meet quality, accuracy, impartiality and timeliness criteria. | Stakeholder feedback indicates high satisfaction. | Key stakeholders are satisfied. |

Output Class 1 Service Performance: Policy Advisory Group

Policy advice to the Prime Minister

Objective

To provide high-quality information, analysis and advice that enables the Prime Minister to lead and manage the public policy business of the government.

Performance

The Policy Advisory Group provided advice to the Prime Minister as necessary on all Cabinet and Cabinet committee papers in time for these to be used in Cabinet or Cabinet committee meetings.

The Policy Advisory Group also provided timely briefing notes on issues of interest to the Prime Minister, either in response to requests from the Prime Minister or on the Group’s initiative. Feedback from the Prime Minister on advice tendered was made available to the Chief Executive, the Director of the Policy Advisory Group, and the advisor concerned.

The Policy Advisory Group led a number of inter-agency projects, such as the cross-government initiative on tackling methamphetamine which involved Customs, Health, Justice and Police. The resulting Action Plan was published in October 2009 and the first of what will be regular six-monthly updates on progress was provided to the Prime Minister in April this year.

The Policy Advisory Group also participated in a wide range of whole-of-government processes. DPMC worked closely with Treasury and SSC to provide ministers with a better sense of overall state sector performance and how to improve it. For example, under SSC leadership, the central agencies have almost completed the first tranche of four agency reviews (including earlier pilots) using the newly developed Performance Improvement Framework (PIF).

Together with the Cabinet Office, the Policy Advisory Group reviewed the level of ministerial satisfaction with the performance of the officials’ committees established in support of Cabinet committees. Policy Advisory Group staff either convened or participated in all Cabinet officials’ committees.

Objective

To satisfy the Prime Minister that the Group’s advice and coordination services are provided to a high standard.

Performance

The Prime Minister gave regular oral and written feedback on the advice provided by the Policy Advisory Group.

Objective

To satisfy the Prime Minister that the department’s leadership and coordination roles are carried out effectively in a timely manner.

Performance

The Prime Minister is regularly advised by the Chief Executive (with the support of the Director of the Policy Advisory Group, the Secretary of the Cabinet, and the Director of DESG in their own specialist areas) of the range of activities undertaken to facilitate cross-agency coordination of policy advice and implementation. These activities include: fortnightly meetings of departmental chief executives, which are convened to share information on policy directions; weekly meetings with counterpart central-agency chief executives; and interdepartmental coordination of a wide range of policy priorities.

DPMC has worked closely with its central agency partners (Treasury and SSC), recognising that the central agencies are jointly responsible for leading performance improvements within the state sector, albeit with distinctive roles and perspectives. The three central agencies are committed to ensuring that better services are delivered to New Zealanders, that the state sector is high-performing, and that state sector expenditure is disciplined.

In 2009/10, amongst a range of other activities, the central agencies focused on three crucial areas:

Better services to New Zealanders: supporting performance information

With SSC and Treasury, DPMC developed a “toolkit” to support dialogue between ministers and departmental chief executives on obtaining improved financial and performance information. Feedback from ministers suggests that the toolkit is a useful way of encouraging better performance information. The three central agencies have continued to work together to provide advice to ministers on ensuring the public sector is well placed for meeting future challenges.

A high level of state sector performance: implementing the Performance Improvement Framework (PIF)

The central agencies have been working closely to progress the SSC-led PIF and have reviewed the Department of Conservation, the Ministry of Foreign Affairs and Trade, Te Puni Kōkiri and Land Information New Zealand. The outcomes of the reviews will be published in September. The reviewed departments have produced action plans to address any issues identified, and the central agencies will monitor the progress made against these action plans. Early evidence suggests the PIF is likely to be an effective tool for lifting state sector performance.

Disciplined state sector expenditure: managing state sector industrial relations

The central agencies assisted the Government in setting the context for state sector pay negotiations and in monitoring the performance of those agencies holding significant talks during the year. Settlements have been subsequently reached with the Police, nurses (and significant proportions of the health sector workforce), border agencies and a number of smaller unions. These settlements have been consistent with Government’s fiscal and economic strategy and its Expectations for Pay and Employment Conditions in the State Sector. The Expectations were updated in June 2010 to reflect continuing fiscal constraint for state sector agencies and also the requirement for all decisions about pay and employment conditions to support improving service delivery and fiscal responsibility.

There has been restraint in state sector wage settlements compared with recent years: public sector settlements are no longer ahead of private sector settlements and all settlements have been funded from within baselines.

The piloting and refining of the PIF was one of the department’s key success indicators for 2009/10. Together with SSC and Treasury we will be monitoring closely the next stage of the process: the implementation of the PIF action plans.

The proposed independent stakeholder survey of state sector agency leaders, which was intended to measure the central agencies’ contribution to state sector performance and the state sector’s alignment with the Government’s priorities, was not undertaken in 2009/10 because of changes in organisational priorities. The central agencies are also reconsidering the usefulness of this survey, given new and emerging performance measurement tools such as the PIF. The PIF in particular includes extensive stakeholder interviews and is likely to provide information about the dimensions of system performance that the central agencies need to address.

Output Class 1 Service Performance: Cabinet Office

Support for the proper and effective operation of the key institutions of executive government

Objective

To provide impartial, efficient and effective secretariat services to Cabinet and Cabinet committees to ensure they operate smoothly and within Cabinet’s rules.

Performance

The Cabinet Office provided secretariat services to 271 (2008/09 comparison: 203) Cabinet and Cabinet committee meetings, and 34 (42) Executive Council meetings during the year. See “Meeting statistics” table.

The Prime Minister, the chairs of Cabinet committees, and ministers’ offices were consulted as required on the compilation of agendas and the acceptance of submissions for meetings.

There were 2,121 (2,028) summary cover sheets prepared for submissions to Cabinet and Cabinet committees during the past year.

Our performance target for the delivery of submissions to ministers’ offices is for all papers to be delivered by the close of business two days before the meeting. In the past year, 85 (85) per cent of submissions were received in the Cabinet Office within the Cabinet deadline for lodging papers and we achieved a delivery rate of 79 (77) per cent of all papers to ministers’ offices within the period stated in our performance target.

