Formats

Chief Executive's overview#

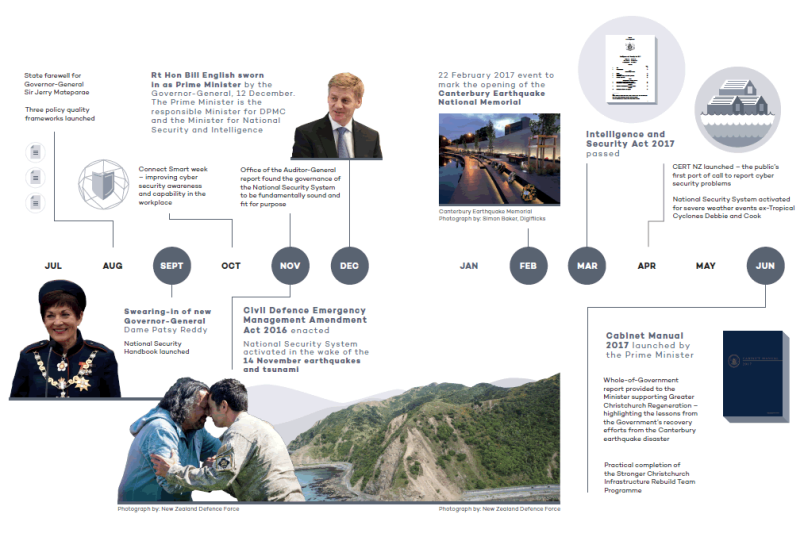

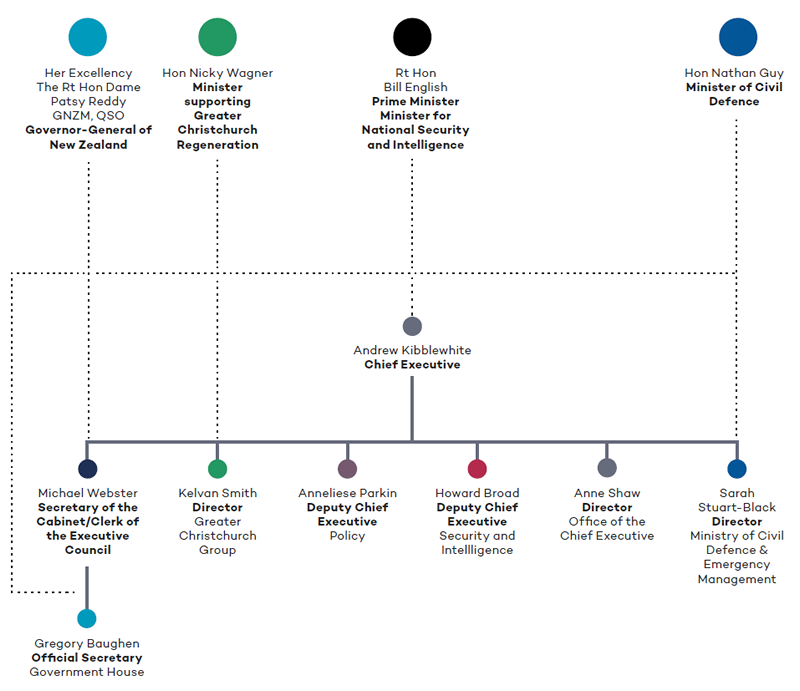

The Department of the Prime Minister and Cabinet (DPMC) has had a successful year, managing many challenges, changes and emergencies over the course of 2016/17. I have been heartened by the way staff from across the Department have risen together to tackle these, at all times displaying thorough professionalism and commitment. It has been a privilege to work for two Governors-General, two Prime Ministers and a number of dedicated portfolio Ministers over the past year.

Our core business is about ensuring New Zealanders can live in a country that is confident, well-governed and secure. That continues to drive everything that we do across DPMC.

The commencement of Dame Patsy Reddy as Governor-General, on 28 September 2016, was a significant constitutional and ceremonial moment for New Zealand, and for the staff in the Cabinet Office and Government House who ensured the smooth transition from Sir Jerry Mateparae. Government House has been active in support of the work of Dame Patsy, including her strategic priorities of creativity, innovation, leadership and diversity.

The Policy Advisory Group (PAG) has supported two Prime Ministers over the past year, and provided both with high-quality, timely and contextualised policy advice on the range of issues that face the Government on a daily basis. The advice and analysis from this group provided decision-makers with a key advantage, and helped translate government priorities into action.

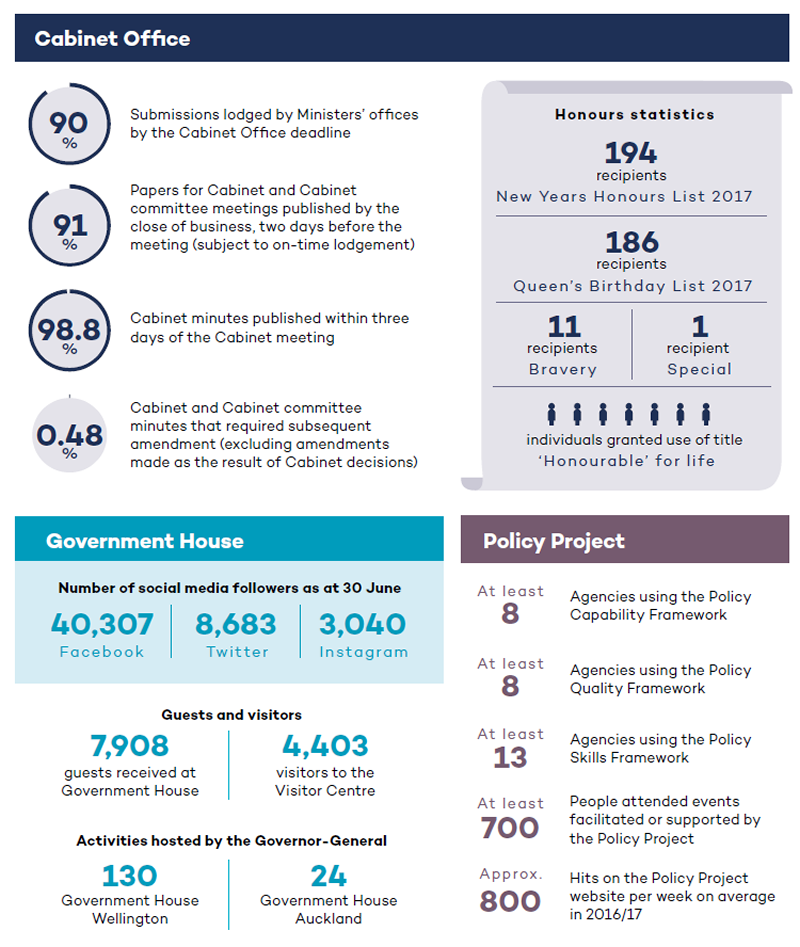

Cabinet Office continued to provide high-quality, integrated advice and support to the Prime Minister, Cabinet and Cabinet Committees, on a range of policy and constitutional matters. A particular highlight was the launch of the 2017 version of the Cabinet Manual by the Prime Minister in June. New Zealand's Cabinet Manual has been a source of envy for many countries around the world, with its focus on the principles of good governance and an ability to adapt to changes in practice, while being durable enough to provide clarity in moments of political uncertainty or systemic change.

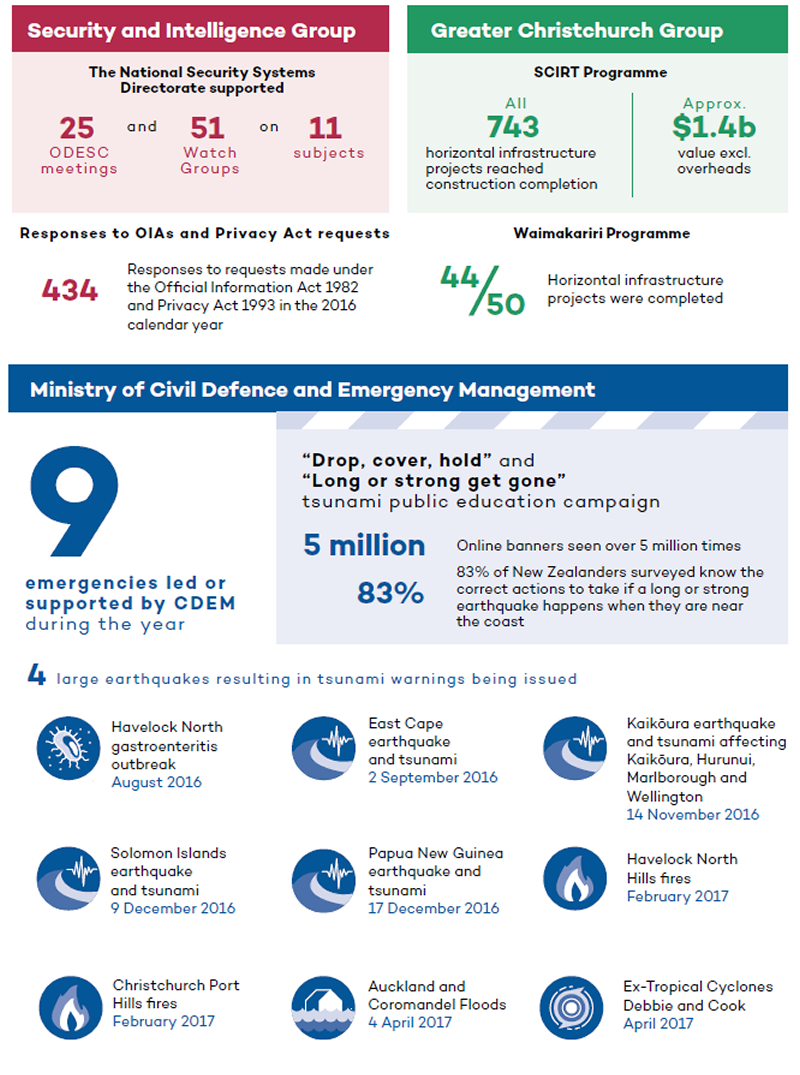

DPMC has been at the forefront of an evolving national security and resilience space, with the response and recovery to nine emergencies supported by the Ministry of Civil Defence and Emergency Management (MCDEM) throughout the year.

