Formats

Acknowledgement#

DPMC acknowledges with sorrow the passing of Professor Piri Sciascia ONZM, who died in January 2020 and was laid to rest at his home marae at Porangahau.

Piri affiliated to Ngāti Kahungunu, Ngāti Raukawa, Ngāi Tahu and also had Italian ancestry. DPMC worked with him since 2016 as kaumātua to the Governor-General and the Prime Minister. This was just one part of his lifetime of achievement as a custodian of traditional arts, kapa haka and oratory, and as an educator. He was honoured in 2013 for services to Māori arts.

E moe e te rangatira.

Chief Executive's foreword#

Mahia i runga i te rangimārie me te ngākau māhaki

With a calm mind and a respectful heart we will always get the best results

The COVID-19 pandemic cast a shadow across the globe this year, with health, social and economic consequences that will be material for some time to come.

Meeting the challenge of COVID-19 brought into sharp focus the purpose of the Department of the Prime Minister and Cabinet (DPMC) – advancing an ambitious, resilient and well-governed New Zealand.

As the system leader, DPMC began to coordinate the response to COVID-19 as it emerged overseas. The National Security System (NSS) and the National Crisis Management Centre (NCMC) were activated. An All-of-Government group was established alongside the Ministry of Health to further enhance cohesion and depth of response. Chief executives met regularly, including as the Officials' Committee for Domestic and External Security Coordination (ODESC), to underpin coordination and to provide advice to the Prime Minister and Ministers.

The public service responded at pace in a highly complex, fast-evolving environment, with the wellbeing of all New Zealanders at the centre of the approach. All business units in DPMC provided people and resources to the combined effort, as did other agencies.

Maintaining a well-governed New Zealand during this period required working in different ways. Cabinet Office supported virtual Cabinet meetings as well as the COVID-19 Ministerial Group. The Policy Advisory Group in DPMC continued to provide advice to the Prime Minister and Ministers as they managed far-reaching and diverse issues.

In what was a particularly challenging year for New Zealanders, the NSS and NCMC were also activated following the eruption of Whakaari White Island. The eruption sparked a swift response from emergency services and health professionals. One week before the eruption, on 1 December 2019, the National Management Emergency Agency (NEMA) came into being, as a departmental agency hosted by DPMC. NEMA replaced the Ministry of Civil Defence & Emergency Management (MCDEM) as part of a programme of change for New Zealand’s emergency management system. It has a national leadership role and is charged with ensuring people and communities are at the heart of the system.

Looking to the future, New Zealand’s first Child and Youth Wellbeing Strategy was released with the vision of Aotearoa New Zealand, being ‘the best place in the world for children and young people’. Its development was led by DPMC's Child Wellbeing and Poverty Reduction Group and included input from 10,000 New Zealanders, more than half of them children and young people. The Strategy sets the direction for short and longer-term government policy and action, with a programme to be led and delivered by 20 government agencies.

The National Security Group published New Zealand’s Counter-Terrorism Strategy in early 2020 to help protect New Zealanders from terrorism and violent extremism of all kinds. The comprehensive Counter-Terrorism work programme focuses on reducing the threat and building social cohesion, while ensuring systems and capabilities are in place to act early if needed.

The Global Settlement between the Crown and the Christchurch City Council was a significant milestone in the return to local leadership nearly a decade after the first of the Canterbury earthquakes. Although small and reducing in size, DPMC’s Greater Christchurch Group played a key role in delivering this settlement and continued to work closely with partners.

Our staff at Government House supported the Governor-General, Her Excellency The Rt Hon Dame Patsy Reddy, as she hosted the Prince of Wales and the Duchess of Cornwall during their visit to New Zealand in November. Their Royal Highnesses visited the Waitangi Treaty Grounds and also engaged with other communities on issues such as the environment and sustainability.

Efforts across the Department have been supported by our Strategy, Governance and Engagement Group (SGE), and Central Agencies Shared Services (CASS). SGE provides the glue as we build our capability as an organisation, continue to deliver on government priorities and provide leadership as a central agency. Underpinning this are the values that continue to guide us; we are courageous – kia māia, we are connected – kia honohono, we are committed – kia manawanui, and we do it with respect – kia taute.

Brook Barrington

Chief Executive

A Who we are and what we do#

This section sets out our strategic framework, our roles and key activities

Our strategic framework#

for the year ended 30 June 2020

We recently updated our strategic framework through our Strategic Intentions 2020/21 to 2023/24. The Annual Report 2019/20 reports on progress against the above framework, while future annual reports will report on progress made towards the outcomes set in our new strategic framework.

About us#

We have around 300 staff in Auckland, Wellington and Christchurch, spread across seven business groups and one departmental agency. We have a unique role as the trusted advisor, leader and steward of Aotearoa New Zealand's system of executive government. We, with the National Emergency Management Agency, also lead the National Security and Emergency Management Systems to make Aotearoa New Zealand stronger, more resilient and improve the wellbeing of all New Zealanders. Our work is fundamentally about ensuring New Zealanders can live in a country that is ambitious, resilient and well-governed.

We collaborate to lead the public service

The scope of our role makes collaboration critical to our success. As a central agency, we work closely with Te Kawa Mataaho Public Service Commission and the Treasury to lead the public service and deliver results for New Zealanders. In particular, we contribute to this by monitoring progress against the Government's priorities, as well as promoting and modelling change.

We provide advice and support to enable a proactive and responsive public service which helps shape and deliver the Government's priorities

As a Department, we provide advice and support to the Prime Minister, as well as serving Ministers with responsibilities relating to national security, risk and resilience, the regeneration of greater Christchurch, and child wellbeing and child poverty reduction. Through the National Emergency Management Agency we provide advice to Ministers with responsibilities relating to civil defence and emergency management.

The Policy Advisory Group provides advice to the Prime Minister and Cabinet across the full spectrum of issues facing government. The Policy Advisors provide contestable advice on all issues going to Cabinet for decisions and first opinion advice when required. They also work with Te Kawa Mataaho Public Service Commission and the Treasury to ensure the public service understands and responds effectively to the Government's priorities.

The Strategy Unit was established during 2019/20 to strengthen New Zealand's governance by providing analysis and advice to the Prime Minister on medium to long-term strategic options.

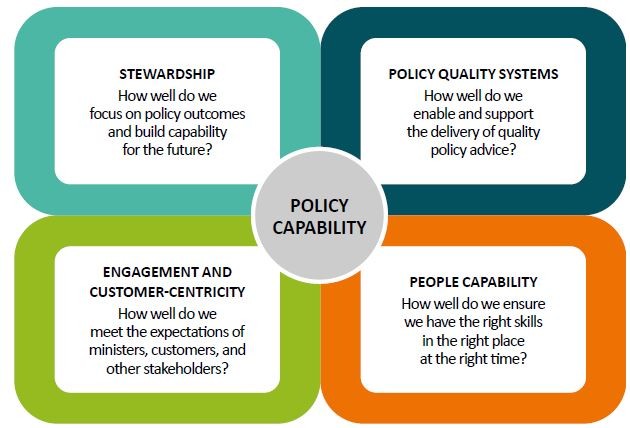

Great policy advice is the foundation of effective government decision making. It underpins the performance of the economy and the wellbeing of everyone in New Zealand. DPMC hosts the Policy Project, whose role is to build a high-performing policy system that supports good government decision making. The Policy Project supports our Chief Executive, Brook Barrington, in his stewardship role as the Head of the Policy Profession.

We help ensure New Zealand's systems and institutions of executive government are trusted, effective and enhance our nation's reputation

The Cabinet Office supports executive government to work effectively. Advice and support are provided to the Governor-General, Prime Minister and other Ministers on constitutional, policy, legislation and procedural issues, and impartial secretariat services are provided for meetings of the Executive Council, Cabinet and Cabinet committees.

The Honours Unit administers the New Zealand Royal Honours system and supports the Prime Minister and the Cabinet Appointments and Honours Committee to consider nominations.

The Government House team works with the Cabinet Office to support the Governor-General across the four main duties of the office: constitutional, ceremonial, community leadership and international. They also undertake kaitiakitanga for the heritage buildings and grounds of the residences in Auckland and Wellington.

We lead and steward our National Security System to make Aotearoa New Zealand stronger and more resilient

The National Security Group leads, coordinates and supports New Zealand's National Security System. DPMC leads the coordination of advice on national security matters for the Prime Minister in her role as Minister for National Security and Intelligence. Through governance structures such as ODESC, we strengthen the National Security System's support for the Government's priorities, develop better risk and assessment-based situational understanding, and improve agencies' coordination and collaboration to effectively deal with national security issues.

The National Emergency Management Agency (NEMA) is charged with supporting communities to reduce the impact of emergencies across all hazards and risks, and to better respond to, and recover from emergencies when they happen. More information on NEMA and its achievements in 2019/20 can be found in the NEMA Annual Report on pages 27 to 34.