There were 2,403 (2,299) Cabinet and committee minutes recorded over the year. Only 15 (16) of these required amendment by the Cabinet Office. (This excludes amendments to committee minutes made as a result of a Cabinet decision.)

All Cabinet committee minutes were issued within three days of the meeting, before the next meeting of Cabinet.

Ninety-five (91) per cent of all Cabinet minutes were issued within three days of the Cabinet meeting.

| Number of meetings | Number of agenda items | Average number of items per meeting | |

|---|---|---|---|

| Executive Council | 34 | 260 | 7 |

| Cabinet | 46 | 745 | 16 |

| Cabinet Policy Committee | 18 | 18 | 1 |

| Cabinet Committee on Treaty of Waitangi Negotiations | 14 | 45 | 3 |

| Cabinet Committee on Implementation of Auckland Governance Reforms | 15 | 23 | 1 |

| Cabinet Economic Growth and Infrastructure Committee | 30 | 301 | 10 |

| Cabinet Social Policy Committee | 28 | 152 | 5 |

| Cabinet External Relations and Defence Committee | 12 | 78 | 6 |

| Cabinet Legislation Committee | 29 | 204 | 7 |

| Cabinet Appointments and Honours Committee | 21 | 276 | 13 |

| Cabinet Expenditure Control Committee | 20 | 50 | 2 |

| Cabinet Committee on Domestic and External Security Coordination | 1 | 2 | 2 |

| Cabinet Business Committee | 11 | 104 | 9 |

| Cabinet Domestic Policy Committee | 26 | 123 | 5 |

| Subtotal of Cabinet committee meetings | 225 | 1376 | 6 |

| Total including Cabinet | 271 | 2121 | 8 |

Objective

To provide impartial and effective advice to the Prime Minister and ministers to support the proper operation of Cabinet and Cabinet committees.

Performance

Six Cabinet Office circulars were prepared and issued in 2009/10 on a range of issues: the fees framework for members appointed to bodies in which the Crown has an interest; guidelines for changes to baselines; consultation and operating arrangements for the National-led administration; new guidance for regulatory impact analysis; the Statutes Amendment Bill (No 2) for 2010; and expectations for capital asset management.

The Cabinet Office provided 25 (2008/09: 19) briefing seminars to departments and interested parties on the Cabinet decision-making process. The Secretary of the Cabinet also gave briefings to a number of departmental chief executives and senior managers on ministers’ expectations for Cabinet papers.

Feedback from the Prime Minister and other stakeholders was positive.

Objective

To provide impartial and effective advice to the Governor-General, the Prime Minister and ministers:

• to support the proper and effective operation of the key institutions of executive government

• to ensure the constitutional processes involving the Governor-General, the Prime Minister and ministers are appropriately facilitated and supported.

Performance

Advice and support was provided to the Prime Minister and the Governor-General on a range of matters relating to constitutional issues and the functioning of executive government. This included: contributing to the Law Commission’s review of the provisions in the Civil List Act 1979 relating to the Governor-General and advising on the development of the subsequent Governor-General Bill; providing administrative support to effect changes in ministerial responsibilities and appointment of new ministers; managing the processes around the appointment of the Queen’s Representative in the Cook Islands; providing advice on matters relating to ministerial conduct, public duty and personal interests; advising on policy and legislative proposals – such as work around electoral matters – that have implications for executive government; and updating the Directory of Ministerial Responsibilities and the Register of Assigned Legislation.

Feedback from the Prime Minister and the Governor-General was positive.

Objective

To coordinate the policy and administrative aspects of the legislative programme, as directed by the Cabinet Legislation Committee.

Performance

Advice and support was provided to the Leader of the House and the Cabinet Legislation Committee on the management of the Government’s legislative programme, and on the preparation and management of the legislative programme for the 2010 calendar year.

Objective

To provide advice on the policy aspects of the New Zealand royal honours system, support for the compilation of honours lists, and administration of the honours system.

Performance

The Honours Secretariat advised and assisted the Cabinet Appointments and Honours Committee on the compilation of the 2010 New Year Honours List (193 recipients) and the 2010 Queen’s Birthday Honours List (172 recipients). See “New Zealand and other honours” table.

| The Order of New Zealand | |

|---|---|

| Ordinary Member (ONZ) | 1 |

| The New Zealand Order of Merit | |

| Knight/Dame Grand Companion (GNZM) | – |

| Dame Companion (DNZM) | 2 |

| Knight Companion (KNZM) | 10 |

| Honorary Knight Companion (KNZM) | 1 |

| Companion (CNZM) | 20 |

| Officer (ONZM) | 44 |

| Additional Officer (ONSM) | – |

| Honorary Officer (ONZM) | 1 |

| Member (MNZM) | 94 |

| Additional Member (MNZM) | 2 |

| Honorary Member (MNZM) | 2 |

| The Queen's Service Order | |

| Companion (QSO) | 23 |

| The Queen's Service Medal | |

| Medal (QSM) | 148 |

| The New Zealand Antarctic Medal | |

| Medal (NZAM) | 4 |

| The Distinguished Service Decoration | |

| Decoration (DSD) | 13 |

| TOTAL | 365 |

| Other honours and appointments | |

| Grant of the title "The Honourable" for life | 1 |

| GRAND TOTAL | 366 |

Following the completion in June 2009 of the project to reinstate titular honours into the New Zealand Order of Merit, a special ceremony was held at Old St Paul’s Church in Wellington on 14 August 2009 at which the Governor-General formally recognised 65 of the 72 new knights and dames, with new warrants of appointment and – in the case of the knights – the conferring of the accolade of knighthood. Of the 85 members of the Order eligible to accept a title, 72 elected to do so. See “New Zealand Order of Merit: titular honours and companionate status” table.

| Principal Companions (PCNZM) | 7 |

|---|---|

| Elected to accept a title | 5 |

| Elected to retain Principal Companion status | 2 |

| Distinguished Companions (DCNZM) | 78 |

| Elected to accept a title | 67 |

| Elected to retain Distinguished Companion status | 11 |

| Widows of Principal and Distinguished Companions | 5 |

| Elected to accept the courtesy title of “Lady”. | 3 |

The most significant activity undertaken this year has been the design, development and commissioning of a new business system that will manage the core business of the Honours Secretariat for the foreseeable future. The system was used for the first time to assist with the production of the 2010 Queen’s Birthday Honours List and will eventually hold records of everyone who has been nominated for an honour.