The response to, and recovery from, the November earthquakes was one of the biggest efforts the Department has led in my time as Chief Executive. MCDEM led the response in the National Crisis Management Centre (NCMC) which was activated for 26 days, and staff from across the Department worked alongside the emergency services, government agencies, lifeline utilities and others 24 hours a day in the first weeks to ensure affected people and communities had access to the support they needed. The response showed first-hand the increasing role DPMC has in the resilience space, with active involvement from MCDEM, the Security and Intelligence Group (SIG), PAG, Greater Christchurch Group (GCG), Cabinet Office and the Office of the Chief Executive (OCE).

Following the November Kaikōura earthquake and tsunami, DPMC led work on an amendment to the Civil Defence Emergency Management Amendment Act (CDEM Act) and two other new pieces of legislation. The Act brought forward the commencement of provisions enabling local authorities to continue to use certain powers after a state of emergency to smoothly transition into recovery. The Act also established a National Recovery Manager role supported by a temporary MCDEM National Recovery Office. MCDEM continues to host the National Recovery Office, which supports the recovery of communities affected by the 14 November earthquakes and tsunami and the floods affecting Whakatāne in April.

During the year, we made significant progress towards the implementation of the mobile phone-based Cell Broadcast Alerting technology. The new system that will be used across government agencies is intended to be launched by the end of 2017.

We also had the opportunity to reflect on the progress made in national security during the Office of the Auditor-General's performance audit of the National Security System. I was reassured to see the report note that “... the governance arrangements for responding to national security events and emergencies are well established, fundamentally sound, and fit for purpose”.

The Intelligence and Security Act (the Act), which came into force on 1 April 2017, sets out clearly, and in one place, all legislation relating to the Intelligence Agencies and their oversight. The Act ensures the agencies can continue to respond to increasingly complex security threats while providing greater certainty and robust safeguards for New Zealanders. This marks the most robust and comprehensive review of our security and intelligence agencies ever and politicians from across Parliament noted that the process followed was amongst the best ever seen in New Zealand. My thanks to all involved, particularly our National Security Policy team, who worked tirelessly throughout the process.

GCG has had another very busy year supporting regeneration. A major milestone was reached with all 743 horizontal infrastructure projects in the Stronger Christchurch Infrastructure Rebuild Team (SCIRT) programme (totalling approximately $1.4 billion in value, excluding overheads) completed during the year. This is just one of many achievements as we support greater Christchurch going from strength to strength.

None of the above would have been possible without the hard work and dedication of the entire staff of DPMC, who embody our motto “committed to serve, willing to lead”. Thanks also to our families at home who support us in what we do.

Andrew Kibblewhite

Chief Executive

A: Our Strategic Direction#

This section sets out:

- Our year at a glance

- Who we are and what we do

- Our numbers at a glance

- How we measure our performance

- Our performance story

- Where we are going.

Who we are and what we do#

Our role is all about making sure New Zealanders can live in a country that is secure, confident and well-governed. We work closely with our stakeholders to make this happen:

A confident New Zealand has a strong sense of nationhood, and can rely on key institutions and systems to work together in the public interest.

Well-governed means Cabinet decision-making is supported by the best available advice and evidence, and the Governor-General is well-supported in her constitutional, ceremonial, community and international roles.

A secure New Zealand is able to respond to and recover from shocks and stressors in a timely and effective way. It proactively builds resilience with a risk-based, reliable and integrated National Security System (NSS).

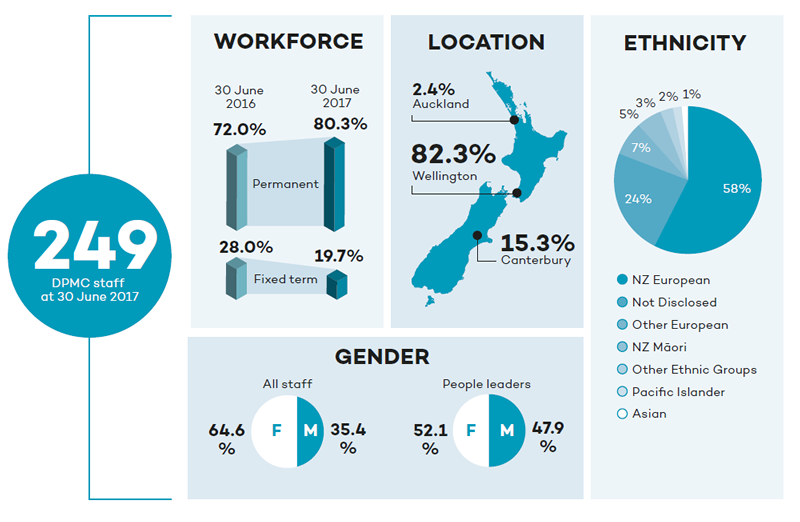

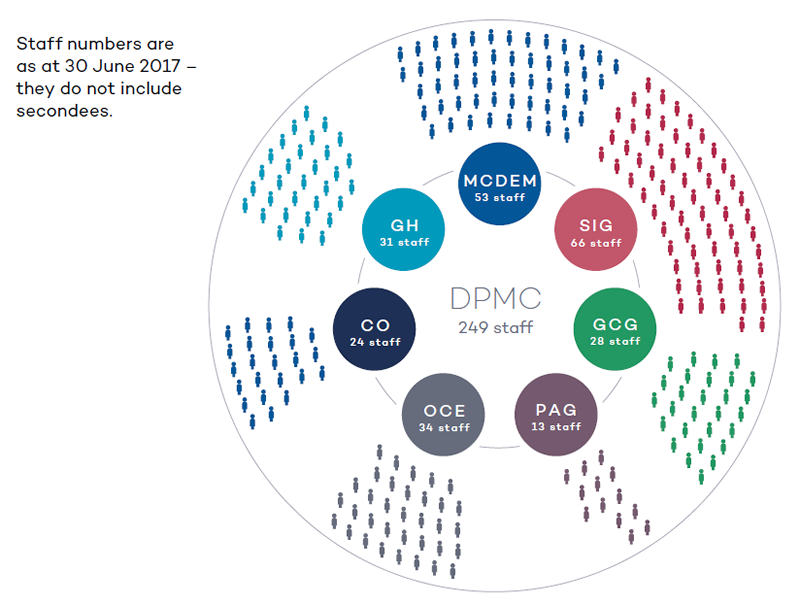

We have seven Business Groups, with 249 staff in Auckland, Wellington and Christchurch. At a glance, our Business Groups achieve our purpose through our four main functions:

- executive government advice and support

- constitution and nationhood

- national security - risk and resilience, and

- Greater Christchurch regeneration.

Executive government advice and support: Serving the Prime Minister and Cabinet#

Policy Advisory Group

The Policy Advisory Group (PAG) provides free and frank advice to the Prime Minister and on occasion to other Ministers, contributes to policy development across the public service and leads policy projects commissioned by the Prime Minister.

PAG takes a whole-of-government view and links agencies to ensure that officials' advice takes account of broader government priorities. Advisors take a strategic perspective, to increase policy coherence, and work closely with colleagues at the State Services to promote a collective approach to leadership.

We host a project team - the Policy Project - to drive policy advice improvement across government. This team supports our Chief Executive in his stewardship role as Head of the Policy Profession.

The Policy Project takes a collaborative approach to its work programme with co-development from policy practitioners from across government and promotion by the Tier 2 Policy Leaders Network (Deputy Chief Executives with policy responsibilities). The programme is jointly funded by government agencies with significant policy functions.

Constitution and nationhood: Supporting well-conducted government#

Cabinet Office

The Cabinet Office supports executive government to work effectively. Advice and support are provided to the Governor-General, Prime Minister and other Ministers on certain constitutional, policy and procedural issues, especially those in the Cabinet Manual.

The Cabinet Office provides impartial secretariat services for meetings of the Executive Council, Cabinet and Cabinet committees.

The Cabinet Office helps to provide an annual framework to establish priorities for preparing, and managing the progress of, the Government's legislation.

The Honours Unit administers the New Zealand Royal Honours system and assists the Prime Minister and the Cabinet Appointments and Honours Committee to consider nominations.

Government House

Government House works with the Cabinet Office to support the Governor-General across four main duties of the office: constitutional, ceremonial, community-leadership and international. Government House provides support services for the Governor-General and maintains the heritage buildings and grounds of the residences in Auckland and Wellington.

Government House supports a strategy for how the Governor-General can make a contribution to New Zealand, and implements this by arranging or coordinating events hosted and attended by the Governor-General.

National security - risk and resilience - leading an effective National Security System, including cross-government arrangements across the '4Rs': risk reduction, readiness, response and recovery #

Security and Intelligence Group

The Security and Intelligence Group (SIG) plays a key role in advising the Government on national security, so people can go about their daily lives free from fear and able to make the most of their opportunities. SIG also exercises a collaborative leadership role within the New Zealand Intelligence Community (NZIC).

Many of SIG's responsibilities are about the governance and coordination of the National Security System (NSS). NSS is a flexible system that responds at a number of levels ranging from events managed by multi-agency groups of senior officials, through to the Officials Committee for Domestic and External Security Coordination (ODESC), through to decision-making by Ministers in the National Security Committee.