We are focused on making Aotearoa New Zealand the best place in the world for children and young people

The Child Wellbeing and Poverty Reduction Group supports the Government's priority of making Aotearoa New Zealand the best place in the world for children and young people. It does this by supporting and providing advice to the Minister for Child Poverty Reduction, working with others to identify actions and policies for reducing child poverty and supporting the development and implementation of New Zealand's first Child and Youth Wellbeing Strategy.

We provide advice, leadership and coordination to ensure Christchurch is a dynamic, productive and inspiring place to live, work, visit and invest

The Greater Christchurch Group oversees the Crown's interests in the regeneration of greater Christchurch. This is achieved through the provision of leadership and coordination across government agencies, engagement with local entities and the community and supporting the transfer of responsibility for leading greater Christchurch regeneration to local entities.

We are enabled by our corporate services

The Strategy, Governance and Engagement Group supports us to achieve our strategic intentions by working across DPMC to ensure we have a sound strategy, a prioritised work programme and budget, effective governance, a strong culture and values, and efficient organisational systems and processes.

The CASS provide services relating to finance, human resources, information management and technology, publishing and payroll.

B Our performance story#

This section sets out our key achievements in advancing an ambitious, resilient and well-governed New Zealand during 2019/20

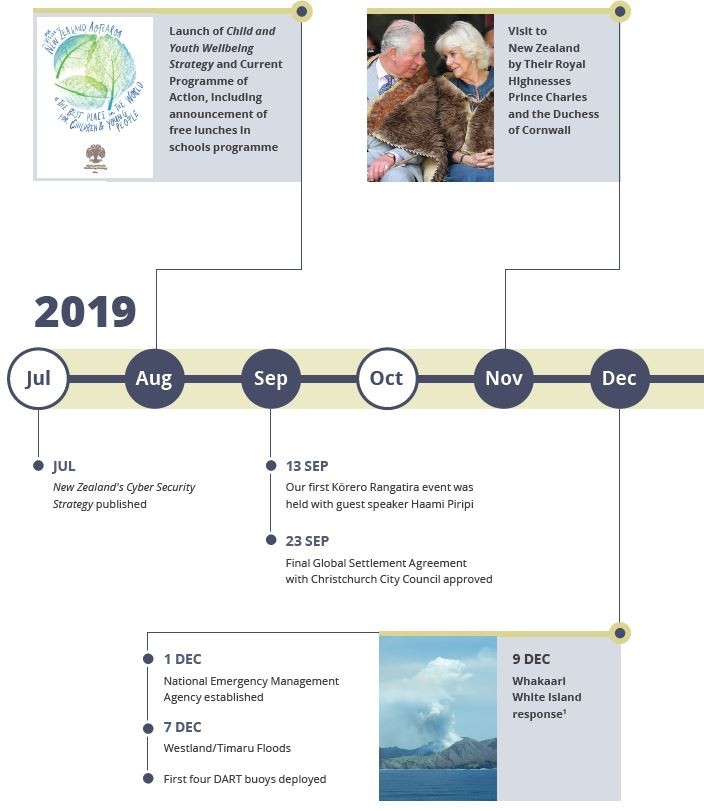

2019/20 at a glance#

- Credit: VML ID 226548, Karen Britten, GNS Science/EQC.

Our numbers at a glance#

In 2019/20 we:

- This includes $220 million towards the Canterbury Multi-Use Arena, $40 million towards residential red zone projects, and $40 million towards roading projects.

Strategic intention 1:

A proactive and responsive public service, helping shape and deliver the Government's priorities#

What we intended to achieve

The Prime Minister, Cabinet and other Ministers are supported by timely, well-informed information and advice.

What we achieved in 2019/20

We supported the shaping and delivery of government priorities

The Policy Advisory Group continued to provide high-level strategic advice on issues of the day to support good decision making throughout 2019/20. This included the provision of advice on all Cabinet Papers, excluding appointments, supporting the Prime Minister on her international travel programme and then through the response to COVID-19. Throughout the year, we worked with our Central Agency colleagues to monitor and support the implementation of the Government's priorities.

The Strategy Unit was established in September 2019 to help strengthen New Zealand's governance by providing analysis and advice to the Prime Minister on medium to long-term strategic options. Key areas the unit worked on since its establishment include:

- providing advice on recovery and rebuild activity following COVID-19

- developing long-term strategy proposals for consideration by the Prime Minister, including on the government's strategy for recovery from COVID-19.

We helped build a high-performing policy system

The Policy Project has a range of policy improvement frameworks and tools to support agencies and policy practitioners to improve the quality of their policy advice. These resources promote a more joined up and consistent approach to improving the quality of policy advice across the public sector. During 2019/20, we conducted 24 workshops and presentations to support agencies in using the policy resources. We also published case studies on how agencies and policy practitioners can use the policy resources, and showcased the resources at public sector events, including the All-of-Government Innovation Showcase, the Government Economics Network conference, Institute of Public Administration New Zealand event and graduate events.

Other key achievements during 2019/20, include:

- piloting an online policy hub where agencies can share resources and knowledge with each other

- supporting the Head of the Policy Profession to co-launch the Ministry for Women's gender analysis tool, Bringing Gender In

- expanding the Policy Methods Toolbox, a repository of policy development methods, to include futures thinking to help policy practitioners know when and how to use futures thinking for policy initiatives

- progressing the development of guidance on how to engage effectively with the public as part of the policy process, including conducting a literature review, workshops, as well as surveying community groups, policy practitioners and engagement specialists. The guidance is expected to be published next year.

Case Study

Supporting agencies to stay ahead of the game

Inland Revenue (IR) regularly applies the Policy Capability Framework as a health check, to maintain focus on the policy improvement outcomes it wants to achieve. The Policy Capability Framework is an organisational improvement tool that supports agencies to identify areas for policy improvement.

IR started using the Policy Capability Framework when it embarked on a five-year business transformation programme to modernise the tax system, including ways of working.

The new strategy didn't immediately resonate with policy staff who weren't convinced they needed to change. By applying the Policy Capability Framework, IR was able to bring policy staff on board through using language and framing the issues in a way that resonated with them.

“We have a number of shifts to achieve that can be easily grouped under a global description of ‘just being better at developing and providing policy advice'. And that sort of generalised aspiration isn't very helpful. The benefit of the Policy Capability Framework and the maturity matrix is that, we understand what they mean and they help us to be specific and to target capabilities that we want to improve”

- Mike Nutsford, Policy Lead

“We felt we were already a good ‘policy shop' and this was backed up by feedback from ministers - yet we also realised that to stay at the front of our game we would have to continuously improve our capability. The Policy Capability Framework gelled with us and I will be using the capability maturity matrix to help me track whether or not we are achieving our development goals”

- Emma Grigg, Acting Deputy Commissioner

Strategic intention 2:

New Zealand's systems and institutions of executive government are trusted, effective and enhance our nation's reputation#

What we intended to achieve

- Effective operation of the Cabinet system in support of the Government's operating arrangements

- Greater understanding of the role and purpose of the Governor-General and the nature and functioning of Cabinet government in New Zealand

- New Zealanders acknowledge and celebrate the services, achievements, and diversity of recipients of New Zealand Royal Honours.

What we achieved in 2019/20

We supported the Government's operating arrangements

We continued to support executive government to run smoothly by:

- providing advice and support to the Prime Minister and Ministers on the functioning of executive government, the management of conflicts of interest and other Cabinet Manual matters

- providing secretariat support for Cabinet, Executive Council and Cabinet committees

- supporting the Leader of the House to prepare and manage the government's legislation programme for the 2019 and 2020 calendar years

- updating the Cabinet policy paper template, in consultation with key central government stakeholders and agencies

- continuing to make enhancements to CabNet, our online system that supports Cabinet processes.

During the COVID-19 lockdown, we supported Cabinet and Cabinet committees to meet remotely and provided secretariat support for the COVID-19 Ministerial Group meetings.

We supported the Prime Minister and Governor-General

The most visible part of the Governor-General's activity is engaging as widely as possible with the communities of New Zealand. Since the March 2019 terror attack in Christchurch, a strong emphasis has been on diversity and inclusion. Key activities during 2019/20, included Tuia 250 and the Mount Erebus commemoration as well as visiting Maungapōhatu in the Urewera to sign the Rua Kēnana Pardon Bill.