During the reporting period, the Honours Secretariat dealt with requests from Commonwealth and foreign governments – including those of Australia, Canada, France, Papua New Guinea and the United States – for approval to confer their country’s honours on New Zealand citizens. The Secretariat has continued to work with the New Zealand Defence Force on relevant policy matters. The Secretariat also responded to public enquiries about the honours system.

The department is now implementing initiatives to improve the quality of secretariat support provided to ministers in the context of the Cabinet Appointments and Honours Committee.

Objective

To maintain the records of Cabinet; and to provide related information services.

Performance

The Cabinet Office maintains records of all Cabinet and Cabinet committee meetings, administers the convention on access to documents of previous administrations, and provides advice to ministers’ offices on the storage and disposal of Cabinet papers.

The Cabinet Office receives and redirects Official Information Act requests for Cabinet documents and handles substantive requests for information about the work of the Cabinet Office. In addition, on behalf of the Prime Minister, it consults with the Leader of the Opposition about the proposed release of official information dating from previous Opposition administrations.

In 2009/10 the Cabinet Office handled 162 (2008/09: 205) enquiries and requests from ministers’ offices and departments about Cabinet papers and related information.

The Cabinet Office finished upgrading its computer network infrastructure, software, and electronic document and records management system (EDRMS). The project was formally completed on 30 June 2010. A working group has been engaged in preliminary thinking about the role and functionalities of a Cabinet support system enabled by communication and information technologies.

Output Class 1 Service Performance: Domestic And External Security Group

Objective

To provide integrated advice on issues involving national security and defence, emergency management, intelligence, and counter-terrorism; and to guide and coordinate crisis-management arrangements across the government.

Performance

The Domestic and External Security Group (DESG) provided advice to the Prime Minister as necessary on Cabinet and Cabinet committee papers and met the requirements for quality and timeliness.

DESG provided a wide range of briefing notes on security issues of interest to the Prime Minister, either in response to requests from the Prime Minister or on the Group’s initiative. Feedback was received from the Prime Minister on advice tendered.

DESG provides leadership, support and coordination on a range of policies and plans designed to strengthen national security and stability and to help deal with various civil contingencies. In particular, DESG works with a number of government agencies and with local authorities to:

- strengthen early warning of emerging security issues

- assess and evaluate possible threats or national risks

- identify potential vulnerabilities and likely consequences

- determine options for controlling significant risks

- develop management policies for government

- coordinate strategic planning and response around security risks.

This work is part of an ongoing programme to ensure domestic and external security issues are managed effectively and to build resilience in government and communities.

In its coordination role, DESG provided policy advice and support for periodic meetings of departmental chief executives under ODESC (Officials’ Committee for Domestic and External Security Coordination); chaired Watch Group (close situation monitoring) meetings of specialists to deal with detail; and conducted regular meetings with officials from central government and key people from industry, local government and other areas to advance policy and practical solution-finding.

In response to reviews of intelligence agencies undertaken recently, the Cabinet agreed to a series of decisions aimed at improving the efficiency and effectiveness of the way the intelligence sector operates. DESG has supported implementation of Cabinet’s decisions, in particular by developing terms of reference for ODESC’s membership and structure, and its governance of the intelligence sector.

DESG has been leading work on the development of a national security framework. This work will set out the foundations and organisational arrangements for managing national security issues, and will support the process of determining which security issues are of national significance.

Other issues covered include:

- assuring the security of New Zealanders at major events overseas (for example Gallipoli, the FIFA World Cup 2010, the Hockey World Cup)

- support for consular incidents overseas and disasters in the South Pacific (such as the Samoa tsunami and tropical cyclones)

- management of security planning and coordination for the 2011 Rugby World Cup, including national exercises and preparedness

- assisting the Ministry of Health in whole-of-government management of responses to the influenza pandemic in New Zealand

- oversight of the further development of the Parliamentary contingency plan, including relocation to Auckland in the event of a major disaster in Wellington

- supporting the process of designating a number of entities as terrorist organisations.

Objective

To provide a system of foreign intelligence collection and assessment activity that reflects policy priorities, national requirements and available resources, and that also ensures a coordinated and harmonised outcome.

Performance

DESG chaired and provided secretariat support for meetings of intelligence committees on a number of sensitive issues throughout the past year. It also undertook other intelligence coordination, which included:

- support for intelligence sector projects

- facilitation of inter-agency cooperation

- intelligence support to ODESC, Watch Groups, and other inter-agency groupings

- provision of a shared resource to assist agencies in dealing with operational issues.

DPMC has reviewed the intelligence coordination function in light of the Review of the Intelligence Agencies. A Director Intelligence Coordination has been appointed to:

- support ODESC in its intelligence coordination and governance roles in relation to the New Zealand Intelligence Community (NZIC), including the setting of objective and priorities, allocation of resources and monitoring of performance

- lead collaboration within the NZIC to ensure that agencies provide coordinated, high-value products

- offer a strategic view across the NZIC

- support the community in being well placed for future service delivery.

Output Class 2: Support services to the Governor-General and maintenance of the two Government HouseS#

Description

This class of outputs involves:

- providing financial, administrative, communications, travel, and advisory services to the Office of the Governor-General; and providing domestic and personal services to the Governor-General

- conducting a range of official functions, investitures and receptions at Government House, and hosting state and other dignitaries

- providing for the general upkeep and security of the Government Houses and grounds in Wellington and Auckland

- maintaining the other residences and buildings associated with the two Government Houses.