SIG:

- provides all-source intelligence assessments to inform government decision-making - DPMC is the New Zealand Government's primary source of independent assessment on intelligence material

- provides a whole-of-government approach to managing national security risks

- provides decision support and policy services to NSS participants in support of agencies with lead responsibility for risk, and

- provides policy services through the National Cyber Policy Office (NCPO).

National security risks are addressed on an all-risks basis and include, for example, armed conflict, geological and meteorological hazards, infrastructure failure, drought, biosecurity, food safety, pandemics, fire, hazardous substances, oil spills, terrorism, transnational organised crime and cyber incidents.

Ministry of Civil Defence and Emergency Management

The Ministry of Civil Defence and Emergency Management's (MCDEM) main aim is to build New Zealand's resilience. The '4Rs' of Risk Reduction, Readiness, Response and Recovery frame our approach. MCDEM puts the right tools, knowledge and skills in the hands of those who will be responsible for designing and implementing solutions at the local level. MCDEM works closely with local and central government, lifeline utilities, the emergency services and a range of other organisations involved in civil defence emergency management (CDEM) to uphold its responsibilities under the Civil Defence Emergency Management Act 2002.

In an emergency, MCDEM:

- leads the national response and recovery for:

o geological – earthquakes, volcanic, tsunami landslides

o weather – coastal hazards, floods, severe winds, snow

o infrastructure failure – telecommunication, power networks

- supports CDEM Groups which lead emergency response and recovery at the local level for the above hazards, and

- supports other agencies when they have the lead such as Police (for example, terrorism events), Ministry for Primary Industries (for example, drought, biosecurity and food safety) and Ministry of Health (MOH) (for example, human pandemics).

Greater Christchurch regeneration: Providing leadership and coordination for the regeneration effort#

Greater Christchurch Group

The Greater Christchurch Group (GCG) oversees the Crown's interests in the regeneration of greater Christchurch, and was formed in March 2016 following the disestablishment of the Canterbury Earthquake Recovery Authority (CERA). GCG coordinates the Crown's regeneration activities. It focuses on the delivery of central government's priorities; working collaboratively with the Strategic Partners[1] and supporting the two new entities Ōtākaro Limited and Regenerate Christchurch to achieve their regeneration objectives.

Key activities GCG carries out include:

- part-funding and joint governance of horizontal infrastructure repairs

- monitoring and reporting on the overall progress of regeneration

- administering the Greater Christchurch Regeneration Act 2016, and

- providing advice to Ministers on the regeneration of greater Christchurch.

Office of the Chief Executive

The Office of the Chief Executive (OCE) supports us to achieve our strategic objectives and manage risk by working across the Department, ensuring we have sound strategy, effective governance and efficient organisational systems and processes.

Our organisational structure#

DPMC also provides support to Hon Simon Bridges, Minister for Communications, on aspects of cyber security, and Hon Chris Finlayson, Minister in Charge of the NZ Security Service and Minister Responsible for the Government Communications Security Bureau (GCSB), on aspects of security and intelligence.

How we measure our performance#

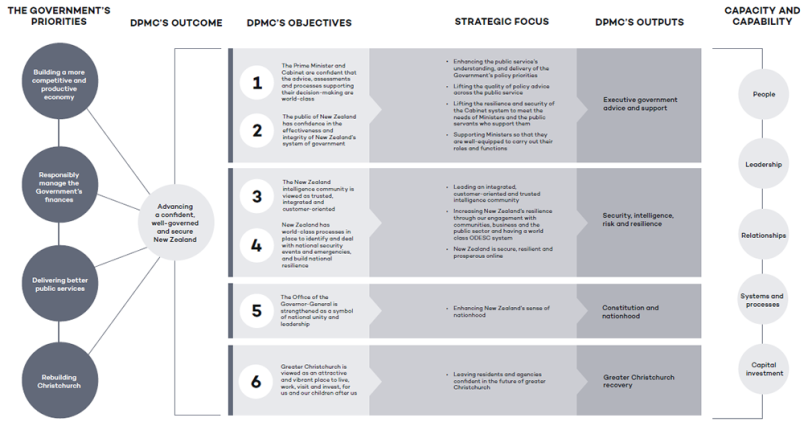

Our six strategic objectives drive progress against our purpose: Advancing a confident, well-governed and secure New Zealand. Nine strategic focus areas sit beneath those objectives, to help us focus our efforts.

Our performance story#

The 2016/17 year has been hugely eventful. During the year, we managed an unprecedented number of emergencies and national security-related events, while also continuing to strengthen our core capability and deliver key programmes of work to achieve our purpose.

At the forefront of an evolving national security and resilience space#

On 14 November 2016 the Kaikōura magnitude 7.8 earthquake and tsunami occurred. Two people lost their lives and the earthquakes and tsunami significantly affected land, seabed, roads and buildings in Marlborough, Kaikōura, Hurunui and Wellington. These events sharply focused much of our work from that point on and continue to be our priority: to coordinate efforts and processes to enable the immediate, medium-term and long-term holistic regeneration and enhancement of communities following this emergency.

On 10 November 2016, prior to the earthquakes, Parliament had the third reading of an amendment to the Civil Defence Emergency Management Act 2002 to allow a smoother and more effective transition from the response phase to recovery after an emergency and the appointment of a national and group recovery manager. It provided those carrying out recovery with powers previously only available under a state of emergency. The majority of this amendment was proposed to commence in six months but was brought forward following the 14 November earthquake and tsunami.

Our responsive policy advice led to timely and effective legislation (the amendment to the Civil Defence Emergency Management Amendment Act 2016, which brought into force the amendment to provide powers for those carrying out recovery, the Hurunui/Kaikōura Earthquakes Recovery Act 2016, and the Hurunui/Kaikōura Earthquakes Emergency Relief Act 2016) to support the response and recovery to the earthquakes. We appointed the first National Recovery Manager and set up the MCDEM temporary National Recovery Office (NRO) to support this position and provided a mechanism for local authorities to continue to use certain powers after a state of emergency to smoothly transition into recovery. NRO worked alongside agencies delivering recovery activity for Kaikōura, Hurunui, Marlborough and Wellington, and to support recovery from the flooding in Whakatāne.

We led the National Security System (NSS), monitored emerging issues and risks, and worked with responsible agencies to ensure quick and effective management when required. Seven events required ODESC's attention, including the 14 November Kaikōura earthquake and tsunami, which resulted in nine meetings of ODESC and a further nine Watch Group[2] meetings.

While supporting NSS, SIG provided a strategic and policy framework to improve collaboration within the intelligence community. Our work supporting the passing of the Intelligence and Security Act 2017 was a departmental highlight for the year.

Alongside its work to lead the response to many civil defence-related emergencies during the year, MCDEM substantially progressed a new National Warning System, to significantly improve the ease of sending out national warnings during an emergency.

Enabling effective executive government#

In December 2016, New Zealand had a change in Prime Minister. This was followed by changes to ministerial portfolios in December, and then again in May. PAG continued to help focus agencies to support the Government's priorities during this period of transition, and provided a continuous flow of strategic advice to the Prime Minister.

Cabinet Office and Government House undertook significant work to enable the smooth transition to both a new Governor-General (in September) and New Zealand's new Prime Minister, as well as supporting the Prime Minister in making changes to ministerial portfolios. The launch and publication of the 2017 Cabinet Manual and continued smooth operation of the CabNet online system were successfully completed to uphold the effectiveness and integrity of executive government.

Leaving Christchurch stronger#

GCG continued to strongly support cross-agency collaboration by providing the strategic leadership and framework necessary to empower local institutions to get back into the “driving seat”. Two notable pieces of work were the successful practical completion of the Christchurch Horizontal Infrastructure Programme and handover to the Christchurch City Council, as well as the completion of the Waimakariri Residential Red Zone Recovery Plan.

Where we are going#

Our objectives summarise our five medium-term strategic priorities through to the end of the 2020-21 financial year. We call these our “Challenges” and they are:

that the public service understands, delivers and helps shape the Government's priorities

governance for the 21st century

New Zealanders understand and celebrate the institutions and processes that contribute to a strong, shared, sense of national identity

increasing New Zealand's resilience through leading and building a risk-based, community-focused and integrated National Security System, and

leaving residents and agencies confident in the future of greater Christchurch.

To support our achievement of our Challenges, in the next financial year:#

- PAG will assist the incoming Prime Minister to focus the public service on the Government's priorities for the new term. The Policy Project is planning for the next three years of work, with five work streams expected in 2017-18.

- The Cabinet Office will focus on preparing for, then supporting, the Governor-General and Prime Minister-elect with the formation of government following the 2017 General Election; inducting any new Ministers; and, providing the incoming Government with effective and responsive secretariat services and constitutional, policy and procedural advice.

- Government House will continue to step up the pace and comprehensiveness of the implementation of the Governor-General's strategy - including a more planned approach to the Governor-General's engagement in Auckland.

- SIG intends to submit proposals regarding the refresh of the National Intelligence Priorities to the National Security Cabinet Committee; refresh the NSS Handbook; improve the quality and availability of training and development regarding national security responses; prepare for NSS' management of security for major events; continue to focus on the intelligence customer engagement programme; and grow some parts of SIG to improve NZIC's capability. NCPO (within SIG) will continue to oversee the implementation of New Zealand's Cyber Security Strategy and Action Plan and ensure it is fit for purpose.

- MCDEM will progress the development of the National Disaster Resilience Strategy, upgrade the current Emergency Management Information System and prepare for go-live implementation for the Cell Broadcast Alerting system based on mobile phone technology. Cell Broadcast Alerting will deliver emergency alerts straight to enabled mobile phones where people's lives or wellbeing are threatened. The outcome of the current “Ministerial Review: Better Responses to Natural Disasters and Other Emergencies in NZ” has potential implications for both MCDEM and NSS in the year to come. DPMC is prepared and ready to shift focus into supporting these recommendations.