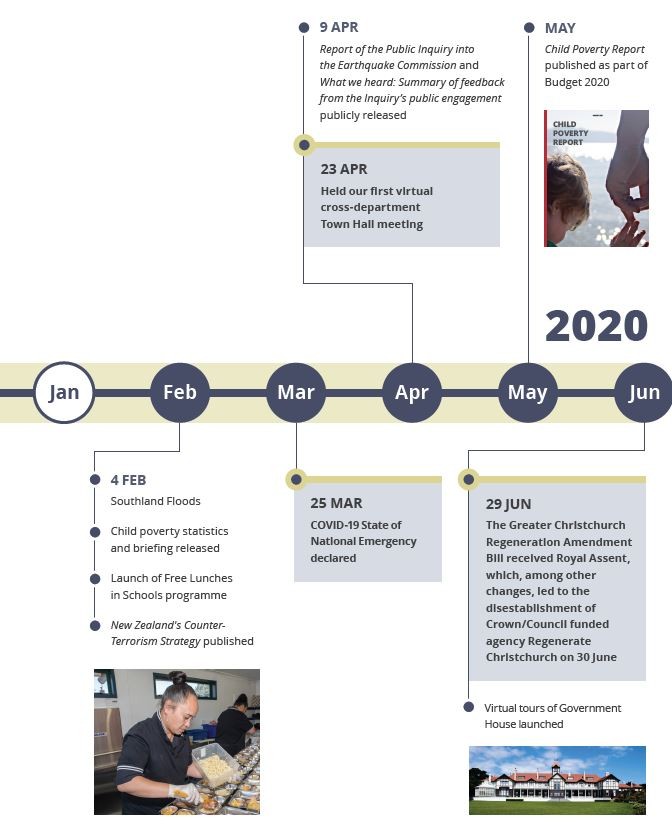

Their Royal Highnesses the Prince of Wales and the Duchess of Cornwall visited Aotearoa New Zealand from 17 to 23 November 2019. The Clerk of the Executive Council was responsible to the Prime Minister for delivering a programme that met both Aotearoa New Zealand's interests and captured the key areas of interest for the Prince and Duchess. The Prince and Duchess visited Auckland, where they were formally welcomed by the Governor-General, Waitangi (see case study), Christchurch and Kaikōura.

During COVID-19 Alert Level 4 the Governor-General's core constitutional role was crucial to government operations, as Her Excellency discharged her duties virtually to sign the Bills and other formal instruments that provided the legislative base for the Government's response to the COVID-19 pandemic.

We led the New Zealand Royal Honours processes

Awarding New Zealand Royal Honours is one way our country acknowledges and celebrates the significant contribution of New Zealanders. We provide support to the Prime Minister and Ministers in considering and progressing nominations, through to organising presentation of honours to recipients.

In 2019/20, the 50/50 gender balance for awards that was first achieved in 2018 was maintained.

Due to COVID-19 restrictions, it was not possible to undertake the normal cycle of investiture ceremonies planned for April 2020 to recognise the 2020 New Year Honours recipients. Instead, these were rescheduled to the second half of 2020 when a special priority was placed on supporting the Governor-General in hosting as many recipients as possible from both the 2020 New Year and 2020 Queen's Birthday lists.

Most of the administrative work to progress and deliver the 2020 Queens' Birthday Honours list was undertaken during the COVID-19 lockdown and resulted in some new and innovative ways of working, which we will continue to use in the future.

Case Study

Visit to Waitangi by Their Royal Highnesses the Prince of Wales and the Duchess of Cornwall

Visits to Aotearoa New Zealand by members of the Royal family are community occasions which help strengthen the connection between New Zealanders and the Sovereign, as well as providing an opportunity for us to showcase our nation and culture. The visit in November 2019 by Their Royal Highnesses the Prince of Wales and the Duchess of Cornwall was their third visit here together, and the tenth visit to Aotearoa New Zealand by Prince Charles.

A key highlight was the visit to the Waitangi Treaty Grounds, which marked the first time in 25 years that a member of the Royal family had been to the Treaty Grounds. The Prince gave a speech acknowledging the work that has been done in Aotearoa New Zealand since his last visit in 1994, in settling historical grievances in the spirit of partnership. He personally reaffirmed a commitment to the defining promise of the Treaty for himself, his children and grandchildren. The Prince also brought with him a cloak to loan to the Waitangi Museum from the Queen, which had been gifted to Queen Victoria by Reihana Te Taukawau on his historic visit to England in 1863. The Prince spoke of it as a taonga that symbolises the real and enduring relationship between the Crown and the Māori people, in which his family has taken immense pride for generations.

Strategic intention 3:

Our cohesive, risk-based national security system makes New Zealand stronger and more resilient#

What we intended to achieve

- Aotearoa New Zealand uses its understanding of risk to inform policy, investment and operational decisions

- There is an effective response and recovery to highly complex national security risks and emergencies in New Zealand

- Our communities are able to manage risk, respond to, and recover from, emergencies.

What we achieved in 2019/20

We used our understanding of risk to inform key decisions

We lead and steward Aotearoa New Zealand's National Security System in strengthening national resilience, developing situational understanding and improving coordination and collaboration on nationally significant issues. In support of this, during 2019/20 we took a more strategic risk-based approach to enable better governance by the Security and Intelligence Board and the Hazard Risk Board through leading cross-agency assessment, analysis and treatment of risk.

The National Assessments Bureau continued to provide independent, all source assessments to inform decisions on New Zealand’s security and foreign policy interests. This included reporting on COVID-19 and providing assessments on the economic, social and geopolitical implications of the global pandemic.

The National Security and Intelligence Priorities, which were publicly released last year, cover a wide range of potential risks to New Zealand's national security and wellbeing. The Priorities help agencies that have a national security role make informed, evidence-based policy and decision making, and focus on what matters most.

Another key strategic focus over the last year has been on the implications of cyber security to New Zealand's national security and economic growth. As New Zealanders spend more time online, including as a consequence of the COVID-19 pandemic, and use more online services we are increasingly exposed to malicious cyber activity.

New Zealand's latest Cyber Security Strategy was published in July 2019. The Strategy was developed using a co-creation model, involving public consultation and workshops, and drew on a range of sources to ensure that Aotearoa New Zealand is adapting to the growing and evolving threat. A key deliverable in the first year of the strategy has been the work towards accession to the Budapest Convention on Cybercrime. The future year's work programme will also take into account implications of COVID-19 on cyber security, for example risk mitigations associated with more New Zealanders working remotely and trading online.

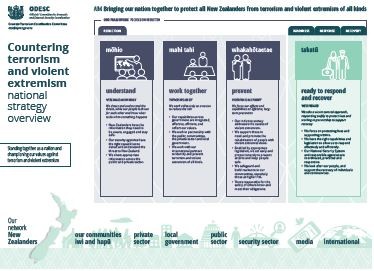

We also worked across the sector to lead the development of New Zealand's first Counter-Terrorism Strategy (see case study) and began implementation of the comprehensive cross-agency work programme which focuses on prevention and reducing the risk of terrorism and violent extremism.

With the 2020 General Election and referendums, we worked with other agencies to develop a set of interagency protocols to provide guidance for government agencies. This included strategies to manage and respond to election disruptions and threats, such as managing foreign interference and cyberattacks.

We responded to, and supported the recovery from, national security issues

Throughout the year, we led and supported lead agencies to respond to, and support recovery from, a number of national security issues and emergencies. We activated the National Security System to provide whole-of-government decision support for agencies and Ministers for 13 ODESC meetings and 18 senior officials' Watch Groups. A wide range of issues prompted activation of the system, including the Whakaari White Island eruption and the response to COVID-19.

New Zealand's response to COVID-19 required a significant cross-government effort. In our system leadership role, we provided strategic support for the lead agency response and to Watch Group and ODESC meetings, provided analysis and assessments, and helped to ensure coordinated all-of-government decision making around policy issues.

We also supported the Royal Commission of Inquiry into the Attack on Christchurch Mosques. This included responding to requests from the Inquiry and engaging in the natural justice, fact checking and declassification processes. We led cross-agency preparation for the next part of the process to ensure a joined-up, whole-of-government response to the report upon its release.

For information on key achievements relating to emergency management in support of this strategic intention, refer to the National Emergency Management Agency Annual Report 2019/20 on pages 27 to 34.

Case Study

Our national Counter-Terrorism Strategy

New Zealand's first national strategy for countering terrorism and violent extremism came into effect on 23 September 2019. The Strategy is about working together to prevent terrorism and violent extremism, while ensuring the systems and capabilities are in place to act early and respond when needed.

The Strategy's aim is “Bringing our nation together to protect all New Zealanders from terrorism and violent extremism of all kinds”. It seeks to prevent tragedies such as the terrorist attack in Christchurch from happening again, and emphasises aspects such as:

- social inclusion

- working together by partnering with communities

- eliminating terrorist and violent extremist content online

- focusing on victims in the event of an incident.

The new Strategy was developed collaboratively by a wide range of agencies, led by DPMC. We are now working with the public sector, communities and others to coordinate the delivery of this Strategy to help keep New Zealanders safe and resilient.

Strategic intention 4:

New Zealand is the best place in the world for children and young people#

What we intended to achieve

Supporting the Government to make effective policy and investment decisions aimed at reducing child poverty and improving child wellbeing.

What we achieved in 2019/20

We launched the Child and Youth Wellbeing Strategy and Programme of Action

The Child and Youth Wellbeing Strategy was launched in August 2019. It sets out a shared understanding of what is important for child and youth wellbeing, what the Government is doing to help achieve the wellbeing outcomes and how others can help. The Strategy's Programme of Action (POA) includes 75 main actions and more than 40 supporting actions led by 20 government agencies, to drive progress against the outcomes set in the Strategy over coming years.