The Governor-General is The Queen’s representative in New Zealand – and has constitutional, ceremonial and community roles. He requires high-quality advice and support to carry out these roles in a way that is appropriate for the representative of our head of state. Government House Wellington and Government House Auckland are important facilities for carrying out the Governor-General’s duties, and are also important as listed historic places.

| 30.06.09 | 30.06.10 | 30.06.10 | ||

|---|---|---|---|---|

| Actual $000 |

Actual $000 |

Main Estimates $000 |

Supplementary Estimates $000 |

|

| 3,512 | Revenue - Crown | 3,491 | 3,561 | 3,491 |

| 52 | Revenue - other | 45 | 59 | 40 |

| 3,491 | Expenditure | 3,484 | 3,595 | 3,521 |

| 73 | Surplus | 52 | 25 | 10 |

| 2009/10 | ||

|---|---|---|

| Performance Measures | Actual Standard | Budget Standard |

| Support to the Governor-General is efficient and effective. | Positive feedback has been received. | Feedback from the Governor-General is positive. |

| Events at Government Houses are well organised. | Stakeholder feedback indicates high satisfaction. | Feedback from key stakeholders on the quality of events is positive. |

| Maintenance of Governor-General’s programme is appropriate and well-balanced. | Feedback has been predominantly positive. | Feedback from the Governor-General and other key stakeholders is positive. |

| The usefulness and heritage value of the two Government Houses is maintained or increased. | Feedback has been positive. | Feedback from key stakeholders is positive. |

Output Class 2 Service Performance: Support Services To The Governor-General And Maintenance Of The Two Government Houses

Support services to the Governor-General

Objective

To provide efficient and effective support to the Governor-General to facilitate the ceremonial and the community roles of the Governor-General.

Performance

The strategic programme framework developed in the previous year to enhance the Governor-General’s ceremonial and community roles was fully implemented. A full domestic and international programme was maintained by Their Excellencies including visits in support of New Zealand’s foreign-policy objectives to Papua New Guinea, the Solomon Islands, Singapore and Timor-Leste. Regional visits within New Zealand were made to the Nelson-Tasman, Otago, Canterbury and Taranaki regions. Close liaison in support of these visits was maintained with other government agencies such as the Cabinet Office, Ministry of Foreign Affairs and Trade, Veterans’ Affairs, Culture and Heritage, Defence, and Police. Full briefing as well as travel and administrative support was provided. In addition to these activities, the Governor-General hosted or supported a range of community and patronage-related events.

The Governor-General’s ceremonial programme included Waitangi Day activities at Waitangi in Northland and at Akaroa in the South Island; 23 investiture ceremonies for the recipients of the 2009 Queen’s Birthday Honours and 2010 New Year Honours awards in Dunedin, Christchurch, Wellington and Auckland as well as special ceremonies for the Rt Hon Helen Clark ONZ, and the Hon Sir Bruce Robertson KNZM. Seven credentials ceremonies for newly accredited heads of diplomatic missions were also held as was a state welcome for the President of Hungary in September 2009. In addition, Government House supported the visit to New Zealand by the Vice-President of the People’s Republic of China in June 2010. A highlight of the year was the ceremony held at Old St Paul’s in Wellington in August 2009 when more than 60 New Zealanders were redesignated as knights or dames of the New Zealand Order of Merit. In addition, the biennial dinner for members of the Order of New Zealand was held at Government House Auckland in October 2009. Their Excellencies’ participation in these events was warmly received, and was well covered by the media.

Their Excellencies were kept well informed on all programme-planning activities through regular reviews of the strategic programme framework, weekly programme-planning meetings, and full debriefings after overseas and regional visits. Regular feedback was sought and received from the Governor-General on the range of services provided in support of his ceremonial and community roles. Feedback on performance was also regularly received from external agencies and other stakeholders.

Objective

To provide services to the Governor-General to ensure the efficient and effective running of the official programme and the household. These services include advisory, administrative and household activities, and the organising of functions.

Performance

With the temporary closure of Government House Wellington, support was provided to Their Excellencies at Government House Auckland, at Government House Vogel in Lower Hutt, and at the Islington Office in the grounds of Government House Wellington. The Prime Minister also made Premier House in Thorndon available for some vice-regal ceremonies.

A diverse range of functions was delivered and supported throughout the year to the standard required by the Governor-General. This included 164 official engagements throughout New Zealand and the hosting of 122 functions at Government House Vogel, Premier House, and Government House Auckland, with an estimated 8,098 persons participating as guests. A highlight of the year was the visit, in January 2010, of HRH Prince William. The Governor-General hosted a hangi dinner at Government House Auckland on the evening before Prince William officially opened the new Supreme Court building in Wellington.

Feedback from Their Excellencies and guests confirm that these events were well organised and maintained the dignity and standard expected of the Office of the Governor-General.

The review of Government House operations and its management and staffing structure was implemented during the year. Following the completion of the review, an overall management team was established at Government House to support the Official Secretary. The four sub-teams within this – Programme, Household, Operations and Public Affairs – were also designed to provide enhanced services to Their Excellencies and to better equip staff for the reopening of Government House Wellington in 2011.

All correspondence including Royal Prerogative of Mercy applications and commemorative cards and letters were dealt with in a timely and appropriate manner. A new online brochure and form for Royal Prerogative of Mercy applications was launched in December 2009 in collaboration with the Ministry of Justice. The brochure and form are written in plain language and are available for download from the Government House website.

More than 250 draft speeches were also prepared for Their Excellencies on a wide range of topics. These speeches were favourably commented on by Their Excellencies for their content and informative style and were well received by audiences. Significant speeches were loaded to the Government House website, as were many photographs and features focusing on Their Excellencies’ work.

Maintenance of the two Government Houses

Objective

To preserve, secure and enhance the buildings and grounds of both Government Houses as appropriate residences for the head of state and as historic places.

Performance

The Government House Conservation Project continued apace in 2010 and is proceeding in accordance with its planned completion date of mid 2011. The project is designed to meet the uses and requirements of Governors-General both now and in the future, to address regulatory and statutory requirements, to incorporate environmentally sustainable design features, and to maintain the heritage values of Government House Wellington. A working party was established to plan a series of events to mark the centenary of the building in October 2010 and its reopening in mid 2011.

At Government House Auckland, a maintenance plan and schedule was prepared. As a result, three bathrooms in the VIP suites were upgraded and general maintenance of the selected areas of the exterior was also undertaken. A meeting of the Garden Advisory Committee was also convened to provide input into ongoing maintenance development of the Auckland grounds.

The views of Their Excellencies on the maintenance and development programmes for both Government Houses were sought regularly and taken into account.

Output Class 3: Intelligence assessments to support national security priorities#

Description

This class of outputs involves:

- producing intelligence assessments on political, economic, scientific, environmental, strategic, and biographic subjects overseas affecting New Zealand’s interests

- collecting, collating, evaluating, and analysing information that is used in the production of these assessments.