- GCG will continue to lead central government oversight of the regeneration of Greater Christchurch, and empower agencies to progress the next stage of regeneration.

- OCE will support the Department to achieve our immediate and long-term objectives, taking a whole-of-department view and ensuring we continue to be well-connected and have sound corporate systems.

B: Progress in 2016/17#

Advancing a Confident, Well-governed and Secure New Zealand#

This section sets out our activities and achievement against our six 2016-2020 strategic objectives which are:

- The Prime Minister and Cabinet are confident that the advice, assessments and processes supporting their decision-making are world class

- The public of New Zealand has confidence in the effectiveness and integrity of New Zealand’s system of government

- The New Zealand intelligence community is viewed as trusted, integrated and customer orientated

- New Zealand has world-class processes in place to identify and deal with national security events and emergencies, and build national resilience

- The Office of the Governor-General is strengthened as a symbol of national unity and leadership

- Greater Christchurch is viewed as an attractive and vibrant place to live, work, visit and invest, for us and our children after us.

Our objective one#

The Prime Minister and Cabinet are confident that advice, assessments and processes supporting their decision-making are world class#

What we said we would do#

- Enhance the public service's understanding and delivery of the Government's policy priorities

- Lift the quality of policy advice across the public service

What we achieved#

Improving the public service's understanding and delivery of the Prime Minister's policy priorities

PAG provides advice on issues of the day, while also proactively testing and turning its mind to issues that might challenge the Government in the future. In 2016/17 PAG provided a continuous flow of advice to the Prime Minister, and other Ministers, and continued to focus agencies on supporting government priorities.

By bringing a clear focus to issues across agency boundaries, PAG assisted the Government to achieve its policy objectives. PAG worked with the other central agencies to support the public service to develop and implement Better Public Services (BPS) initiatives. As at March 2017, 7.5 out of 10 BPS results had been achieved.

Throughout the year, PAG met regularly with the chief executives and senior leaders of the agencies it works with, and provided coordination of policy following the 14 November Kaikōura earthquake and tsunami for recovery work.

During the transition to New Zealand's new Prime Minister in December 2016, PAG continued to work closely with its central agency partners and responsible agencies to provide seamless support. PAG provided specialist policy advice to the new Prime Minister, often with a rapid turnaround. PAG continued to ensure it takes a medium to long-term view of strategic issues, to complement its advice on issues of the day.

Improvements PAG has seen in the public service's understanding and delivery of the Prime Minister's policy priorities include an increased willingness to embrace policy innovation; for example, the work underway on social investment.

PAG also provides a liaison point with the Prime Minister's Chief Science Advisor (Sir Peter Gluckman), who works to increase the public's understanding of, and engagement with, science.

Enabling public service policy leaders to take collective responsibility for the overall capability and responsiveness of the policy system#

As Head of the Policy Profession (HoPP), our Chief Executive is responsible for ensuring consistent improvements in policy quality and capability over time, across the public service.

The launch of three policy improvement frameworks in August 2016 established expected standards for high-performing policy organisations, skilled policy advisors and high-quality policy advice. Since the launch, the Policy Project has helped agencies to use the frameworks by making them easy to use and hard to avoid - ensuring they are the “go to” standard for lifting policy quality, skills and capability.

Throughout the year, the Policy Project has worked with agencies individually and collectively (in cross-agency workshops) to enable greater use and sharing of innovative, citizen-centric approaches to policy design and delivery, and a more strategic and whole-of-government approach to building policy capability across the public service.

Progress to date includes increasing engagement and participation from agencies in the policy system (see “Numbers at a glance” section on page 14 of this report), international interest and recognition (a Policy Project framework was featured in an OECD Public Governance Committee paper and briefings requested by the Head of the Civil Service in Singapore, and the UK Head of the Policy Profession Support Unit); and growing capability in new methods (we have hosted events and published reports on: co-production; public value; design-thinking, behavioural insights and data; and evidence for policy. The Policy Project has released the first elements of an online methods toolkit accessible to the policy community via the refreshed DPMC website).

Case study: The Ministry for Culture and Heritage's efforts to improve policy quality and capability#

The Ministry for Culture and Heritage (MCH) has been a strong supporter of the Policy Project from the outset. MCH contributed at the Tier 2 Policy Leaders Network, as well as to technical working groups during the development of the three policy improvement frameworks.

MCH is part-way through implementing the policy improvement frameworks. MCH is using new tools provided by the Policy Project to support its 2017 ex-post assessment of the quality of its policy advice - one of the first policy agencies to move to internal assessment.

“Great policy advice doesn't just happen - policy advisors need the right skills and the best tools. We are using the Policy Project's frameworks to build our policy capability, both organisationally and at the level of individual advisors. It's still early days, but I'm seeing advice that is better framed, better evidenced, and better connected to the wider context of our decision makers.”

Paul James, Chief Executive, Ministry for Culture and Heritage

Our objective two#

The public of New Zealand has confidence in the effectiveness and integrity of New Zealand's system of government#

What we said we would do#

- Lift the resilience and security of the Cabinet system to meet the needs of Ministers and public servants who support them

- Support Ministers so that they are well-equipped to carry out their roles and functions

What we achieved#

Throughout 2016/17, Cabinet Office continued to support executive government to run smoothly, especially during times of change and transition.

In 2016, Cabinet Office managed the transition of the office of Governor-General from Sir Jerry Mateparae to Dame Patsy Reddy by providing an intensive briefing and induction programme for Dame Patsy as Governor-General Designate; arranging an audience with the Queen; supporting Dame Patsy to develop strategic themes and goals that will underpin her term; and arranging and holding a public swearing-in ceremony at Parliament.

Cabinet Office also led the formal transition to a new Prime Minister in December 2016, and supported the Prime Minister in making changes to ministerial portfolios in December 2016 and May 2017. Regular feedback from the Governor-General and the Prime Minister on the support provided by Cabinet Office continues to be strongly positive.

Lifting the resilience and security of the Cabinet system

The CabNet online system successfully completed its second full year of operation. Minor enhancements were made for users and changes to master data management significantly reduced complexity. Two updated versions of the CabDocs app were released to Ministers.

Supporting Ministers to carry out their roles and functions

The support Cabinet Office provided Ministers to carry out their roles and functions also includes:

- completion of the update of the Cabinet Manual 2017 (as set out below in the case study)

- providing advice and support to Ministers on constitutional issues, the function of executive government, conflicts of interest and matters around conduct, and

- supporting the Leader of the House to prepare and manage the Government's legislation programme for the 2016 and 2017 calendar years.

During the year, the ministerial induction and briefing programme was also reviewed and updated. The six new Ministers appointed during the year received comprehensive briefings to ensure they were well-equipped to carry out their roles and functions. The Ministers reported a high level of satisfaction with the induction programme.

Case study: Cabinet Manual#

During 2016/17, the Cabinet Office completed a major project to revise and update the Cabinet Manual 2008. The Cabinet Manual is the authoritative guide to central government decision-making for Ministers, their offices and those working within government. For nearly 40 years the Cabinet Manual has captured and recorded Cabinet's practices and procedures, underpinning the effectiveness and integrity of New Zealand's system of government.

For the review, all government departments, Ministers' offices and other agencies were canvassed for comment and proposals for amendment. These suggestions, along with material the Cabinet Office had already identified for update, informed the work of a reference group of officials from core agencies to consider, test and review revisions to the text. Cabinet agreed to the proposed changes and endorsed the new edition, which was launched in early June. The Cabinet Manual 2017 is available on our website.

Our objective three#

The New Zealand Intelligence Community is viewed as trusted, integrated and customer-oriented#

What we said we would do#

- Lead an integrated, customer-oriented and trusted intelligence community

What we achieved#

Leading the New Zealand Intelligence Community

Our government is responsible for protecting national security and advancing national interests. Our NSS therefore needs to be well-led and responsive. SIG has a leadership and coordination role across the New Zealand Government's intelligence professionals. During 2016/17, we worked across the NZIC to ensure government priorities were met through the collection of the right intelligence, robust assessment and effective communication of those assessments to decision-makers.

Through the National Assessments Bureau (NAB), we provided independent assessment drawing on all source information, including intelligence, to the Prime Minister and other senior decision-makers, and on national security and foreign policy issues consistent with the Government's national intelligence priorities.

Increasing effective collaboration and enabling a joint approach

NZIC agencies have been working together to increase the impact of the National Intelligence Priorities - improving our insight into our most important national security problems. During the year, we made good progress in building an intelligence community that has common standards, customer-focused approaches and a joint approach to planning and resource management.

The National Security Policy Directorate (NSP) completed a significant piece of policy work which contributed to the passing of the Intelligence and Security Act 2017 (the Act).

We are leading work on a refresh of the National Intelligence Priorities for 2018, finding out what matters most to our customers for each of the most critical National Intelligence Priorities and developing meaningful performance measurement.

To strengthen capability within the national intelligence and security work programme, we set up:

- a national security workforce initiative to improve the versatility and capability of staff within the Top Secret clearance workforce

- a specialist position to assist with risk management advice particularly regarding our counter-terrorism programme, and

- a national risks group within SIG that will be responsible for the governance, administration and analysis of New Zealand's risks.

Case study: Intelligence and Security Act 2017#

In March 2017, the Intelligence and Security Act 2017 (the Act) was passed. NSP led the substantial piece of policy work between February 2016 and the Select Committee's report back, in February 2017.

The Act clarifies the functions of the New Zealand Secret Intelligence Service (NZSIS) and the Government Communications Security Bureau (GCSB), provides for a new warranting regime and strengthens the oversight provided by the Inspector-General of Intelligence and Security. The Act implements the majority of the recommendations made in the first independent review of intelligence and security, carried out by Sir Michael Cullen and Dame Patsy Reddy.