The Strategy has been well received by stakeholders, who see it as an important opportunity to align collective efforts to improve the lives of children and young people and their whānau. A dedicated website publishes regular news updates, and showcases innovative community-led projects and activities from around the country. Subscribers to the Child and Youth Wellbeing e-newsletter (published every 6 to 8 weeks) are steadily increasing, with around 2,200 at the end of 2019/20.

We supported the requirements under the Child Poverty Reduction Act

In February 2020, we reported on the impact of the Families Package and Budget 2019 initiatives on child poverty rates, to support the release of Stats NZ's child poverty statistics. This was followed by the Child Poverty Report, published as part of the Budget in May 2020, which provides the first indication of progress on the measured rates of child poverty since the Government's targets were gazetted.

Advice is being developed on the short and medium-term implications of COVID-19 for child poverty, including estimated impacts on the child poverty targets.

We worked on cross-agency policy to improve child wellbeing and reduce child poverty

We are continuing our work to help engage agencies and others, and mobilise collective action.

Through the Strategy, we have established strong cross-agency governance and working groups to provide joined-up policy advice, including advice on Budget priorities as well as longer-term planning work. There is growing agency alignment to the Strategy, with the Framework being incorporated into business and strategic planning documents, and used to shape upcoming work programmes.

There are also some early indications that the Strategy's impact is reaching beyond central government agencies. For example, we are working closely with local government leaders to explore how the Strategy's Framework can be used to inform their strategic and long-term planning, and help prioritise work programmes and spending. We are also working with community stakeholders to develop tools, guidance and resources to support alignment of activities to the Strategy.

Agencies are making good progress in implementing the initiatives in the POA, with most proceeding as planned, including many large initiatives requiring the input of multiple agencies and non-government organisations. The Strategy is also providing the framework for cross-agency COVID-19 response efforts. It already has a strong focus on lifting the wellbeing of those who are most disadvantaged, and is helping us drive a unified and holistic approach to new and emerging issues and needs for children, young people and their whānau.

Policy work in the Strategy's five focus areas has contributed to new investments announced in the Budget 2020 and COVID-19 Response and Recovery Fund (CRRF) funding packages, and further work continues in these areas with a new COVID-19 recovery lens.

The POA will continue to evolve in response to emerging issues and needs, as well as new opportunities to make transformative and lasting change.

Case Study

Free and healthy school lunches prototype

DPMC's Child Poverty Unit worked closely with the Ministry of Education to develop the Free and Healthy School Lunches prototype.

Around 7,000 school children kicked off the 2020 school year with full tummies, thanks to a Free and Healthy School Lunches programme piloted at 31 schools in Hawke's Bay Tairāwhiti and Bay of Plenty Waiariki.

The programme aims to ease financial hardship and reduce food insecurity, by providing access to a nutritious lunch in school every day. Research shows that reducing food insecurity makes all the difference to a child's learning - improving their levels of concentration, behaviour and school achievement. It also boosts their overall health and wellbeing.

The programme was announced at the launch of the Child and Youth Wellbeing Strategy in August 2019, and is one of 75 initiatives launched by the government last year to tackle child poverty and improve child and youth wellbeing.

Providing lunch to all students in the school means every child who needs a free lunch can access one, without the stigma or eligibility complexities sometimes associated with receiving free meals.

The intention was to extend the pilot programme to up to 21,000 students in around 120 schools by the beginning of 2021, however the COVID-19 response saw the Government scale up the programme with the objective of reaching around 200,000 students by mid-2021.

Strategic intention 5:

Christchurch is a dynamic, productive and inspiring place to live, work, visit and invest#

What we intended to achieve

Work with local leadership to sustain and improve the pace and momentum of regeneration.

What we achieved in 2019/20

We supported the ongoing transition to locally-led regeneration

We made further significant progress towards the transition to locally-led regeneration in greater Christchurch. A number of key milestones were reached and we are in a strong position to transition our remaining roles ahead of the expiry of the majority of the Greater Christchurch Regeneration Act (the Act) on 30 June 2021. Progress made over the last year has further strengthened the relationship between the Crown and local agencies, providing a strong foundation for the future.

Our key achievements over the past year include:

- approval of the final Global Settlement Agreement between the Crown and the Christchurch City Council providing certainty on the long-term ownership of key regeneration assets, and final roles and responsibilities for regeneration (see case study)

- the Greater Christchurch Regeneration Amendment Bill receiving Royal Assent in June 2020. The Bill amends the Greater Christchurch Regeneration Act 2016 by repealing specific provisions early, removing some extraordinary powers that are no longer required, disestablishing Regenerate Christchurch and providing for limited extension of some land powers.

We utilised Greater Christchurch Regeneration Act powers to achieve optimal regeneration outcomes

The Ōtākaro Avon River Corridor Regeneration Plan, developed by Regenerate Christchurch, was approved by the Minister for Greater Christchurch Regeneration in August 2019. The Plan provides a vision and objectives for short, medium and long-term future land uses and opportunities for 602 hectares of land in the east of Christchurch. This was a milestone in the City's regeneration and a further step in the return to local leadership.

We provided advice that enabled the unique section 71 powers of the Act to be used to fast track changes to district planning documents regarding regeneration outcomes for Lyttelton Commercial Zone Parking and Hagley Oval. As a result, the amendments provide greater certainty regarding the regeneration and redevelopment of Lyttelton town centre and enable Christchurch to bid for “top-tier” international cricket matches through rule changes to flood lighting and the number of match days allowed. A last section 71 proposal, seeking amendments to district and regional planning documents to better enable the development and operation of commercial film or video production facilities in Christchurch, was also received. This proposal will be considered further next year, as will the Christchurch City Council’s proposal to amend the Christchurch Central Recovery Plan in respect of the Canterbury Multi-Use Arena.

We supported key regeneration activities

We maintained strong relationships with regeneration partners through regular engagement, providing ongoing support to their work programmes, actively participating in a number of government groups and facilitating solutions to ensure key projects were progressed collaboratively. This included:

- drafting an Order in Council to modify the process for future resource consent applications relating to reinstatement work on the Christ Church Cathedral, preventing lengthy delays and minimising costs

- organising the appointment of members to the independent Christ Church Cathedral Reinstatement Review Panel, tasked with providing advice and recommendations to the Minister on the draft Order in Council

- supporting processes resulting in the approval of three Christchurch Regeneration Acceleration Facility investment cases - the Canterbury Multi-Use Arena, Ōtākaro Avon River Corridor red zone, and roading projects specifically linked to regeneration needs to develop further business confidence and growth for the city

- completing the Greater Christchurch Horizontal Infrastructure programme.

We supported ongoing improvements to increase our future resilience

We hosted and supported the Public Inquiry into the Earthquake Commission, launched in November 2018 and led by Dame Silvia Cartwright. The Inquiry was established to examine the role and work of the Earthquake Commission, and to learn lessons that can be applied to how it operates in future.

The Inquiry reported its findings and recommendations to the Governor-General at the end of March 2020, and on 9 April 2020 the Minister Responsible for the Earthquake Commission and the Minister for Greater Christchurch Regeneration jointly released the Report of the Public Inquiry into the Earthquake Commission and What we heard: Summary of feedback from the Inquiry's public engagement.

Case Study

Global Settlement Agreement

The Global Settlement Agreement (GSA) was signed by the Christchurch City Council and the Crown in September 2019. This was a critical point of progress, providing certainty on the long-term ownership of key regeneration assets, and final roles and responsibilities between the Crown and the Council relating to regeneration leadership of Christchurch.

The GSA provides a solid foundation for the Crown to step back from its extraordinary role, and for the Council to lead and coordinate the City's activities to support its vision for Christchurch.

At a high level, the GSA provides for the transfer of certain Crown assets to the Council, with the Council taking on responsibility for their long-term operation.

Additionally, both parties committed to a number of actions, including:

- payments of $76.5 million (Council) and $4.6 million (Crown) for outstanding sums owed relating to anchor projects and the Residential Red Zone (RRZ)

- a Crown/Ōtākaro contribution of a total of $13 million towards decontamination or public realm works by Council on the Canterbury Multi- Use Arena (CMUA) and Performing Arts Precinct sites

- Land Information New Zealand (LINZ) using reasonable endeavours to carry out significant title reconfiguration in the Ōtākaro Avon River Corridor (OARC), and some limited road stopping outside the OARC, before transfer of land

- a Crown contribution of $1 million to any reconfiguration carried out by Council outside the OARC

- establishing a consultative group comprising stakeholders and community representatives to advise the Council and LINZ on transitional land use of RRZ

- the Metro Sports Facility transferring to the Council or another party to be agreed as part of further negotiations upon practical completion by Ōtākaro

- recognising Te Rūnanga o Ngāi Tahu's unique role as Treaty partner, and the roles of Te Ngāi Tūāhuriri and Te Hapū o Ngāti Wheke as mana whenua with responsibility pertaining to all resources and protection of Ngāi Tahu interests in relation to the RRZ areas to be transferred.

The GSA also recognised that, through the Christchurch Regeneration Acceleration Facility, the Government had committed $300 million for regeneration projects.