The use of effective planning and coordination processes in government can manage the risks of certain adverse events occurring, and can lessen their effect if they do occur. The department is responsible for assessing, monitoring and responding to threats of any kind in a timely and structured way.

| 30.06.09 | 30.06.10 | 30.06.10 | ||

|---|---|---|---|---|

| Actual $000 |

Actual $000 |

Main Estimates $000 |

Supplementary Estimates $000 |

|

| 3,482 | Revenue - Crown | 3,463 | 3,482 | 3,463 |

| 2 | Revenue - other | – | 2 | – |

| 3,378 | Expenditure | 3,457 | 3,484 | 3,463 |

| 106 | Surplus | 6 | – | – |

| 2009/10 | ||

|---|---|---|

| Performance Measures | Actual Standard | Budget Standard |

| The assessments of developments overseas are high-quality, accurate and succinct. | 99% of assessments were factually correct. | 100% of assessments are factually correct. |

| At least 90% assessments required no more than minor revision. | 90% of assessments require no more than minor revision. | |

| Stakeholder feedback indicates high satisfaction. | Feedback from key stakeholders is positive. | |

| The assessments are of policy relevance to New Zealand. | Stakeholder feedback indicates high satisfaction. | Feedback from key stakeholders is positive. |

Output Class 3 Service Performance: National Assessments Bureau (Nab)

Objective

To ensure the effective provision of high-quality, accurate and succinct assessments of overseas developments that are of policy relevance to New Zealand.

On 1 March 2010, the External Assessments Bureau was renamed the National Assessments Bureau (NAB). This was one of several changes agreed by the Cabinet as part of a review of intelligence agencies. NAB was given a new mandate to develop a national assessments programme which draws on the resources of the whole of the New Zealand Intelligence Community (NZIC) and which is relevant to national security interests and priorities. NAB was also mandated to develop common quality standards for intelligence assessment and analysis.

The implementation of this mandate is now underway, under the oversight of the National Assessments Committee (NAC). The NAC has evolved in order to effect these new priorities and has assumed a strengthened role in oversight, tasking, coordination, and quality assurance.

The new national assessments programme is in place, working in a different way to meet the assessment needs of NAB’s multiple audiences. Several partner agencies within the NZIC have begun to contribute to the programme, and reporting is being explicitly oriented towards national security interests and priorities. This implementation will continue into 2010/11, with emphasis on identifying national security priorities for the programme in a more comprehensive and robust way, and on broadening the programme’s coverage across the entire NZIC.

The development of common assessment practices and techniques, relevant training, and formal education in intelligence is also underway.

Performance

There were no instances of significant factual errors being reported in papers that had already been issued.

In a few instances, readers (particularly in New Zealand diplomatic missions overseas) provided additional information, insights and interpretations subsequent to the publication of papers, especially for biographic reports. (NAB generally seeks such input before publication, as part of its established process of consultation to improve the quality of its assessments.)

In developing new reporting vehicles, NAB has introduced greater variation than formerly in the length and format of papers in order to tailor them more closely to the preferences of the audience(s). NAB plans to undertake consultations to clarify those preferences.

During the reporting period:

- The NAC approved 41 (2008/09: 61) papers. This fall in number resulted from a shift of emphasis to quality assurance, and also from a decision in the final quarter of the period to put the reporting programme on hold (or to issue papers through other vehicles) in order to allow time for the NAC’s terms of reference to be redefined and new operating practices to be determined and introduced.

- NAB prepared 718 (622) biographical reports.

- There were 194 (201) other assessments and reports prepared, including 87 (90) executive intelligence summaries.

Biographic reports were delivered to primary customers before the visits and conferences to which the reports related. See “NAB assessments” table.

| 2010 | 2009 | 2008 | 2007 | |

|---|---|---|---|---|

| National Assessments Committee reports | 41* | 61 | 74 | 71 |

| Biographical reports | 718 | 622 | 575 | 536 |

| Other reports and assessments | 107 | 111 | 108 | 99 |

| Executive intelligence summaries | 87 | 90 | 93 | 92 |

| * The new emphasis on quality assurance has meant fewer reports but greater quality assurance in those that have been produced. This trend is likely to continue. | ||||

Objective

To ensure that the Prime Minister, other senior ministers, and officials are satisfied with the assessments and reports provided.

Performance

As noted above, the Government’s guidance on its expectations was significantly updated during the period and NAB is underway with implementation of responses. The Prime Minister and stakeholders have been more active in requesting reports on priority matters.

At least 90 per cent of assessments submitted to the NAC required no more than minor revision. (This performance indicator remains unchanged from last year.) NAB maintains a file record of the outcome of every NAC meeting so that its performance against this criterion is documented. From time to time the Intelligence Coordinator takes the NAC chair to provide independent oversight of the performance of both NAB and the NAC itself.

Output Class 4: Science Advisory Committee#

Description

This class of outputs involves:

- providing strategic and operational advice on science and science policy issues to the Prime Minister

- promoting the public understanding of, and engagement with, science

- developing relationships with similar offices overseas.

The Chief Science Advisor, Professor Sir Peter Gluckman, is appointed as a Ministerial Advisory Committee of one. He is accountable to the Prime Minister.

| 30.06.09 | 30.06.10 | 30.06.10 | ||

|---|---|---|---|---|

| Actual $000 |

Actual $000 |

Main Estimates $000 |

Supplementary Estimates $000 |

|

| – | Revenue - Crown | 335 | – | 335 |

| – | Revenue - other | – | – | – |

| – | Expenditure | 328 | – | 335 |

| – | Surplus | 7 | – | – |

| 2009/10 | ||

|---|---|---|

| Performance Measures | Actual Standard | Budget Standard |

| Advice provided meets the department’s quality, quantity and timeliness standards. | Stakeholder feedback indicates high satisfaction. | Key stakeholders are satisfied. |

Objective

To provide independent advice to the Prime Minister and his Government on such matters as are from time to time included in an agreed work programme determined by the Prime Minister.