All political parties involved in the parliamentary debates on the Bill leading to the Act commented favourably on the quality of advice received from officials, as well as the process followed, and the Bill received almost unanimous support in the House.

Our objective four#

New Zealand has world-class processes in place to identify and deal with national security events and emergencies, and build national resilience#

What we said we would do#

- Increase New Zealand's resilience through our engagement with communities, business and the public sector and having a world-class ODESC system

- Ensure that New Zealand is secure, resilient and prosperous online

What we achieved#

Our role in the National Security System

Our work focuses on national security risks and we work with agencies to reduce risk and be better prepared to manage the consequences when emergencies occur. We support lead agencies when an event occurs. Where required, NSS provides additional whole-of-government decision support for agencies and Ministers where the threshold for NSS activation is met.

MCDEM has a particular role in leading the civil defence emergency management sector to achieve the purpose of the Civil Defence Emergency Management Act 2002. This includes operating at an often rapid pace in providing emergency management policy advice to government and managing hazard risks across the 4Rs - risk reduction, readiness, response and recovery.

Leading the response to and recovery from emergencies and national security events

During the year, we led or supported response to and recovery from an unprecedented number of emergencies and national security events including earthquakes, tsunami, floods and cyclones. Seven of these required ODESC's attention, including the Kaikōura earthquake and tsunami in November 2016.

We also coordinated across agencies to manage risks relating to major events such as the Rio de Janeiro Olympics.

Building the capability of our National Security System

During the year, we ensured NSS remained agile and responsive. In August and September 2016, MCDEM led over 100 agencies in Exercise Tangaroa, New Zealand's largest ever exercise. This tested New Zealand's arrangements for preparing for, responding to and recovering from a nationally significant tsunami and forms part of our National Exercise Programme.[3]

We published the NSS Handbook in August 2016 - to strengthen understanding of New Zealand's national security governance.

After each major event, the National Security Systems Directorate (NSSD) conducts a debrief of all the agencies involved in the response. The lessons identified are turned into a corrective action plan and then remediation actions are assigned to the appropriate agency. Lead agencies also conduct their own debriefs.

Specific outcomes from debriefs conducted during the year included: improvements being made to our cyber response framework, in particular the CSERP (Cyber Security Emergency Response Plan); and a programme of work being run by the newly-constituted CT Capability Working Group to improve aspects of our system's counter terrorism capabilities. The continuing importance of effective and timely dissemination of information across the system was also emphasised.

Stakeholder feedback for the 2016/17 year is that the ODESC system is effective, efficient and trusted by the officials involved in it, and the Ministers who receive advice from it. The Office of the Auditor-General report “Governance of the National Security System” (published November 2016) found that:

“… the governance arrangements for responding to national security events and emergencies are well established, fundamentally sound, and fit for purpose.”

Legislative changes to support response and recovery

Our policy advice led to new legislation including the Civil Defence Emergency Management Amendment Act 2016 (the Amendment Act) and, following the 14 November Kaikōura earthquakes and tsunami, the amendment to this Amendment Act. The Amendment Act introduced provisions enabling the use of certain powers after a state of emergency to smoothly transition into recovery. The amendment to the Amendment Act brought forward the commencement of these provisions to allow them to be used to support the response and recovery to the Hurunui earthquakes and tsunami.

Supporting resilient communities

Our new National Warning system will significantly improve how we issue national advisories and warnings to agencies, CDEM Groups and the media. Our redeveloped public education programme also targets effective messaging to the right audiences - further information is in the case study over the page.

To encourage whole-of-society participation in disaster risk management, MCDEM is collaborating with a diverse range of organisations to seek their engagement in the development of a new 10-year Strategy. MCDEM remains committed to finalising the new Strategy (proposed “National Disaster Resilience Strategy”) as soon as practicable, pending any potential implications of the current “Ministerial Review: Better Responses to Natural Disasters and Other Emergencies in NZ”.

Increasing the public's confidence to operate securely in cyber space

During the year, NCPO worked with multiple agencies and Connect Smart[4] public and private partners to implement New Zealand's Cyber Security Strategy, along with its plans. The Government's first annual report on the implementation of the Strategy found that good progress had been made in improving New Zealand's cyber security.

Significant work by NCPO contributed to the launch of CERT NZ[5] in April 2017 as a branded unit within the Ministry of Business, Innovation and Employment (MBIE). CERT NZ is the first place for the public to report cyber security problems. NCPO also set up a Cyber Security Skills Taskforce to address the shortage of cyber security professionals, established a regular cyber security exercise programme and is leading work to set up a “cyber credentials scheme” for small businesses to provide them with low cost assessment, support and certification.

Case study: Preventing injury and saving lives through public education#

In the wake of the 14 November 2016 Kaikōura earthquake and tsunami, we took action to improve New Zealanders' understanding of what to do should a large tsunami hit our country. MCDEM developed a multi-media campaign with a creative agency to show people the right and immediate action to take during an earthquake (Drop, Cover and Hold) and if the earthquake is “long or strong get gone”.

The campaign was launched in a very tight timeframe. From receiving Cabinet approval on Monday 5 December 2016, MCDEM had a social media campaign running the same day, posters ready for CDEM groups, government agencies and other partners to share on Thursday 8 December and a nationwide radio campaign in place by Friday 9 December. The television and online campaign began on 16 December. Full page newspaper and outdoor (bus stop) advertising also ran over the New Year holiday.

From April to May 2017, our online advertising had over 3 million views, On Demand advertising had almost 200,000 views, 70% of the target audience saw TV advertisements at least once and 62% saw them three times or more.

Our objective five#

The Office of the Governor-General is strengthened as a symbol of national unity and leadership#

What we said we would do#

- Enhance New Zealand's sense of nationhood

What we achieved#

Supporting the Governor-General and connecting New Zealanders to their nation

The 2016/17 year was marked by the transition from Lt Gen the Rt Hon Sir Jerry Mateparae's term as Governor-General, to Rt Hon Dame Patsy Reddy taking up the role. Sir Jerry's term of office ended in August with several highlights supported by Government House, including his attendance at the Olympic Games in Rio de Janeiro in his role as Patron of the New Zealand Olympic Committee.

As Dame Patsy Reddy prepared to take up the role, Cabinet Office and Government House assisted her to develop a strategy for her five-year term focusing on creativity, innovation, diversity and leadership.

During the year, Government House supported an extensive official programme for the Governor-General, including the following high-profile and nation-building events:

- reviewing the international regatta for the Royal New Zealand Navy's 75th anniversary

- speaking at the opening of the Canterbury Earthquake National Memorial

- opening the He Tohu Exhibition at the National Library of New Zealand, and

- attending the WWI Battle of Messines centennial commemorations in Belgium.

Further measures of our progress in this area can be found in the “Our numbers at a glance” section on page 14 of this report as well as at page 56 (within the “Support Services to the Governor-General and Maintenance of the Official Residences” category).

Case study: Investitures of Royal Honours#

Awarding New Zealand Royal Honours, carried out at formal investiture ceremonies by the Governor-General, is a highly public way of recognising significant contributions that New Zealanders have made in all walks of life, and contributes to the development of our national identity.

After consideration by the Cabinet Appointments and Honours Committee, the Prime Minister makes recommendations to the Queen for Royal Honours. Following her approval, Honours lists are announced at New Year and Queen's Birthday.

The Cabinet Office supports the Government in considering nominations, and Government House assists the Governor-General in conducting investiture ceremonies. The last investitures for the 2016/17 year took place in five ceremonies at Government House Auckland in April 2017, and six ceremonies at Government House Wellington in May 2017.

Our objective six#

Greater Christchurch is viewed as an attractive and vibrant place to live, work, visit and invest, for us and our children after us#

What we said we would do#

- Leaving residents and agencies confident in the future of greater Christchurch

What we achieved#

Leaving Christchurch stronger

Full transition to strong local leadership will enhance the long-term resilience of greater Christchurch. GCG observes, coordinates and supports key stakeholders (including Strategic Partners[6] and Regeneration Partners[7]) to make sure that critical regeneration issues are prioritised and coordinated.

During the year, GCG maintained the strong relationships already built with Regeneration Partners. GCG regularly engaged with, supported and influenced these agencies to collaborate effectively. GCG continued to participate in a number of governance groups, including the Urban Development Strategy Implementation Committee, Chief Executives Advisory Group, the City Executives Forum, the Psychosocial Governance Group, the Canterbury Government Leaders Group, the National Earthquake Memorial Project Steering Group and the Horizontal Infrastructure Governance Group.

As a part-funder of the Horizontal Infrastructure programme, the Crown supported the successful transition of SCIRT data, information and systems to the Christchurch City Council (the Council) to safeguard the Crown's investment in the rebuild/repair of horizontal infrastructure networks and to ensure that the Council was set up to efficiently and effectively manage its networks going forward. The transition of data, information and systems was completed by July 2017.

The construction of all 743 Horizontal Infrastructure projects in the SCIRT Programme (totalling approximately $1.4 billion in value, excluding overheads) was completed during the year.

In addition, 44 of the 50 Horizontal Infrastructure projects in the Waimakariri programme were completed (totalling approximately $17.5 million in Crown funding or 58% of the total $29.9 million Crown appropriation).

The quality of the policy advice and reporting GCG provided on the regeneration was assessed using both ministerial satisfaction surveying and a methodologically robust quality assessment process (see page 45). Policy advice and reporting includes comprehensive monitoring reports (three produced during the year for the Minister on the progress of overall regeneration in greater Christchurch) and weekly statistical dashboards (six additional weekly dashboards were produced from May to June 2017 on specific areas of interest relating to the regeneration of greater Christchurch covering a wide range of portfolios).