Improving our organisational health and capability#

Across DPMC, we share a common purpose, vision and commitment to living our values - kia māia, kia honohono, kia manawanui, kia taute. Each of us has different work to do, yet we all work to advance an ambitious, resilient and well-governed Aotearoa New Zealand. To support our people to do this, we are committed to providing every employee with career pathways and development, a safe environment that reflects our values and support to ensure they are well-positioned for success.

What we achieved

We are creating One DPMC

As a department, we are diverse by design with a wide range of functions, roles and priorities. Our workplace is filled with change as we grow and shrink, and our work is challenging in often complex areas. Building One DPMC means creating an integrated department with a strong sense of community and belonging, and staff wellbeing.

Results from our Kōrero Mai surveys throughout 2019/20 told us that we need to learn more about each other, our skills and our mahi, we need to improve how our leaders lead and how we manage performance, and we need to grow good habits across DPMC. These signposts guided our people strategy to build One DPMC over the last year.

Key achievements in progressing One DPMC include:

- learning more about our people and considering how to better leverage our combined skills and experience, including holding our first online Town Hall during lockdown with a focus on the work we each do

- focusing on getting the basics right to ensure an equitable and consistent ‘employee journey', with similar opportunities and processes, including the introduction of a refreshed induction programme for all new employees

- continuing to support our staff to have courageous conversations

- learning from past experience of groups coming into and leaving DPMC, to help us create a sustainable future model and way of working that can flex for peaks or changes in our work when required.

COVID-19: An unexpected change environment

The COVID-19 global pandemic created a change environment where challenges and innovations at an individual, team, project and organisation-wide level emerged. Around 75% of DPMC and NEMA staff worked from home during Alert Level 4, with approximately 22% working in the office or other locations in support of the response such as in the National Crisis Management Centre (NCMC).

Through balancing our leadership role in the response to COVID-19 alongside continuing to deliver on our core roles and responsibilities, we learnt several valuable lessons. We are now creating our ‘new normal' by evolving from the experiences during the COVID-19 lockdown, in particular reflecting the benefits of using technology to connect to a location agnostic workplace, embedding a culture of trust and realigning our views on what work can be done remotely.

Looking ahead, these lessons will help us as we embed our new flexible by default approach and ensure we remain resilient as a department.

We continued to develop a diverse and inclusive workplace

We want to foster the development of our people and culture though opportunities to develop and grow, be recognised and rewarded, and be part of an inclusive workplace where diversity of thought, ideas and people is valued, nurtured and celebrated.

Throughout 2019/20, we progressed our diversity and inclusion work programme through several initiatives to create a positive DPMC workplace. These also contribute to the five Papa Pounamu priority commitments of addressing bias and discrimination, strengthening cultural competency, building inclusive leadership, developing relationships that are responsive to diversity, and supporting and engaging with employee-led networks. Key achievements include:

- supporting staff-led networks (such as the Women's Network and Wellness Network) and developing guidance to help our people start a staff-led network or group

- establishing and delivering the Kōrero Speaker Series, which provided staff with diverse perspectives and insights to broaden knowledge and awareness on the issues facing Māori from a policy and decision making perspective

- updating our Gender Pay Gap Action Plan to reflect environmental and policy impacts as we ensure gender is not a factor in remuneration outcomes

- holding People Leader Forums to support and develop our leaders, including raising awareness of wellbeing during COVID-19, and unconscious bias training

- participating in the cross-government Gender Pay Gap Working Group to develop flexible by default goals and support the development of documents to help with implementation of Te Kawa Mataaho Public Service Commission's expectations.

We enhanced our information and communication systems

Improvements to our information and communication systems over the last year significantly enhanced the way we work and engage with each other. In particular, the rollout of collaborative tools, such as Microsoft Teams, changed the way we connect across the department and our various locations. This change was a key foundation in enabling us to perform efficiently and effectively during the COVID-19 lockdown.

Other key achievements in 2019/20 include support for the transition of the National Emergency Management Agency to a departmental agency and support for several NCMC activations. In particular, the response to COVID-19 required the standing up of a new NCMC site at the Ministry of Health for 200 staff to work 24/7 for several months.

We managed our risks effectively

Our senior management regularly review the Department's top strategic and operational risks. We also commission independent assurance to examine specific aspects of our operations. Risk reviews and independent assurance are used to identify actions we can take to ensure we are operating effectively and can deliver on our intentions.

DPMC's risk and assurance approach is supported by a staff member who provides guidance and advice to senior management. Oversight of our risk and assurance activities continued to be provided by DPMC's Risk and Assurance Committee, who continued to provide the Chief Executive with direct and independent advice.

During 2019/20, our business continuity planning was essential from both a physical workplace perspective as well as in maintaining delivery of our work. This enabled staff to continue to deliver during lockdown, whilst also ensuring security and privacy was maintained.

We maintained a safe, healthy and secure working environment

The environment our people work in is dynamic and fast moving, and often means we are working in busy and high pressure situations. We want to make sure that all of our staff, contractors and visitors are in a healthy, safe, secure and supportive environment, and that we all get home happy, healthy and safe to our families at the end of the day.

We continued to support the health, safety and wellbeing of our people during 2019/20 through provision of a range of support including the wellbeing reimbursement, Employee Assistance Programme and seasonal flu vaccinations. Our Health and Safety Committee also continued to bring together workers and management to develop and review health and safety policies and practices for the workplace.

In addition, key achievements during 2019/20 include:

- consolidating all health and safety pages on our intranet, Kāinga, to create a one stop shop for all health and safety related information and make it easier for staff to access the information they need when they need it

- improving how staff can report incidents, by adding a button on Kāinga to make it easier to report incidents and provide useful information to the health and safety team

- improving how we record and report on health and safety, in particular through centralising record keeping and providing monthly reporting to our Security, Privacy and Organisational Health Committee on incidents, near misses, inductions, wellbeing indicators and progress against our health and safety work plan

- supporting our people during the COVID-19 lockdown, through creation of an information hub which was updated as we moved through alert levels. In particular, wellbeing while working from home was a priority due to the majority of our staff working remotely during Alert Levels 3 and 4. We also developed a COVID-19 Suspect/Confirmed Case Protocol process to ensure we were prepared for if any active cases were present at one of our locations.

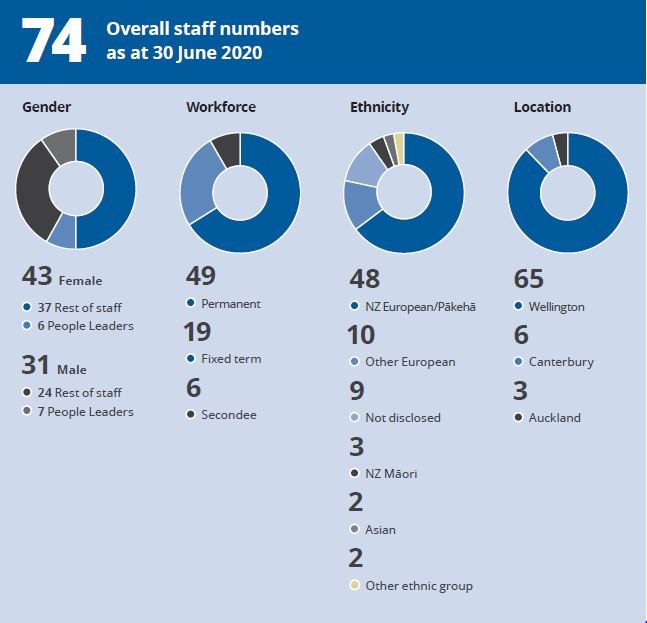

A picture of our staff as at 30 June 2020#

- Data relating to those working for the National Emergency Management Agency have not been included in the information on this page. See page 29 for a breakdown of their staffing numbers.

- The COVID-19 Group was formally established as a DPMC business unit on 1 July 2020. Therefore, data on this page does not include those working on the response and seconded to the NCMC as at 30 June 2020.

- Ethnicity has been reported using total response data. This means that every ethnic group a person identifies with is counted. Therefore, the sum of categories is greater than the number of people.

C National Emergency Management Agency#

Annual Report 2019/20

Introduction from the Chief Executive#

The National Emergency Management Agency (NEMA) is charged with supporting communities to reduce the impact of emergencies across all hazards and risks, and to better respond to, and recover from, emergencies when they happen.

Emergencies have consequences for people, whānau, communities, property, infrastructure, the economy and the environment.

Our key organisation milestone this year was the establishment of NEMA as a departmental agency hosted by the Department of the Prime Minister and Cabinet, and the transfer of Ministry of Civil Defence & Emergency Management staff and functions into NEMA. As a departmental agency, NEMA has greater autonomy and a mandate from Government to lead and coordinate across the emergency management system (including central and local government) for all hazards and risks.