Performance

The Prime Minster was consulted on the Chief Science Advisor’s work programme; and the programme – involving activities aimed at promoting the role of science in, and its contribution to, society – has been well executed. In 2009/10 the Chief Science Advisor gave more than 30 public lectures and many informal addresses. He has met with – amongst others – the United Kingdom’s chief scientist (twice), the Australian chief scientist (twice), senior officials in the United States (including President’s science advisor), senior Chinese officials and vice-ministers, and senior officials in Singapore; local diplomatic representatives have also sought meetings with him. The Chief Science Advisor has provided requested reports to the Prime Minister on subjects such as methamphetamine, adolescence issues, and the commercialisation of research.

Feedback from the Prime Minister on the performance of the Chief Science Advisor has been positive.

Our Demographics as at 30 June 2010#

| 20101 | 2009 | 2008 | 2007 | 2006 | ||

|---|---|---|---|---|---|---|

| Full time | Part time | |||||

|

||||||

| Office of the Chief Executive | 2 | 0 | 2 | 2 | 2 | 2 |

| Corporate Services | 15 | 1 | 15 | 15 | 15 | 15 |

| Government House Project | 2 | 0 | 2 | 2 | 1 | – |

| Policy Advisory Group | 14 | 3 | 17 | 16 | 16 | 14 |

| Domestic and External Security Group | 5 | 2 | 8 | 6 | 8 | 7 |

| National Assessments Bureau | 25 | 2 | 30 | 27 | 28 | 29 |

| Cabinet Office | 20 | 6 | 26 | 25 | 27 | 27 |

| Government House | 28 | 1 | 19 | 27 | 28 | 29 |

| Sub-total | 111 | 15 | ||||

| TOTAL | 1262 | 1193 | 1204 | 1255 | 1236 | |

| Gender distribution | 2010 | 2009 | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|

| Female | 52% | 52% | 55% | 55% | 47% |

| Male | 48% | 48% | 45% | 45% | 53% |

| Ethnicity | 2010 | 2009 | 2008 | 2007 | 2006 | |

|---|---|---|---|---|---|---|

| 7 Data not reported in 2006. | ||||||

| NZ European | 83% | 79% | 81% | 82% | 90% | |

| NZ Maori | 4% | 7% | 7% | 8% | 10% | |

| Pacific peoples | 1% | 1% | 2.5% | 2% | –7 | |

| Asian | 2% | 3% | 2.5% | 2% | –7 | |

| Other | 10% | 12% | 7% | 6% | –7 | |

Departmental Health and Capability#

Creating a supportive and focused workplace is central to the department's ability to maintain high performance.

Key capability requirements in DPMC are fairly constant. They are based on our ability to attract and retain high-performing staff. DPMC seeks to create a workplace where staff are treated – and treat each other – fairly and with respect, where staff are well managed, and where unhelpful barriers to work and personal development are removed as much as possible.

Our people

One-third of our staff have been with us for five years or more and just over half of our staff have been with DPMC three years or more. DPMC continues to balance the retention of existing staff – and their good organisational knowledge – with the recruitment of new talent and skills.

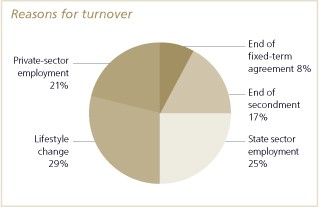

Planned turnover (defined as retirement and secondment) and unplanned turnover has remained stable for the last five years, at close to 19 per cent. DPMC’s solid practice of secondment of staff continues to be reflected in this 19 percent: staff are attracted to the department because they wish to broaden their policy coordination experience in a whole-of-government environment or to work on specialist projects or taskforces with the intention of using this experience upon their return to a line agency. Almost a third of staff who left in the last 12 months did so for lifestyle reasons, and one quarter moved to other positions within the state sector.

Organisational health

In 2010 the department commissioned an assessment of staff perceptions of organisational climate and their degree of engagement with the organisation. This is the fourth such survey undertaken by DPMC, with the measurement of engagement being a new feature. The Climate Survey provides invaluable insight into the way staff think about working at the department, and their areas of concern and satisfaction. The response rate to the survey was 86.4 per cent (2008: 83 per cent), which is very positive compared with industry standards. The department was again considered by staff as achieving ratings that ranged from “good practice” to “outstanding”. See “Snapshot of 2010 Climate Survey results” table.

| 2009/10 | ||

|---|---|---|

| ELEMENTS OF AN EFFECTIVE ORGANISATIONAL CULTURE | DPMC’s RATING | EXPLANATION |

| Clarity | Outstanding | Purpose, values and roles are clear to all and widely understood. People know what they have to do to be successful. |

| Drive | Good Practice | The organisation has the building blocks of a performance culture. Rewards extend beyond financial. Innovation is seen as important. |

| Alignment | Good Practice | Structures are creating organisational flexibility, underpinned by good communication. Cooperation across the business is occurring. |

| Confidence | Good Practice | Staff believe the organisation can succeed and their unit is effective. Morale is positive. Improvement in the other factors will improve this result further. |

Key results show that:

- DPMC continues to be seen as a high-performing organisation. Compared with two years ago, scores have trended upwards. Government House scores in particular have risen significantly.

- The most important motivators for all staff are meaningful work and challenging work.

- DPMC staff show as “engaged” in four important areas of the employee-engagement scale: pride in their organisation; satisfaction with leadership; opportunities to perform well at work; and performance being recognised and acknowledged. In two areas, staff show as being only “somewhat engaged” (neutral): prospects for future personal and professional growth; and a positive work and team environment.

- Women are slightly more engaged than men. In the climate-factor ratings, however, there is little practical gender difference.

- The biggest opportunity to enhance DPMC’s effectiveness and staff engagement will be achieved by improving “drive” and “alignment”. Specific areas for attention within these elements are workload, particularly in NAB and DESG, and the creation of opportunities for stretch and advancement within the organisation.

Our health

Creating a healthy and safe work environment is an ongoing departmental priority. Our staff are encouraged to participate in a wide variety of health and wellbeing activities.

Absence due to illness remains low. Average sick-leave usage is 5.4 days per annum (2008: 5.7); average accrued sick leave is 37.5 days (2008: 41.8). We continue to monitor sick leave and actively encourage staff to stay home when they are sick. The department remains vigilant in its response to potential influenza outbreaks by supplying all employees with a personal pack of hand antiseptic, providing travel packs for those travelling for work purposes, arranging extra cleaning services of commonly used services, and advising staff and managers to stay home if they have any flu symptoms.