GCG also draws on a range of data sources to monitor overall regeneration progress. As monitoring progress against regeneration and recovery necessitates a comprehensive approach, these data sources ranged from MBIE to Canterbury District Health Board. The data sources are regularly reviewed and reported to the Minister. This approach allows for GCG to be agile and responsive, with the option of taking a “deep dive” and an in-depth look into any areas of specific concern if necessary.

In addition to the above, GCG continued to empower agencies to support regeneration and ensure the prioritisation of critical recovery issues by achieving the following milestones and activity during the year:

- Almost all Christchurch Replacement District Plan hearings were completed, substantive decisions were released and appeals the Crown was involved in relating to these hearings were resolved.

- The Minister approved three other planning frameworks (including the Waimakariri Residential Red Zone Recovery Plan - detailed in the case study over the page).

- Supported Regenerate Christchurch to build its capability as a new entity, progress regeneration planning outcomes and to meet its accountability obligations under the Greater Christchurch Regeneration Act 2016.

- Provided advice on the ongoing transition of functions from CERA to other agencies. This included assisting MBIE to mitigate issues with unresolved multi-unit residential insurance claims.

Strengthening New Zealand's resilience in responding to any future earthquakes

To improve future (national and international) recovery actions, GCG led the development of a whole-of-government report, highlighting the lessons from the Government's recovery efforts from the Canterbury earthquake disaster. This report synthesises the lessons captured from the published material related to the Government's actions following the earthquakes. It encompasses lessons focusing on five specific areas: Recovery Governance Arrangements, Recovery Legislation, Land Decisions, Insurance Response and the Horizontal Infrastructure Rebuild Programme.

Case study: Waimakariri Residential Red Zone Recovery Plan#

In September 2015 the then Minister for Canterbury Earthquake Recovery directed the Waimakariri District Council to prepare a Draft Recovery Plan that identified the long-term uses of red zone land in Waimakariri.

Preparing the Draft Recovery Plan was a collaborative process. The Council worked closely with GCG as well as Environment Canterbury, Te Rūnanga o Ngāi Tahu, Ngāi Tūāhuriri Rūnanga and the community. In December 2016 the Minister supporting Greater Christchurch Regeneration approved the Recovery Plan, and in doing so made the first future use decisions about red zone land.

At a high level, the agreed land uses are: greenspace, mixed use business, rural and private lease. Cabinet agreed in principle to divest the majority of the Crown-owned red zone land to the Council so the Council can drive the Recovery Plan's implementation - this underlines the Crown's commitment to locally led regeneration.

In April 2017, the Draft Recovery Plan received the Best Practice Strategic Planning and Guidance Award as well as the overall award, the Nancy Northcroft Supreme Practice Award, from the New Zealand Planning Institute.

C: Our Departmental Health and Capability#

This section sets out our:

- Workforce capacity and current position

- Work to strengthen our workforce and drive our Department's performance

- Work regarding diversity and inclusion

Our departmental health and capability#

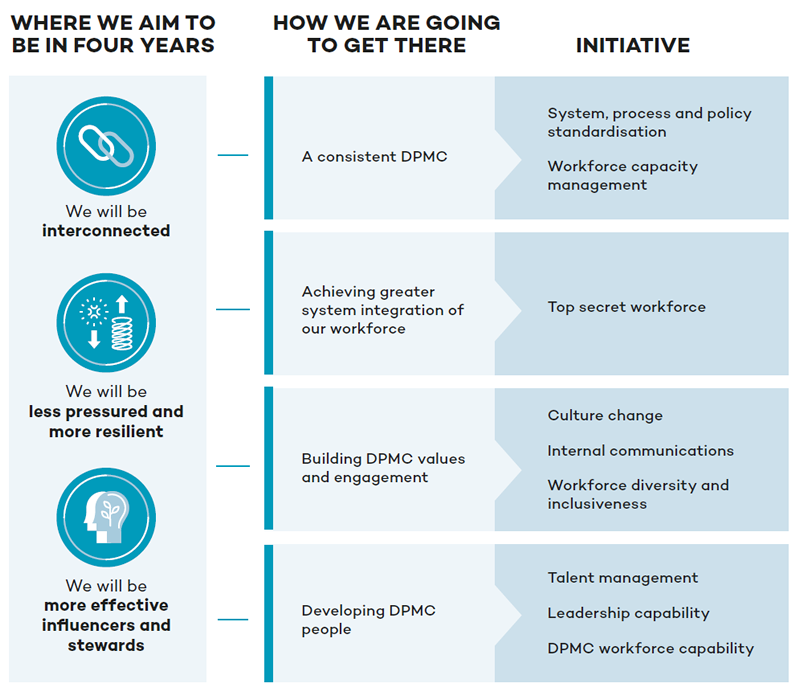

During the year we made good progress against our Workforce Strategy to support our Four Year Excellence Horizon: Being more effective influencers and system stewards, more interconnected and collaborative, less pressured and more resilient.

To improve our consistency and integration, continue to build our values and engagement and develop our people, we:#

- continued to standardise our processes, policies and systems

- continued to develop our induction and orientation programme to make sure our people understand the expectations of their role, and our working culture

- identified areas for improvement in our recruitment and on-boarding processes

- participated in developing a multi-agency strategy for greater system integration of staff within our Top Secret clearance workforce

- improved our internal communications

- reviewed and analysed our gender pay gap

- undertook our biennial engagement survey

- completed a Career Pathway framework for the roles within MCDEM, and

- continued to integrate the Leadership Success Profile (LSP) in our Performance Development process.

Making sure we have the right mix of staff to deliver our objectives#

Over the next three years we will need to continue to “right-size” our organisation as our role in Christchurch diminishes. Reduction in the size of some business groups will be driven mainly through attrition and current fixed-term contracts coming to an end. Making sure we have the right numbers of staff across our business will mean some expansion, and this will require a mix of recruitment and workforce development.

In 2016/17 we recruited 65 new staff. Alongside standard attrition and short-term projects this reflects increased funding for SIG and MCDEM capability through Budget 2016 and also additional roles required post the 14 November Kaikōura earthquake and tsunami.

Making sure staff have a safe and healthy working environment#

We continued to make sure our staff have a safe and healthy working environment by:

- promoting regular health and wellbeing activities including annual flu vaccinations, vision testing, access to an employee assistance programme and an annual health and wellbeing subsidy

- providing ergonomic assessments to ensure our staff are working comfortably

- equipping all offices with emergency provisions should an emergency occur, and

- making flexible working arrangements available to assist staff with work/life balance.

Managing and mitigating our Department's risk#

Our Risk and Assurance Committee provides risk and advisory services to our Chief Executive. The Committee includes three independent members, including the Chair. We also have a staff representative on the Committee who provides an in-house view on the Department's risk and assurance systems and maturity. During the year, the Committee met quarterly to review areas of potential risk, our progress toward mitigating risks and a range of other capability and strategic issues.

Responding to Official information Act requests#

We completed 434 responses to requests made under the Official Information Act 1982 and Privacy Act 1993 in the 2016 calendar year. In the 2015 year, we completed 418 responses, and in 2014, 369 responses. We also updated our OIA policy and worked with the State Services Commission (SSC) on the wider all-of-government work in this space.

Implementing New Zealand Business Number requirements#

The New Zealand Busines Number (NZBN) is a universal identifier to help businesses to easily update, share key information and interact with each other. MCDEM must implement NZBN requirements by 31 December 2018. We updated our Financial Management Information System to the latest version of the software which includes the ability to identify businesses within the finance system by their NZBN. The system will be configured to implement the NZBN during the 2017/18 financial year.

Diversity and inclusion#

We are committed to our five-year diversity goal of making sure we have a working environment where all employees are valued, included and celebrated for the different perspectives they bring, recognised for the contribution they make and offered equitable access to opportunities to succeed.

In 2016/17 we focused on the following activity against our Workforce Strategy 2016-2020:#

- updating and renaming our Equal Employment Opportunities Policy to become our Diversity and Inclusion Policy (to fit better with Better Public Services 2.0)

- understanding staff perceptions of diversity through a customised engagement survey

- building a women's network across DPMC

- identifying diversity and culture initiatives through the establishment of a cross-department working group

- reviewing and assessing existing HR policies to support a more flexible and agile workforce

- working to identify, grow and retain our highest potential future leaders, with a focus on ensuring a diversity balance, and

- conducting a review and analysis of our gender pay gap, and developing a 12-month action plan.

While we still have work to do, staff perception on how clearly defined and understood our diversity policies are has increased on our 2014 engagement survey results. Diversity and inclusiveness carries through as a key focus area in our Workforce Strategy 2017-2021.