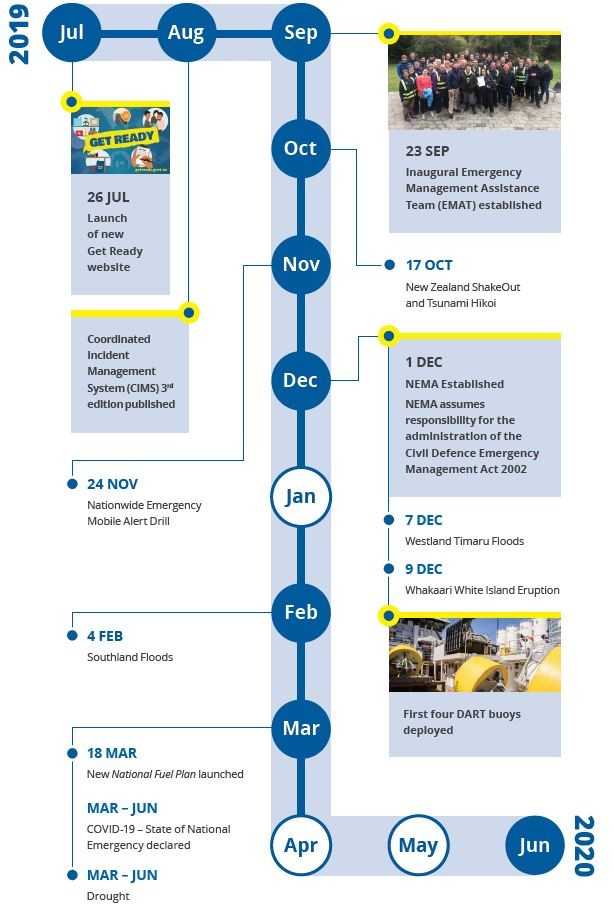

Our focus this past year has been on enabling incremental, yet transformational change to deliver the strategic shift expected by the Government and the sector. This is part of our journey to modernise New Zealand's emergency management system.

Since NEMA was established on 1 December 2019, the emergency management system has been in constant response and recovery mode: the Whakaari White Island volcanic eruption, the Westland, Timaru and South Island floods, widespread drought in the north and most recently COVID-19. The frequency, complex nature and socio-economic consequences of these emergencies highlight and reinforce the importance of stepping up the pace to modernise New Zealand's emergency management system and enhance New Zealand's resilience to withstand and minimise the impacts of a range of hazards and risks.

Despite being in constant response and recovery mode, we delivered on a number of key objectives this year, including the establishment of the Emergency Management Assistance Team, the first deployment of the Deep-ocean Assessment and Reporting of Tsunamis (DART) buoys network, and other initiatives in support of the Emergency Management System Reform programme.

NEMA aspires to deliver the Government's vision for the emergency management system and the tasks before it to achieve that vision. Looking forward to 2020/2021 we are preparing to adopt a stronger national emergency management leadership and stewardship role, to build the capability and capacity of the emergency management workforce, and to improve information and intelligence systems to support decision making in emergencies. The COVID-19 response in particular has confirmed and crystallised what the Ministerial review Better Responses to Natural Disasters and Other Emergencies in New Zealand told us that wide-ranging initiatives are needed to reform the system. These initiatives require investment in infrastructure, technology, systems and resources.

NEMA's evolution as kaitiaki of the emergency management system requires a sharp focus on what it is that only NEMA can or should do; and doing it well.

I acknowledge the highly skilled and passionate NEMA staff who work in service of New Zealand every day. This is not something we do alone. Our many partners in regional and local authorities, iwi, communities, business, and other central government agencies also play a vital part in ensuring emergency responses and recoveries are effective and integrated. I acknowledge the important role of our partners in the successful realisation of NEMA's mandate.

Statement of Responsibility#

I am responsible, as Chief Executive of the National Emergency Management Agency - Te Rākau Whakamarumaru (NEMA), for the accuracy of any end-of-year performance information prepared by NEMA, whether or not that information is included in the Annual Report.

Carolyn Schwalger

Chief Executive

National Emergency Management Agency

Who we are and what we do#

Overview of our agency

NEMA works to build New Zealand's resilience by keeping people safe and reducing the impact of emergencies on our communities and whānau.

NEMA works to build the capability and capacity of the emergency management system to reduce risk, plan for, respond to and recover from emergencies across all hazards and risks. NEMA coordinates central government's response and recovery functions for national emergencies, and supports the management of local emergencies and the emergencies led by other agencies. It also leads on geological and meteorological emergencies, and supports other lead agencies in the response and recovery of other hazard events.

NEMA works with a diverse range of organisations, including central and local government, communities, iwi, emergency services, lifeline utilities, private sector organisations, education providers, researchers, and non-government organisations and business to ensure responses to, and recoveries from, emergencies are coordinated, integrated and effective.

NEMA also holds key international relationships with emergency management counterparts overseas and engages with them on emergency management best practice and operational matters.

NEMA's work is underpinned by the Civil Defence Emergency Management Act (2002), the National Disaster Resilience Strategy, the National Civil Defence Emergency Management (CDEM) Plan and the Emergency Management Systems Reform programme, as set out in the Government's response to the Ministerial review Better Responses to Natural Disasters and Other Emergencies in New Zealand.

Our workforce

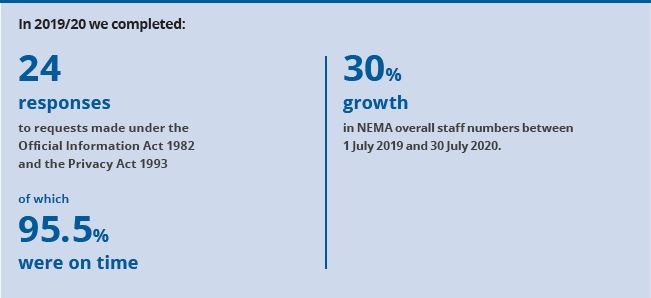

2019/20 at a glance#

Our numbers at a glance#

What we achieved in 2019/20#

The achievements outlined in this section include work undertaken by both the Ministry of Civil Defence & Emergency Management (from 1 July to 30 November 2019) and by NEMA (from 1 December 2019 to 30 June 2020). These achievements contribute to DPMC's Strategic Intention 3: Our cohesive, risk-based National Security System makes New Zealand stronger and more resilient. See pages 15 and 16 for further reporting on this strategic intention.

We led work to strengthen the emergency management system's ability to manage risk, and respond to and recover from emergencies

In August 2019, we published the Coordinated Incident Management System (CIMS) third edition. Enhancements introduced by the third edition include emphasising flexibility in application so that it can be used for incidents through to large-scale emergencies at the national level, as well as highlighting the importance of the inclusion of iwi and Māori in response and recovery.

In March 2020, we launched the National Fuel Plan, in collaboration with the Ministry of Business, Innovation and Employment. The Plan provides an agreed planning framework between fuel companies, government departments and agencies, local government and Civil Defence Emergency Management (CDEM) Groups to respond to major disruptions to fuel supplies.

Our public education campaigns also supported New Zealanders in building their emergency preparedness and resilience. In July 2019, we launched the new Get Ready website, making emergency preparedness easier and more accessible.

We led work to build capability and capacity in New Zealand's emergency management system

In September 2019, we launched the Emergency Management Assistance Team (EMAT), providing a new capability in New Zealand's emergency management system. EMAT has people with a mix of the appropriate skills, experience and attributes to go wherever required, without delay, to work with and support the local Incident Controller and their Incident Management Teams as they manage emergencies. The EMAT cadre is drawn from personnel working in central and local government agencies and emergency services. Since the launch, we have deployed EMAT personnel to support the responses to the West Coast severe weather event in December 2019, the Southland flooding event in February 2020, and COVID-19 in March 2020.

Over the course of the year, we delivered Response and Recovery Leadership Programme Tier 1 courses in Christchurch and Hamilton. These courses are designed to support the capability development of Controllers, Recovery Managers and Response Managers who all play key roles in response and recovery. We also developed an Integrated Training Framework course for Lifeline Utility Coordination, with a pilot workshop held in December 2019.

Case Study

Establishing a tsunami monitoring and detection network for New Zealand

New Zealand's emergency management system has been enhanced through NEMA's deployment of a network of Deep-ocean Assessment and Reporting of Tsunami (DART) buoys this year. This is a significant boost to New Zealand's end-to-end arrangements for monitoring, detecting and issuing warnings about tsunami. The project to establish the DART buoy network began in late 2018 and has involved NEMA (then MCDEM), the Ministry of Foreign Affairs and Trade, the Ministry of Business, Innovation and Employment, GNS Science and NIWA.

New Zealand's geographical and geological place in the Pacific puts us at risk from many different tsunami sources; some may be generated and arrive at our nearest coasts in less than an hour. DART buoys are currently the only accurate way to rapidly confirm a tsunami has been generated - before it reaches the coast.

Early detection of a tsunami using DART buoys allows us to accurately provide early warnings using a range of communication channels including Emergency Mobile Alerts. GNS Science's National Geohazards Monitoring Centre provides 24/7 monitoring support to receive, process and analyse the data from the buoys.

The DART buoy network also provides tsunami monitoring and detection information for Pacific countries, including Tokelau, Niue, the Cook Islands, Tonga and Samoa.