DPMC also provides a comprehensive occupational health service to all staff. This includes:

- immunisation for influenza (free vaccination)

- eye tests

- a health and exercise subsidy

- ergonomic assessment for all new staff as part of induction, and further assessment on request.

The Health and Safety Committee met four times during 2009/10 and facilitated occupational health and safety discussions between management and staff. In addition, a self-audit was undertaken by DPMC and validated by an external resource: this audit highlighted good practices and low risk to staff, and showed the department’s responsiveness to workplace health concerns.

Our learning and development framework

A learning and development matrix was constructed from staff feedback through the performance management process, and a framework was implemented to reflect the development needs identified.

We are working with others on a management skills programme intended to develop the department’s leadership capabilities and to function as a “bridge” into further development opportunities such as the Leadership Development Centre (LDC) and Australia New Zealand School of Government (ANZSOG) offerings.

The department has also collaborated with Learning State in facilitating opportunities for administrative staff to pursue nationally recognised qualifications in business administration. This initiative has seen a good level of interest from the target group, with a small cohort of staff currently working through their qualifications.

DPMC continues to build strong collaborative relationships with the other central agencies, Treasury and SSC, in the sphere of learning and development. The central agencies’ induction programme – which provides good opportunity for new staff from DPMC, Treasury and SSC to understand the role and function of each agency – continues to be well supported and well attended.

Risk-assurance processes

DPMC continues to update its strategic risk profile. After further efforts from a DPMC-wide working group, the review of each of our high-level risks and associated mitigation strategies has been established as a formal agenda item for the department’s Senior Management Group. This review process is expected to continue into the 2010/11 financial year.

The Audit and Risk Committee has continued to meet regularly to review and assess a range of DPMC capabilities and areas of potential risk, and to report on these to the Chief Executive. The current committee consists of two external members (Souella Cumming, who is also the Chair; and from May 2010 Shenagh Gleisner) and one DPMC representative (Steve Long in 2009 and Michael Webster in 2010). Michael Wintringham was an external member, and also the Chair, until March 2010.

Information management

Systems development focused on the delivery of a highly resilient and available network, and the server environment has been “virtualised” to support this. Work continues on the establishment of a disaster recovery site in Auckland. A new business process application for the Honours Secretariat was implemented, offering a more efficient and effective process for honours nominations and awards. Work has commenced on revamping the department’s intranet and its websites. Challenges for network management, security and the protection of data integrity are ever-present as viruses, spam and cyber threats increase and evolve.

Statutory and Formal Responsibilities#

Chief Executive

The Chief Executive has the following responsibilities:

- the statutory responsibility to appoint such officers as may be required to assist the Intelligence and Security Committee of Parliamentarians (established under the Intelligence and Security Committee Act 1996) to carry out its duties

- coordination responsibilities in the response phase of an emergency under the International Terrorism (Emergency Powers) Act 1987.

Secretary of the Cabinet and Clerk of the Executive Council

The statutory and formal responsibilities of the Secretary of the Cabinet and the Clerk of the Executive Council are:

- to administer the Letters Patent Constituting the Office of the Governor-General of New Zealand 1983

- to preserve and maintain the official records of Cabinet, and to administer the convention on access to documents of a previous administration

- to administer the Civil List Act 1979

- to certificate subordinate legislation approved in Executive Council in terms of Section 32 of the Evidence Act 1908

- to certificate other instruments executed by the Governor-General in terms of the Official Appointments and Documents Act 1919

- to administer the Oath of Allegiance and the Executive Councillors’ Oath in terms of Section 23 of the Oaths and Declarations Act 1957

- to administer the Statutes of The Queen’s Service Order (2007), The Order of New Zealand (1987), and The New Zealand Order of Merit (1996)

- to administer the Royal Warrants of the New Zealand Gallantry Awards and the New Zealand Bravery Awards (1999)

- to administer the Seal of New Zealand Act 1977

- to administer the Royal Titles Act 1978.

Statement of Responsibility#

In terms of the Public Finance Act 1989 I am responsible, as Chief Executive of the Department of the Prime Minister and Cabinet, for preparation of the department’s financial statements and Statement of Service Performance, and for the judgements made in them.

I have the responsibility of establishing and maintaining, and I have established and maintained, a system of internal control procedures that provides reasonable assurance as to the integrity and reliability of financial reporting.

In my opinion, these financial statements and this Statement of Service Performance fairly reflect the financial position and operations of the department for the year ended 30 June 2009.

[Signed by]

Maarten Wevers CNZM

Chief Executive

Date: 24 September 2010

[Countersigned by]

Brent Anderson

Corporate Services Manager

Date: 24 September 2010

Departmental Financial Statements for the year ended 30 June 2010#

Statement Of Comprehensive Income for the year ended 30 June 2010#

| 30.6.09 | 30.6.10 | 30.6.10 | |||

|---|---|---|---|---|---|

Actual $000 |

Note | Actual $000 |

Main Estimates $000 |

Supplementary Estimates $000 |

|

| INCOME | |||||

| 15,398 | Revenue – Crown | 15,658 | 15,497 | 15,658 | |

| 57 | Revenue – other | 3 | 31 | 66 | 40 |

| – | Gains | 14 | – | – | |

| 15,455 | Total INCOME | 15,703 | 15,563 | 15,698 | |

| Expenses | |||||

| 10,854 | Personnel costs | 4 | 11,133 | 11,024 | 11,180 |

| 308 | Depreciation and amortisation expense | 7, 8 | 383 | 370 | 550 |

| 53 | Capital charge | 5 | 53 | 53 | 53 |

| 3,904 | Other operating expenses | 6 | 4,037 | 4,091 | 3,905 |

| 15,119 | Total expenditure | 15,606 | 15,538 | 15,688 | |

| 336 | Net surplus | 97 | 25 | 10 | |

The accompanying notes form part of these financial statements.