D: End of Year Performance Reporting Against Appropriations#

This section sets out our:

- Appropriation Statements

- Financial and Performance Reporting Against Appropriations

Appropriation statements#

Statement of Budgeted and Actual Departmental and Non-departmental Expenses and Capital Expenditure Against Appropriations#

for the year ended 30 June 2017

| VOTE PRIME MINISTER AND CABINET | 2016/17 Actual $000 |

2016/17 Budget $000 |

2016/17 Supp. Estimates $000 |

Where performance information is reported |

|---|---|---|---|---|

| DEPARTMENTAL OUTPUT EXPENSES | ||||

| Canterbury Earthquake Recovery | 16,038 | 20,741 | 19,546 | Part D |

| TOTAL DEPARTMENTAL OUTPUT EXPENSES | 16,038 | 20,741 | 19,546 | |

| DEPARTMENTAL CAPITAL EXPENDITURE | ||||

| Department of the Prime Minister and Cabinet - Capital Expenditure PLA | 350 | 2,450 | 513 | Part D |

| TOTAL DEPARTMENTAL CAPITAL EXPENDITURE | 350 | 2,450 | 513 | |

| NON-DEPARTMENTAL OTHER EXPENSES | ||||

| Emergency Expenses | 2,181 | 2,000 | 2,450 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act |

| Emergency Management Preparedness Grants | 737 | 889 | 889 | |

| Ex gratia Payment to the University of Auckland | 120 | 120 | 120 | |

| Fees for the Commissioner of Security Warrants PLA | 46 | 74 | 74 | |

| Governor-General's Programme PLA | 1,144 | 989 | 1,289 | |

| Governor-General's Salary and Allowance PLA | 613 | 576 | 650 | |

| Governor-General's Travel Outside New Zealand PLA | 299 | 307 | 307 | |

| Local Authority Emergency Expenses PLA | 36,202 | - | 65,000 | Minister's Report appended to the DPMC Annual Report |

| Rehabilitation of Kaikōura Harbour | 3,250 | - | 5,000 | Minister's Report appended to the DPMC Annual Report |

| Restoration of Kaikōura District Three Waters Network | - | - | 600 | Minister's Report appended to the DPMC Annual Report |

| TOTAL NON-DEPARTMENTAL OTHER EXPENSES | 44,592 | 4,955 | 76,379 | |

| MULTI-CATEGORY EXPENSES AND CAPITAL EXPENDITURE | ||||

| Emergency Management MCA | Part D | |||

| DEPARTMENTAL OUTPUT EXPENSES | ||||

| Community Awareness and Readiness | 3,669 | 1,938 | 3,753 | Part D |

| Emergency Sector and Support and Development | 5,133 | 5,574 | 6,127 | Part D |

| Management of Civil Defence Emergencies | 7,612 | 3,705 | 15,106 | Part D |

| Policy Advice - Emergency Management | 520 | 443 | 570 | Part D |

| Total Emergency Management MCA | 16,934 | 11,660 | 25,556 | |

| Government House Buildings and Assets MCA | Report appended to the DPMC Annual Report | |||

| NON-DEPARTMENTAL OTHER EXPENSES | ||||

| Depreciation of Crown Assets | 744 | 1,962 | 1,962 | Exempt under section 15D(2)(b)(ii) of the Public Finance Act |

| Government House - Maintenance | 813 | 600 | 1,050 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act |

| Loss on Disposal of Crown Assets | - | 170 | 170 | Exempt under section 15D(2)(b)(ii) of the Public Finance Act |

| NON-DEPARTMENTAL CAPITAL EXPENDITURE | ||||

| Government House Buildings and Assets - Capital Investment | 367 | 1,050 | 880 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act |

| Total Government House Buildings and Assets MCA | 1,924 | 3,782 | 4,062 | |

| Policy Advice and Support Services MCA | Part D | |||

| DEPARTMENTAL OUTPUT EXPENSES | ||||

| National Security Priorities and Intelligence Coordination | 10,119 | 9,991 | 10,013 | Part D |

| Policy Advice - Prime Minister and Cabinet | 5,908 | 4,131 | 6,708 | Part D |

| Science Advisory Committee | 725 | 675 | 725 | Part D |

| Support Services to the Governor-General and Maintenance of the Official Residences | 4,078 | 4,139 | 3,888 | Part D |

| Support, Secretariat and Coordination Services | 5,697 | 5,790 | 5,716 | Part D |

| Total Policy Advice and Support Services MCA | 26,527 | 24,726 | 27,050 | |

| TOTAL MULTI-CATEGORY EXPENSES AND CAPITAL EXPENDITURE | 45,385 | 40,168 | 56,668 | |

| TOTAL ANNUAL AND PERMANENT APPROPRIATIONS | 106,365 | 68,314 | 153,106 |

Multi-year appropriation

The Department has a multi-year appropriation for output expenses incurred by the Crown for the establishment costs and the development of strategies and planning activities, with communities, stakeholders and decision-makers, for the regeneration of areas in Christchurch.

| 2015/16 Actual $000 |

2016/17 Actual $000 |

Location of end of year performance information | |

|---|---|---|---|

| Appropriation for non-departmental output expenses: Regenerate Christchurch | |||

| - | Original Appropriation | 20,000 | Minister's Report appended to the DPMC Annual Report |

| - | Adjustments | 1,073 | |

| - | Total adjusted approved appropriation | 21,073 | |

| - | Actual Expenditure | 4,000 | |

| - | Appropriation remaining at 30 June | 17,073 |

Statement of Departmental and Non-departmental Expenses and Capital Expenditure Incurred Without, or in Excess of Appropriation, or other Authority#

for the year ended 30 June 2017

For the year ended 30 June 2017 there has been no unappropriated expenditure in Vote Prime Minister and Cabinet (2016: Nil).

Statement of Capital Injections#

for the year ended 30 June 2017

| 2016/17 Actual $000 |

2016/17 Budget $000 |

2016/17 Supp. Estimates $000 |

|

|---|---|---|---|

| Capital Injection | 163 | 2,350 | 163 |

Statement of Capital Injections Without, or in Excess of, Authority#

for the year ended 30 June 2017

DPMC has not received any capital injections during the year without, or in excess of, authority (2016: Nil).

Reporting Against Appropriations#

Canterbury Earthquake Recovery (M85)

This appropriation is limited to provision of services supporting the regeneration of greater Christchurch. It contributes to our strategic objective that Greater Christchurch is viewed as an attractive and vibrant place to live, work, visit and invest, for us and our children after us.

| Performance measure | Actual 2015/16 | Standard 2016/17 | Actual 2016/17 |

|---|---|---|---|

| Component: Horizontal Infrastructure | |||

| Monitor and report on progress, timeliness and budget of the Horizontal Infrastructure programme to Minister(s) and the Treasury, at least twice per year (see Note 1) | Achieved | Achieved | Achieved |

| The Christchurch Horizontal Infrastructure programme completion, close-out and transition is finalised by 30 June 2017 (see Note 2) | On track | Achieved | Achieved |

| Component: Policy and Legislation | |||

| The satisfaction of the responsible Minister with the policy advice service, as measured using the Common Satisfaction Survey (see Note 3), is at least: | Exceeded expectations | 6 | 6.5 |

| A sample of policy advice fits within the target ranges for quality (see Note 4) | All papers met agreed quality criteria and standards | Achieved |

Not achieved 56% of papers scored 7 or more - against our target of 70%; 16% of papers scored 8 or more - against our target of 30% (see Note 5) |

| Component: Land and Land Use Planning | |||

| All Crown feedback, reviews and appeals are completed within the statutory and hearings panel timeframes | 100% | 100% | 100% |

| Component: Leadership/Brokering/Coordination | |||

| The satisfaction of the responsible Minister with the leadership/brokering/coordination role as measured using the Common Satisfaction Survey (see Note 3), is at least: | Exceeded expectations | 6 | 6.75 |

| The Whole of Government Lessons Learnt Report is completed by June 2017 (see Note 6) | On track for completion by June 2017 | Completed | Achieved (see Note 7) |

| Component: Monitoring and Reporting | |||

| Report to the Minister(s) at least twice per year on recovery/regeneration progress and the performance of the Regenerate Christchurch Board (see Note 8) | The first required six-monthly report on track for delivery in October 2016 | Achieved | Achieved |

| The satisfaction of the responsible Minister with the monitoring and reporting activity, as measured using the Common Satisfaction Survey (see Note 3), is at least: | New measure | 6 | 6 |

| The total cost per hour of producing outputs | $89 per hour | $90-$120 | $104 |

Note 1 - This measure has been revised to improve consistency and focus on the number of reports instead of the timing of reporting.

Note 2 - This measure has been revised to clarify that it related to the Christchurch Horizontal Infrastructure programme. The measure also required a target date for completion.

Note 3 - The Common Satisfaction Survey measures Ministers' satisfaction with the quality, timeliness and value for money of policy advice on a scale from 1 to 10, where 1 means fell well short of expectations and 10 means far exceeded expectations.

Note 4 - A sample of the Department's policy advice will be assessed by a panel using the Policy Project quality framework. The target ranges for the quality of our policy advice are: that 70% of our assessed papers will score 7 or more, and, that 30% will score 8 or more out of 10 with 10 being the highest quality.

Note 5 - This is the first year we have assessed ourselves against these targets and we are developing cross-department work to address these findings.

Note 6 - A symposium was originally included in the Recovery Learning and Legacy project; however, the timing of the event was considered too soon to effectively reflect on learnings and legacy, and deliver the desired outcomes.

Note 7 - The report was completed in June 2017 and released publicly on 30 July 2017. The measure has been amended in 2016/17 to reflect that, while a symposium was originally included in the Recovery Learning and Legacy project, the timing of the event was considered too soon to effectively reflect on learnings and legacy, and deliver the desired outcomes.

Note 8 - This measure has been revised in 2016/17 to reflect the current stage of the rebuild/regeneration rather than recovery. A focus has also been placed on the number of reports produced rather than frequency of reporting.

Financial Information

| 2015/16 Actual $000 |

2016/17 Actual $000 |

2016/17 Budget $000 |

2016/17 Supp. Estimates $000 |

|

|---|---|---|---|---|

| 8,922 | Revenue Crown | 19,546 | 20,741 | 19,546 |

| - | Revenue Other | 346 | - | - |

| 8,922 | Total Revenue | 19,892 | 20,741 | 19,546 |

| 6,906 | Expenses | 16,038 | 20,741 | 19,546 |

| 2,016 | Net Surplus/(Deficit) | 3,854 | - | - |

Expenditure was lower than budgeted mainly due to the exit and subleasing of an onerous lease resulting in a net surplus of $3.854 million.

Department of the Prime Minister and Cabinet - Capital Expenditure PLA#

This appropriation is limited to the purchase or development of assets by and for the use of the Department of the Prime Minister and Cabinet, as authorised by section 24(1) of the Public Finance Act 1989.