DART buoys on board the NIWA Vessel prior to deployment in December 2019

Building our organisational health and capability#

Our focus has been on enabling incremental, yet transformational change to achieve the strategic shift expected by the Government when it established NEMA. We are investing in our people and systems, making sure we have the right people with the right capability to support our work.

As a first step, we've implemented a ‘Stabilising NEMA' programme, using the Government's initial investment in establishing NEMA to alleviate internal human resource issues and to begin to design our future state. Through Stabilising NEMA, the number of permanent staff has begun to increase and will continue to do so over 2020/21. Our immediate priorities for this investment programme include resourcing for policy, operations, national planning, workforce capability, resilience and support to executive leadership.

Development of staff is supported by DPMC processes. Development plans are drawn up for all staff and managed throughout the year to ensure continuous development, including providing opportunities for developing of staff outside of NEMA.

Implementing flexible working by default is underway. A portion of NEMA staff work remotely, flexible hours, part-time, and have the opportunity to buy-back leave. Many of the tools required to support staff and managers are already in place. The COVID-19 lockdown period provided an opportunity to further advance working from home arrangements.

D Our performance information#

This section reports on what we achieved within each appropriation against the expectations set in the Estimates of Appropriations for Vote Prime Minister and Cabinet in 2019/20

Appropriation statements#

Statement of Budgeted and Actual Departmental and Non-departmental Expenses and Capital Expenditure Against Appropriations

for the year ended 30 June 2020

| 2019/20 Actual $000 |

2019/20 Budget $000 |

2019/20 Supp. Estimates[6] $000 |

Where performance information is reported | |

|---|---|---|---|---|

| DEPARTMENTAL OUTPUT EXPENSES | ||||

| Canterbury Earthquake Recovery | 7,999 | 11,636 | 9,426[7] | Part D |

| Cyber Security | 173 | 2,000 | 700 | Part D |

| Support for Inquiry into EQC | 1,073 | 900 | 1,550 | Part D |

| TOTAL DEPARTMENTAL OUTPUT EXPENSES | 9,245 | 14,536 | 11,676 | |

| DEPARTMENTAL CAPITAL EXPENDITURE | ||||

| Department of the Prime Minister and Cabinet - Capital Expenditure PLA |

795 | 646 | 961 | Part D |

| TOTAL DEPARTMENTAL CAPITAL EXPENDITURE | 795 | 646 | 961 | |

| NON-DEPARTMENTAL OTHER EXPENSES | ||||

| Civil Defence Emergency Management Training | 929 | 2,000 | 2,000 | Minister's Report appended to the DPMC Annual Report |

| Contributions to Local Authorities Following an Emergency Event | 2,075 | 1,300 | 2,336 | Exempt under section 15D(2)(b)(ii) of the Public Finance Act 1989 |

| COVID-19: Civil Defence Emergency Management Group Welfare Costs | 28,794 | - | 25,000 | Minister's Report appended to the DPMC Annual Report |

| Disposal of Earthquake Demolition Materials | - | - | 4,000 | Exempt under section 15D(2)(b)(ii) of the Public Finance Act 1989 |

| Emergency Management Preparedness Grants | 1,039 | 889 | 1,295 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| Governor-General's Programme PLA | 1,295 | 1,500 | 1,500 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| Governor-General's Salary and Allowance PLA | 396 | 500 | 500 | Exempt under section 15D(2)(b)(ii) of the Public Finance Act 1989 |

| Governor-General's Travel Outside New Zealand PLA | 62 | 407 | 407 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| Inquiry into EQC | 130 | 70 | 243 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| Local Authority Emergency Expenses PLA | 10,768 | 5,000 | 5,000 | Minister's Report appended to the DPMC Annual Report |

| Maintaining Water Supply in Periods of Drought | 209 | - | 10,000 | Minister's Report appended to the DPMC Annual Report |

| Prime Minister's Chief Science Advisor Research Programme | 120 | 120 | 120 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| Remuneration of Commissioners of Intelligence Warrants PLA | 55 | 174 | 174 | Exempt under section 15D(2)(b)(ii) of the Public Finance Act 1989 |

| Restoration of Kaikōura District Three Waters Network | 1,738 | - | 1,738 | Minister's Report appended to the DPMC Annual Report |

| TOTAL NON-DEPARTMENTAL OTHER EXPENSES | 47,610 | 11,960 | 54,313 | |

| MULTI-CATEGORY EXPENSES AND CAPITAL EXPENDITURE | ||||

| Emergency Management MCA | ||||

| DEPARTMENTAL OUTPUT EXPENSES | ||||

| Community Awareness and Readiness | 2,576 | 1,938 | 1,938 | Part D |

| Emergency Sector and Support and Development | 6,804 | 5,644 | 7,144 | Part D |

| Management of Emergencies | 15,000 | 12,810 | 23,691 | Part D |

| Policy Advice - Emergency Management | 1,226 | 1,143 | 1,543 | Part D |

| TOTAL EMERGENCY MANAGEMENT MCA | 25,606 | 21,535 | 34,316 | |

| Government House Buildings and Assets MCA | ||||

| NON-DEPARTMENTAL OTHER EXPENSES | ||||

| Depreciation of Crown Assets | 1,012 | 1,962 | 1,812 | Exempt under section 15D(2)(b)(ii) of the Public Finance Act 1989 |

| Government House - Maintenance | 746 | 560 | 760 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| NON-DEPARTMENTAL CAPITAL EXPENDITURE | ||||

| Government House Buildings and Assets - Capital Investment |

756 | 800 | 1,000 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| TOTAL GOVERNMENT HOUSE BUILDINGS AND ASSETS MCA |

2,514 | 3,322 | 3,572 | |

| Policy Advice and Support Services MCA | ||||

| DEPARTMENTAL OUTPUT EXPENSES | ||||

| National Security Priorities and Intelligence Coordination | 13,778 | 12,276 | 13,633[7] | Part D |

| Policy Advice - Child Poverty Reduction | 2,163 | 1,946 | 2,246 | Part D |

| Policy Advice - Prime Minister and Cabinet | 6,057 | 3,987 | 5,655 | Part D |

| Science Advisory Committee | 725 | 675 | 755 | Part D |

| Support Services to the Governor-General and Maintenance of the Official Residences | 4,552 | 4,179 | 4,418 | Part D |

| Support, Secretariat and Coordination Services | 5,722 | 5,940 | 6,370 | Part D |

| TOTAL POLICY ADVICE AND SUPPORT SERVICES MCA | 32,997 | 29,003 | 33,077 | |

| Tsunami Monitoring and Detection Network MCA | ||||

| DEPARTMENTAL OUTPUT EXPENSES | ||||

| Management of Tsunami Monitoring and Detection Network | 90 | 465 | 263 | Part D |

| NON-DEPARTMENTAL OTHER EXPENSES | ||||

| Depreciation of Tsunami Monitoring and Detection Network | 366 | 356 | 546 | Part D |

| NON-DEPARTMENTAL CAPITAL EXPENDITURE | ||||

| Tsunami Monitoring and Detection Network - Capital Expenditure | 6,795 | 7,018 | 11,679 | Part D |

| TOTAL TSUNAMI MONITORING AND DETECTION NETWORK MCA | 7,251 | 7,839 | 12,488 | |

| TOTAL MULTI-CATEGORY EXPENSES AND CAPITAL EXPENDITURE | 68,368 | 61,699 | 83,453 | |

| TOTAL ANNUAL AND PERMANENT APPROPRIATIONS | 126,018 | 88,841 | 150,403 |

Multi-year appropriation

The Department has a multi-year appropriation for output expenses incurred by the Crown for the establishment costs and the development of strategies and planning activities, with communities, stakeholders and decision makers for the regeneration of areas in greater Christchurch.

| 2019/20 Actual $000 |

Location of end-of-year performance information | |

|---|---|---|

| Appropriation for Non-departmental output expenses: Regenerate Christchurch | ||

| Original Appropriation | 20,000 | Minister's Report appended to the DPMC Annual Report |

| Adjustments | 1,073 | |

| TOTAL ADJUSTED APPROVED APPROPRIATION | 21,073 | |

| Actual Expenditure 2016/17 | 4,000 | |

| Actual Expenditure 2017/18 | 4,000 | |

| Actual Expenditure 2018/19 | 5,072 | |

| Actual Expenditure 2019/20 | 2,627 | |

| APPROPRIATION REMAINING AT 30 JUNE 2020 | 5,374 |

Expires: 30 June 2021.

Statement of Departmental and Non-departmental Expenses and Capital Expenditure Incurred Without, or in Excess of Appropriation, or other Authority

for the year ended 30 June 2020

For the year ended 30 June 2020, there are two items of unappropriated expenditure in Vote Prime Minister and Cabinet.