Statement of Financial Position as at 30 June 2010#

| 30.6.09 | 30.6.10 | 30.6.10 | |||

|---|---|---|---|---|---|

| Actual $000 |

Note | Actual $000 |

Main Estimates $000 |

Supplementary Estimates $000 |

|

| Current Assets | |||||

| 2,080 | Cash and cash equivalents | 2,017 | 1,916 | 1,256 | |

| – | Other receivables | 53 | – | – | |

| 102 | Prepayments | 56 | 12 | 50 | |

| 100 | Inventory | 100 | 100 | 100 | |

| 2,282 | Total Current Assets | 2,226 | 2,028 | 1,406 | |

| Non-Current Assets | |||||

| 325 | Inventory | 318 | 328 | 325 | |

| 716 | Property, plant and equipment | 7 | 815 | 516 | 1,066 |

| 122 | Intangible assets | 8 | 317 | 156 | 322 |

| 1,163 | Total Non-Current Assets | 1,450 | 1,000 | 1,713 | |

| 3,445 | Total Assets | 3,676 | 3,028 | 3,119 | |

| Current Liabilities | |||||

| 1,145 | Creditors and other payables | 9 | 1,621 | 1,080 | 1,145 |

| 336 | Provision for repayment of surplus | 10 | 97 | 25 | 10 |

| 663 | Employee entitlements | 11 | 626 | 624 | 570 |

| – | Provisions | 12 | 258 | – | 241 |

| 2,144 | Total Current Liabilities | 2,602 | 1,729 | 1,966 | |

| Non-Current Liabilities | |||||

| 241 | Provisions | 12 | – | 120 | – |

| 357 | Employee entitlements | 11 | 371 | 476 | 450 |

| 598 | Total Non-Current Liabilities | 371 | 596 | 450 | |

| 2,742 | Total Liabilities | 2,973 | 2,325 | 2,416 | |

| 703 | Net Assets | 703 | 703 | 703 | |

| Taxpayers' Funds | |||||

| 703 | General Funds | 13 | 703 | 703 | 703 |

| 703 | Total Taxpayers' Funds | 703 | 703 | 703 | |

The accompanying notes form part of these financial statements.

Statement of Changes in Taxpayers' Funds for the year ended 30 June 2010#

| 30.6.09 | 30.6.10 | 30.6.10 | |||

|---|---|---|---|---|---|

| Actual $000 |

Note | Actual $000 |

Main Estimates $000 |

Supplementary Estimates $000 |

|

| 703 | Balance at 1 July | 703 | 703 | 703 | |

| 336 | Total comprehensive income | 97 | 25 | 10 | |

| (336) | Return of operating surplus to the Crown | 10 | (97) | (25) | (10) |

| – | Movements in taxpayers' funds for the year | – | – | – | |

| 703 | Taxpayers' funds as at 30 June | 703 | 703 | 703 | |

The accompanying notes form part of these financial statements.

Statement of Cash Flows for the year ended 30 June 2010#

| 30.6.09 | 30.6.10 | 30.6.10 | ||

|---|---|---|---|---|

| Actual $000 |

Actual $000 |

Main Estimates $000 |

Supplementary Estimates $000 |

|

| Cash flow – operating activities | ||||

| 15,398 | Receipts from the Crown | 15,658 | 15,497 | 15,658 |

| 57 | Receipts from other revenue | 45 | 66 | 40 |

| (4,338) | Payments to suppliers | (3,466) | (3,882) | (3,804) |

| (10,740) | Payments to employees | (11,160) | (11,233) | (11,134) |

| (53) | Payments for capital charge | (53) | (53) | (53) |

| 12 | Goods and services tax (net) | (27) | – | – |

| 336 | Net cash flow from operating activities | 997 | 395 | 707 |

| Cash flow – investing activities | ||||

| (264) | Purchase of property, plan and equipment | (448) | (200) | (895) |

| (108) | Purchase of intangible assets | (276) | (50) | (300) |

| (372) | Net cash flow from investing activities | (724) | (250) | (1,195) |

| Cash flow – financing activities | ||||

| (47) | Repayment of net surplus to the Crown | (336) | (270) | (336) |

| (47) | Net cash flow from financing activities | (336) | (270) | (336) |

| (83) | Net increase/(decrease) in cash and cash equivalents | (63) | (125) | (824) |

| 2,163 | Cash and cash equivalents at the beginning of the year | 2,080 | 2,041 | 2,080 |

| 2,080 | cash and cash equivalents at end of year |

2,017 | 1,916 | 1,256 |

The accompanying notes form part of these financial statements.

Reconciliation of Net Surplus/(Deficit) to Net Cash Flow from Operating Activities for the year ended 30 June 2010#

| 30.6.09 | 30.6.10 | 30.6.10 | ||

|---|---|---|---|---|

Actual $000 |

Actual $000 |

Main Estimates $000 |

Supplementary Estimates $000 |

|

| 336 | Net surplus | 97 | 25 | 10 |

| ADD/(LESS) Non-cash items | ||||

| 308 | Depreciation | 383 | 370 | 550 |

(93) |

Increase/(decrease) in non-current employee entitlements | 14 | – | – |

| – | Increase/(decrease) in non-current provisions | (241) | – | – |

| 215 | Total non-cash items | 156 | 370 | 550 |

| ADD/(LESS) Working capital movements | ||||

| 89 | (Increase)/decrease in receivables and prepayments | (7) | – | 52 |

| 3 | (Increase)/decrease in inventory | 7 | – | – |

| (125) | Increase/(decrease) in creditors and other payables | 523 | – | 95 |

| 13 | Increase/(decrease) in current employee entitlements | (37) |

– | – |

| (195) | Increase/(decrease) in current provisions | 258 | – | – |

| (215) | Working capital movements – net | 744 | – | 147 |

| 336 | Net cash flow from operating activities | 997 | 395 | 707 |

The accompanying notes form part of these financial statements.

Statement of Commitments as at 30 June 2010#

Non-cancellable operating lease commitments

The department leases premises on the third and fifth floors of the Reserve Bank Building, and at 108 The Terrace in Wellington (see note 6).

The annual lease payments are subject to two-yearly and ten-yearly reviews. The amounts disclosed as future commitments are based on the current rental rates. Other operating commitments include contracts for photocopying services and garden maintenance services.

There are no restrictions placed on the department by any of the operating leasing arrangements.

| 30.6.09 | 30.6.10 | |

|---|---|---|

| Actual $000 |

Actual $000 |

|

| Operating commitments | ||

| 637 | Accommodation leases | 295 |

| 106 | Other operating commitments | 108 |