Expenditure in 2016/17 was in accordance with the Department's capital asset management plan.

Financial Information

| 2015/16 Actual $000 |

2016/17 Actual $000 |

2016/17 Budget $000 |

2016/17 Supp. Estimates $000 |

|

|---|---|---|---|---|

| 492 | Property, Plant and Equipment | 350 | 2,450 | 463 |

| - | Intangibles | - | - | - |

| - | Other | - | - | 50 |

| 492 | Total Expenses | 350 | 2,450 | 513 |

During 2016/17, $2.187 million for Cyber Security Services was transferred to MBIE.

Emergency Management MCA#

The overarching purpose of this MCA is to support communities to be resilient by enhancing their capacity and capability to manage civil defence emergencies. This contributes to our strategic objective that New Zealand has world-class processes in place to identify and deal with national security events and emergencies, and build national resilience.

| Performance measure | Actual 2015/16 | Standard 2016/17 | Actual 2016/17 |

|---|---|---|---|

| New Zealand communities are aware of their hazards and risks, are prepared and resilient and are able to respond and recover from an emergency | 70% | 85% | 71% (see Note 1) |

Note 1 - This appropriation measure is an overall measure made up of 24 subordinate performance measures. For 2016/17, seven subordinate performance measures were not achieved, resulting in 71% of the appropriation performance measure being achieved. The rationale for each measure not achieved is provided in the notes related to each measure.

Financial Information

| 2015/16 Actual $000 |

2016/17 Actual $000 |

2016/17 Budget $000 |

2016/17 Supp. Estimates $000 |

|

|---|---|---|---|---|

| 11,748 | Revenue Crown | 23,990 | 11,430 | 23,990 |

| 344 | Revenue Other | 441 | 230 | 1,566 |

| 12,092 | Total Revenue | 24,431 | 11,660 | 25,556 |

| 12,089 | Expenses | 16,934 | 11,660 | 25,556 |

| 3 | Net Surplus/(Deficit) | 7,497 | - | - |

Category: Community Awareness and Readiness#

This category is limited to the development and delivery of long-term national programmes to raise individual and community awareness and preparedness.

| Performance measure | Actual 2015/16 | Standard 2016/17 | Actual 2016/17 |

|---|---|---|---|

| Availability of the civil defence website 24 hours a day, 7 days a week, at least: | 99.9% | 99.9% | 99.9% |

| The proportion of New Zealanders who describe themselves as “fully prepared”, which means: have an emergency survival plan that includes what to do when not at home, have emergency items and water and regularly update emergency survival items, will increase on the previous year by between: | New measure | 1%-2% | 2.5% (see Note 1) |

| The proportion of New Zealanders who know the correct action to take during an earthquake will increase on the previous year by: | New measure | Baseline established | Baseline established (see Note 2) |

| The proportion of New Zealanders who know the correct action to take if they feel a long or strong earthquake near the coast will increase on the previous year by: | New measure | Baseline established | Baseline established (see Note 3) |

| The proportion of New Zealanders who describe themselves as “prepared at home”, which means: have an emergency survival plan that includes what to do when at home, have emergency items and water and regularly update emergency survival items, will increase on the previous year by between: | New measure | 1%-2% | 1.5% (see Note 4) |

Note 1 - An increase of 2.5 percentage points (15.5% in 2015/16 to 18% in 2016/17) as established by our annual Colmar Brunton preparedness survey).

Note 2 - 73% know the correct action to take during an earthquake (as established by our annual Colmar Brunton preparedness survey).

Note 3 - 83% know the correct action to take if they feel a long of strong earthquake near the coast (as established by our annual Colmar Brunton preparedness survey).

Note 4 - An increase of 1.5 percentage points (from 30.5% in 2015/16 to 32% in 2016/17) as established by our annual Colmar Brunton preparedness survey).

Financial Information

| 2015/16 Actual $000 |

2016/17 Actual $000 |

2016/17 Budget $000 |

2016/17 Supp. Estimates $000 |

|

|---|---|---|---|---|

| 2,108 | Revenue Crown | 3,730 | 1,915 | 3,730 |

| - | Revenue Other | - | 23 | 23 |

| 2,108 | Total Revenue | 3,730 | 1,938 | 3,753 |

| 2,260 | Expenses | 3,669 | 1,938 | 3,753 |

| (152) | Net Surplus/(Deficit) | 61 | - | - |

Category: Emergency Sector and Support and Development#

This category is limited to developing and implementing operational policies and projects, advice, assistance and information to the CDEM sector.

| Performance measure | Actual 2015/16 | Standard 2016/17 | Actual 2016/17 |

|---|---|---|---|

| The number of Director Guidelines, Technical Standards, Codes and other civil defence emergency management information publications that are either reviewed or published will be at least: | New measure | 2 per year | 2 (see Note 1) |

| Satisfaction assessed as “Good” or “Very Good”, in relation to: (see Note 2) | |||

| · Coverage of the new Guidelines, Technical Standards, Codes and other publications | New measure | 80% | 50% (see Note 3) |

| · Quality of the new Guidelines, Technical Standards, Codes and other publications | 78% | 80% | 57% (see Note 4) |

| · The quality of the newsletters/updates - 16-20 issues | 80% | 80% | 53% (see Note 5) |

| Facilitate civil defence emergency management courses or workshops annually, at least: | 5 | 3 | 3 (see Note 6) |

| The number of CDEM initiatives developed or implemented in partnership with public sector, private sector and/or the not-for-profit sector will be between: | New measure | 5-6 | 6 (see Note 7) |

Note 1 - Wellington Earthquake National Initial Response Plan (WENIRP) and the National Tsunami Advisory and Warning Plan were reviewed and published.

Note 2 - Satisfaction performance measure involves a five-point scale, either numerical 1-5 (with “5” the highest rating) or qualitative: Very Good, Good, Satisfied, Poor and Very Poor.

Note 3 - The sample size increased significantly from 17 groups to 182 non-traditional stakeholders in the 2016/17 period. Past ratings may have been moderated. Additionally, a significant number of individuals (43.05%) rated the coverage as “satisfied” (neither good nor bad).

Note 4 - The sample size increased significantly from 17 groups to 182 individuals in the 2016/17 period and past ratings may have been moderated. Additionally, a significant number of individuals (38.36%) rated the quality as “satisfied” (neither good nor bad).

Note 5 - The sample size increased significantly from 17 groups to 182 non-traditional stakeholders in the 2016/17 period and past ratings may have been collated and moderated. Additionally, a significant number of individuals (45.61%) rated the quality as “satisfied” (neither good nor bad).

Note 6 - Three facilitated courses/workshops were carried out in 2016/17: (1) Emergency Manager Officer Course - 29-30 May 2017, (2) Takatu - 26 May 2017, (3) Welfare Train the Trainer Course - 21 and 22 March 2017.

Note 7 - Six CDEM initiatives were developed and implemented: (1) Group Welfare Managers Forum, (2) Joint Resilience Workshop, (3) EMIS, (4) Exercise Tangaroa, (5) WENIRP, (6) MFAT/MCDEM Partnership activities.

Financial Information

| 2015/16 Actual $000 |

2016/17 Actual $000 |

2016/17 Budget $000 |

2016/17 Supp. Estimates $000 |

|

|---|---|---|---|---|

| 5,453 | Revenue Crown | 4,856 | 5,453 | 4,856 |

| 262 | Revenue Other | 412 | 121 | 1,271 |

| 5,715 | Total Revenue | 5,268 | 5,574 | 6,127 |

| 5,373 | Expenses | 5,133 | 5,574 | 6,127 |

| 342 | Net Surplus/(Deficit) | 135 | - | - |

Category: Management of Emergencies#

This category is limited to management of national emergency readiness, response and recovery, including support to local CDEM organisations, maintaining NCMC in a state of readiness, national training and exercises, coordination and management of central government's response and recovery activities and administration of related expenses.

| Performance measure | Actual 2015/16 | Standard 2016/17 | Actual 2016/17 |

|---|---|---|---|

| National Warning System tests conducted, at least: | 4 | 4 | 4 |

| An initial National Warning issued within 15 minutes of the Duty Manager's decision to issue a National Warning | New measure | 100% | 100% (see Note 1) |

| National Warning distribution list - accuracy of contact details (at each warning or test), at least: | Achieved | 95% | 98.5% |

| National Crisis Management Centre managed, during activations, with: | |||

| · National Crisis Management Centre has adequate staffing, as deemed by the Duty Manager or National Controller, in place within two hours | 100% | 100% | 100% |

| · Essential information technology systems available and operating at agreed performance levels | Not achieved | 95% | 99.9% |

| · Back-up information technology systems and equipment fully functional, at least: | 100% | 99.8% | 99.9% |

| · Coordination and management consistent with the Response Concept of Operations for extended activations | No extended activations occurred in 2015/16 | 100% | 100% (see Note 2) |

| National Crisis Management Centre activations reviewed: | |||

| · Mode 2 or higher activations - within three months | 100% | 100% | 75% (see Note 3) |

| · Approved recommendations (lessons identified) actioned - within set timeframes | 100% | 100% | 75.9% (see Note 4) |

| Project management regarding Cell Broadcast Alerting is in accordance with the project plan and milestones signed off by project governance (see Note 5) | New measure | Achieved | Not achieved (see Note 6) |

Note 1 - The achievement of this measure is based on the length of time it takes for a warning to be issued which is either measured from the end of the Duty Manager's phone call to the Fire Service to instruct them to issue a warning or from when the Duty Manager instructs the Duty Officer to draft and issue a warning to when the Duty Officer issues that warning (which happened in the case of one event). Due to the National Warning System having been moved to a different website platform, DPMC will look to better capture our performance in this area for 2017/18.