Expenditure Incurred in Excess of Appropriation or other Authority

| 2019/20 Actual $000 |

|

|---|---|

| NON-DEPARTMENTAL OTHER EXPENSES | |

| COVID-19: Civil Defence Emergency Management Group Welfare Costs | 3,794 |

An appropriation was established to achieve the provision of government financial support to local authorities and Civil Defence Emergency Management groups for costs attributable to COVID-19 they incurred in providing urgent welfare support to people who required assistance, and in supporting community-based organisations: a total of $30 million was appropriated; $25 million in 2019/20 and $5 million in 2020/21. Claims for support provided for the year to 30 June 2020 surpassed expectations and were in excess of the 2019/20 appropriation by $3.794 million (2019: $0.500 million relating to the settlement of a legal claim).

The unappropriated expenditure is within the scope of the Non-departmental Other Expense: COVID-19: Civil Defence Emergency Management Group Welfare Costs appropriation.

Expenditure Incurred Without Appropriation or other Authority

| 2019/20 Actual $000 |

|

| NON-DEPARTMENTAL OTHER EXPENSES | |

|---|---|

| COVID-19 publicity campaign | 18,000 |

Following COVID-19 arising in New Zealand, a COVID-19 All-of-Government Response Group was established within DPMC. One function of this team was to lead the Unite against COVID-19 publicity campaign.

In March and April 2020 Cabinet approved funding for the COVID-19 publicity campaign. At the time of committing to the expenditure for this publicity campaign DPMC did not hold the appropriation authority to allow for this to happen.

Some of the expenditure incurred by DPMC for the publicity campaign was intended to be recorded against the Vote Health Non-departmental output expense appropriation Public Health Service Purchasing for 2019/20. An authority was established for the expenditure (based on initial advice from the Treasury prepared under urgency).

However, after the expenditure had been incurred, a review determined that the authority was invalid as section 7C of the Public Finance Act precludes departments being able to incur expenses against Non-departmental expenses appropriations administered by another department.

Statement of Capital Injections

for the year ended 30 June 2020

| 2019/20 Actual $000 |

2019/20 Budget $000 |

2019/20 Supp. Estimates $000 |

|

|---|---|---|---|

| Capital Injection | 861 | 546 | 861 |

Statement of Capital Injections Without, or in Excess of, Authority

for the year ended 30 June 2020

DPMC has not received any capital injections during the year without, or in excess of, authority (2019: Nil).

Reporting against our appropriations#

Canterbury Earthquake Recovery#

This appropriation is intended to achieve support for the regeneration of greater Christchurch, including the ongoing provision of corporate capability.

In 2019/20, this appropriation contributed to achievements in Strategic Intention 1 (A proactive and responsive public service, helping shape and deliver the Government's priorities) and Strategic Intention 5 (Christchurch is a dynamic, productive and inspiring place to live, work, visit and invest).

What we achieved

| Performance measure | Target for 2019/20 | Result for 2018/19 | Result for 2019/20 | Achieved |

|---|---|---|---|---|

| Policy and Legislation | ||||

| The satisfaction of the responsible Ministers with policy advice service, as measured using the Ministerial Satisfaction Survey (see Note 1), is at least: | 4 | Revised measure (see Note 2) |

5 | ✔ |

| Average score for assessed policy papers (see Note 3) | 4 | New measure | 3.5 | ✗ |

| A sample of policy advice fits within the target ranges for quality (see Notes 3 and 4) | Achieved | Not Achieved | Achieved | ✔ |

| Leadership/Brokering/Coordination | ||||

| The satisfaction of the responsible Ministers with the leadership/brokering/coordination role as measured using the Ministerial Satisfaction Survey (see Note 1) is at least: | 4 | Revised measure (see Note 2) |

5 | ✔ |

| Monitoring and Reporting | ||||

| Report to the Minister at least twice per year on the performance of the Regenerate Christchurch Board | 2 | Achieved | 4 | ✔ |

| The satisfaction of the responsible Ministers with the monitoring and reporting activity, as measured using the Ministerial Satisfaction Survey (see Note 1) is at least: | 4 | Revised measure (see Note 2) |

5 | ✔ |

Note 1 - The Ministerial Satisfaction Survey measures Ministers' satisfaction with the quality, timeliness and value for money of advice on a scale from 1 to 5, where 1 means never met expectations and 5 means always exceeded expectations.

Note 2 - Due to the implementation of a new five-point scale for measuring Ministerial satisfaction, results from 2019/20 are not comparable with results from 2018/19 when a ten-point scale was used.

Note 3 - A sample of the department's policy advice was assessed by a panel using the Policy Quality Framework. There are two targets for reporting on overall policy advice: an average score and a distribution score. Policy advice is scored on a scale of 1 to 5, where 1 means unacceptable and 5 means outstanding. All first opinion policy functions contribute to one score across DPMC.

Note 4 - A distribution score has been applied to show the percentage of papers that exceed, meet or don't meet the performance target set. The target for 2019/20 is that 70% of assessed papers score 3 or higher, 30% score 4 or higher, and no more than 10% score 2.5 or less.

How Ministerial satisfaction was calculated

Ministerial satisfaction with policy advice is measured using the Policy Project's Ministerial Policy Satisfaction Survey. The survey contains a common set of questions that agencies use to assess their Minister's satisfaction with the services provided.

The result for Ministerial satisfaction in relation to advice other than policy advice is an average of overall satisfaction and the ratings for the following dimensions: advice meets needs, is timely and of a high quality.

Both the Minister and Associate Minister for Greater Christchurch Regeneration were surveyed on their satisfaction. The result reported is an average of both surveys.

Reporting to the Minister on the performance of the Regenerate Christchurch Board

During 2019/20, we reported to the responsible Minister (the Associate Minister for Greater Christchurch Regeneration) four times on the performance of the Regenerate Christchurch Board, in:

- September 2019 on the Quarter 3 and Quarter 4 performance of 2018/19

- November 2019 on the Quarter 1 performance of 2019/20

- March 2020 on the Quarter 2 performance of 2019/20

- May 2020 on the Quarter 3 performance of 2019/20.

Why we did not achieve one of our policy quality targets

The past year was the first using the new scoring system from the updated Policy Quality Framework. We set two measures for policy quality, one an average score and one on the distribution of scores.

During 2019/20, we continued to focus on improving the consistency of our policy papers across DPMC which is reflected in our achievement of the distribution target. Of the papers reviewed, 88% scored 3 or above and 44% scored 4 or above. Although not directly comparable to previous years, our results also show fewer low scoring papers.

Over the next year we will work on the recommendations from the review to help us further improve the quality of our policy papers and work towards achieving our ambitious target for the average score of policy papers.

How much it cost

| 2018/19 Actual $000 |

2019/20 Actual $000 |

2019/20 Budget $000 |

2019/20 Supp. Estimates $000 |

|

|---|---|---|---|---|

| 11,384 | Revenue Crown | 9,036 | 11,636 | 9,036 |

| 320 | Revenue Other | 343 | - | 390 |

| 11,704 | TOTAL REVENUE | 9,379 | 11,636 | 9,426 |

| 10,271 | Expenses | 7,999 | 11,636 | 9,426 |

| 1,433 | Net Surplus/(Deficit) | 1,380 | - | - |

Expenditure was lower than originally budgeted due to lower costs in 2019/20 than initially anticipated and some activity continuing into 2020/21. The reduction in the Supplementary Estimates reflects a transfer of $3 million to 2020/21, which was approved in March 2020.

Cyber Security#

This appropriation is intended to support activities that address cyber security threats and improve cyber security resilience.

In 2019/20, this appropriation contributed to achievements in Strategic Intention 3 (Our cohesive, risk-based national security system makes New Zealand stronger and more resilient).

What we achieved

| Performance measure | Target for 2019/20 | Result for 2018/19 | Result for 2019/20 | Achieved |

|---|---|---|---|---|

| Delivery of the annual work programme as agreed by the Cyber Security Coordination Committee | Achieved | New measure | Partially achieved | ✗ |

| The satisfaction of the Minister of Broadcasting, Communications and Digital Media with the policy advice service, as measured using the Ministerial Policy Satisfaction Survey (see Note 1) is at least: | See Note 2 | Additional measure | 4.77 |

-

|

Note 1 - The Ministerial Satisfaction Survey measures Ministers' satisfaction with the quality, timeliness and value for money of advice on a scale from 1 to 5, where 1 means never met expectations and 5 means always exceeded expectations.

Note 2 - This measure was not included in the Estimates of Appropriations 2019/20 so no target was formally set. For 2019/20, we used the Policy Project's revised Ministerial Policy Satisfaction Survey to survey each of the Ministers we provide first opinion policy advice to. We are including this result as additional reporting to provide a more complete picture of how we performed during 2019/20.

Why we did not achieve our target

Delivery of the work programme (as agreed by the Cyber Security Coordination Committee) was delayed due to the impact of COVID-19. Outstanding initiatives will be completed as part of the 2020/21 work programme.

How Ministerial satisfaction is calculated

Ministerial satisfaction with policy advice is measured using the Policy Project's Ministerial Policy Satisfaction Survey. The survey contains a common set of questions that agencies use to assess their Minister's satisfaction with the services provided.

How much it cost